- United States

- /

- Telecom Services and Carriers

- /

- NYSE:LUMN

Lumen Technologies, Inc. (NYSE:LUMN) Shares Fly 28% But Investors Aren't Buying For Growth

The Lumen Technologies, Inc. (NYSE:LUMN) share price has done very well over the last month, posting an excellent gain of 28%. This latest share price bounce rounds out a remarkable 509% gain over the last twelve months.

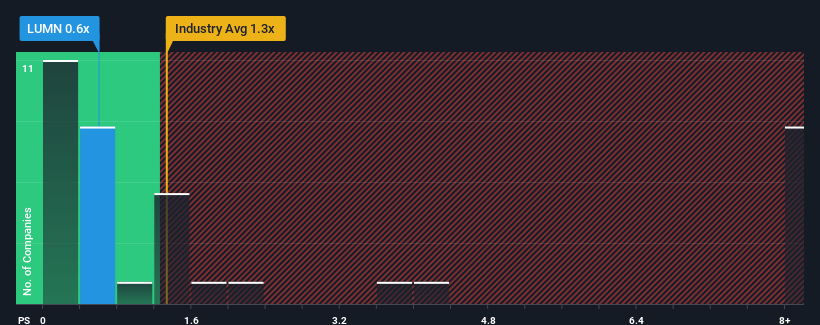

Even after such a large jump in price, Lumen Technologies may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.6x, since almost half of all companies in the Telecom industry in the United States have P/S ratios greater than 1.3x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Lumen Technologies

What Does Lumen Technologies' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Lumen Technologies' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Lumen Technologies.How Is Lumen Technologies' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Lumen Technologies' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 10% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 33% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the twelve analysts covering the company suggest revenue growth is heading into negative territory, declining 3.1% per annum over the next three years. With the industry predicted to deliver 160% growth each year, that's a disappointing outcome.

With this in consideration, we find it intriguing that Lumen Technologies' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Lumen Technologies' P/S

The latest share price surge wasn't enough to lift Lumen Technologies' P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Lumen Technologies' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Lumen Technologies' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Lumen Technologies you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LUMN

Lumen Technologies

A networking company, provides integrated products and services to business and mass customers in the United States and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives