- United States

- /

- Telecom Services and Carriers

- /

- NYSE:LUMN

Is Lumen Technologies a Turnaround Opportunity After Its 36% 2025 Share Price Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Lumen Technologies at around $7.63 is a turnaround bargain or a value trap, you are not alone, and that is exactly what we are going to unpack.

- Despite a bumpy week with a -11.7% move, the stock is roughly flat over 30 days at 0.1%, still up 36.0% year to date and 25.9% over the last year, with a striking 47.0% gain across three years despite a -10.7% five year drag.

- Those swings sit against a backdrop of ongoing efforts to streamline the business and refocus on core network and fiber assets, alongside debt reduction moves that investors have been watching closely. Together, these factors have shifted how the market thinks about both Lumen’s balance sheet risk and its long term cash flow potential.

- Right now Lumen scores a 5/6 on our valuation checks, suggesting it looks undervalued on most of the metrics we use. Next, we will dig into those methods before exploring an even more powerful way to think about what this price really implies.

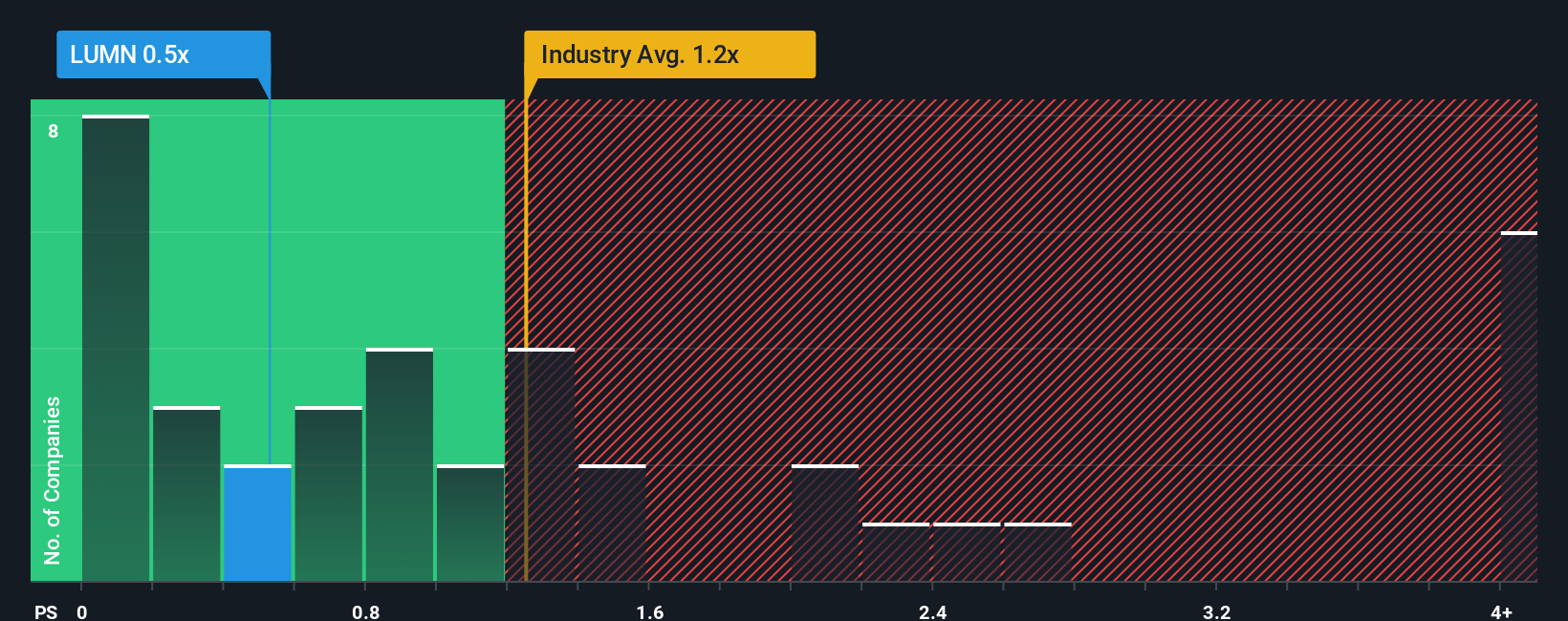

Approach 1: Lumen Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting them back to today to reflect risk and the time value of money. For Lumen Technologies, this analysis starts with last twelve months Free Cash Flow of about $1.79 billion, then incorporates analyst forecasts and longer term estimates.

Analysts expect FCF to dip and then recover over the next few years, with projections such as roughly $344.4 million in 2026 and a weaker patch in 2027 before rebuilding. Beyond the formal analyst horizon, Simply Wall St extrapolates a recovery path, with FCF estimated to reach around $1.33 billion by 2035 as the business stabilizes and grows its core network and fiber operations.

Adding up these discounted cash flows gives an estimated intrinsic value of about $11.57 per share. Compared with the recent share price around $7.63, the model implies Lumen is trading at roughly a 34.1% discount, which indicates potential upside if these cash flow assumptions prove accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lumen Technologies is undervalued by 34.1%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

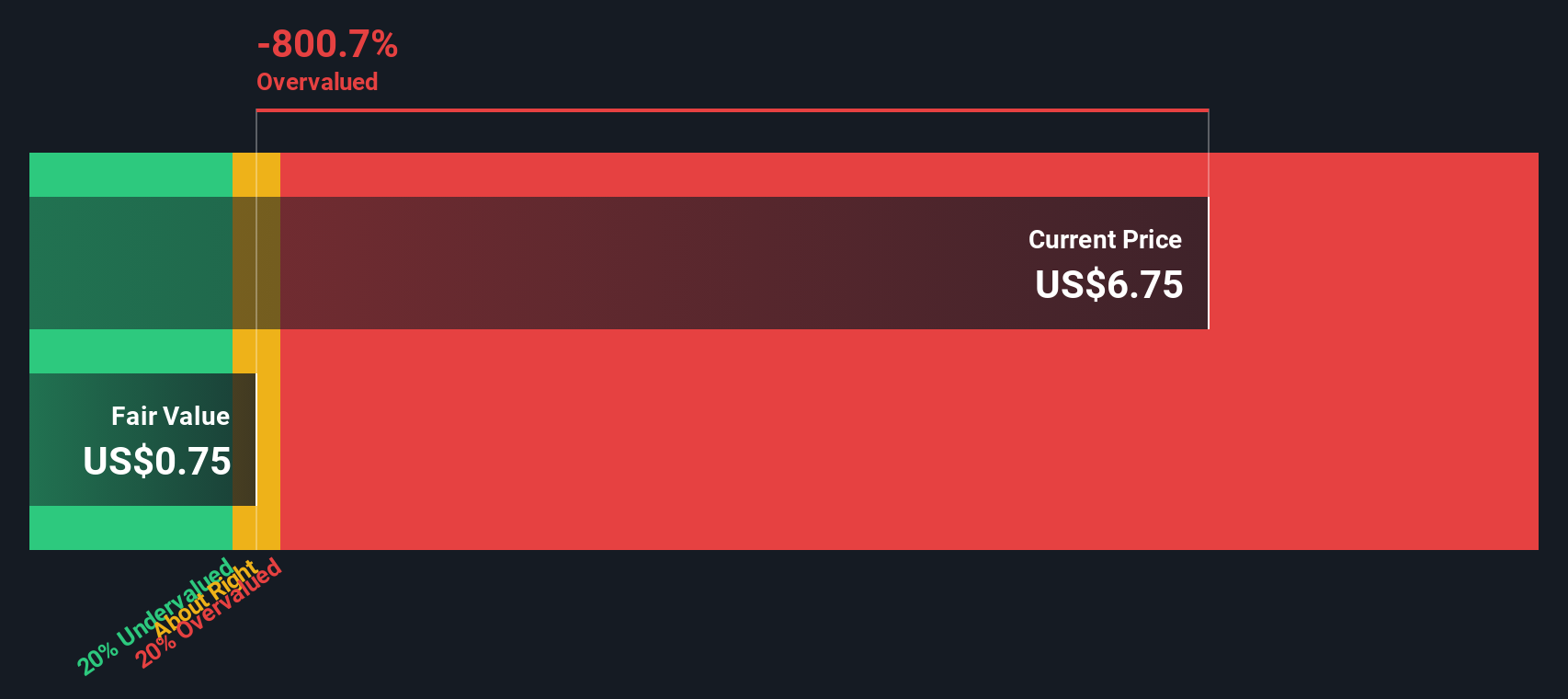

Approach 2: Lumen Technologies Price vs Sales

For companies like Lumen that are working through inconsistent profitability, the Price to Sales ratio is often a more reliable yardstick than earnings based metrics because it focuses on revenue generated rather than volatile or negative net income.

In general, higher growth and lower risk justify a higher normal Price to Sales multiple. Slower growth, heavy leverage or business uncertainty should pull that multiple down. Lumen currently trades on a Price to Sales ratio of about 0.62x, which is well below both the Telecom industry average of roughly 1.22x and the peer group average of about 7.47x, signaling that the market is heavily discounting its revenue base.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what multiple Lumen should trade on, given its growth outlook, profit margins, risk profile, industry and market cap. For Lumen, this Fair Ratio is around 1.24x, above the current 0.62x. Because this company specific benchmark incorporates Lumen’s challenges as well as its recovery potential, the gap between the Fair Ratio and today’s multiple suggests the stock is undervalued on a sales basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1454 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lumen Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page that lets you write the story behind your numbers by linking what you believe about a company’s strategy, growth, margins and risks to a clear financial forecast and a fair value estimate, then continuously updating that view as new news or earnings arrive so you can compare your Narrative Fair Value to today’s price and decide whether to buy, hold or sell. For example, one Lumen Narrative might lean into the upside of AI driven fiber contracts, refinancing and margin recovery and land on a fair value closer to the bullish 8.33 dollar target. A more cautious Narrative could focus on legacy revenue declines, competition and debt risk and align nearer the 2.00 dollar bearish target, showing how different perspectives create different but transparent paths from story to numbers.

Do you think there's more to the story for Lumen Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LUMN

Lumen Technologies

A networking company, provides integrated products and services to business and mass customers in the United States and internationally.

Undervalued with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion