- United States

- /

- Telecom Services and Carriers

- /

- NYSE:LUMN

Lumen Technologies, Inc.'s (NYSE:LUMN) Price Is Right But Growth Is Lacking After Shares Rocket 32%

Lumen Technologies, Inc. (NYSE:LUMN) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 66% share price drop in the last twelve months.

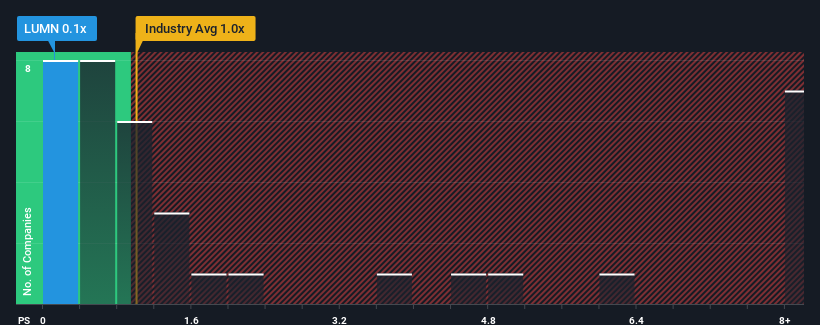

Even after such a large jump in price, Lumen Technologies' price-to-sales (or "P/S") ratio of 0.1x might still make it look like a buy right now compared to the Telecom industry in the United States, where around half of the companies have P/S ratios above 1x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Lumen Technologies

How Lumen Technologies Has Been Performing

Lumen Technologies hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Lumen Technologies will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Lumen Technologies would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 29% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 3.7% per annum as estimated by the eleven analysts watching the company. Meanwhile, the broader industry is forecast to expand by 1.6% per year, which paints a poor picture.

In light of this, it's understandable that Lumen Technologies' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Bottom Line On Lumen Technologies' P/S

The latest share price surge wasn't enough to lift Lumen Technologies' P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Lumen Technologies' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Lumen Technologies' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Lumen Technologies.

If you're unsure about the strength of Lumen Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LUMN

Lumen Technologies

A networking company, provides integrated products and services to business and mass customers in the United States and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives