IHS Holding (NYSE:IHS): Valuation Insights Follow New Brazil Expansion With TIM S.A.

Reviewed by Simply Wall St

IHS Holding (NYSE:IHS) is making headlines after its Brazilian business signed a new agreement with TIM S.A. Together, they plan to build up to 3,000 communications sites across several regions. The rollout will start with an initial phase of 500 locations.

See our latest analysis for IHS Holding.

IHS Holding’s announcement of expanding its partnership with TIM S.A. in Brazil reinforces sentiment that the company’s growth momentum is increasing. Following a strong period, the stock has delivered a year-to-date share price return of 108.8% and a one-year total shareholder return of 117.7%, highlighting how investors are rewarding its execution and international expansion.

If IHS’s global ambitions have you considering broader opportunities, it may be a good time to expand your radar and discover fast growing stocks with high insider ownership

With IHS trading at a substantial discount to analyst price targets and still showing strong growth figures, the question is whether this creates a genuine buying opportunity or if the market has already factored in its future expansion.

Most Popular Narrative: 31.2% Undervalued

The prevailing narrative suggests IHS Holding's fair value is well above its latest closing price of $6.64, catching the attention of value-minded investors. The backdrop includes robust international expansion, rising earnings forecasts, and upwardly revised revenue outlooks, which are driving new optimism around where shares could go next.

Operational efficiencies through technology adoption, AI, and disciplined cost controls continue to expand adjusted EBITDA margins. Management is targeting further margin improvement, directly boosting net income and free cash flow generation. Proactive debt reduction and capital structure optimization have meaningfully lowered interest expense (average cost of debt down 100 bps), enabling rising ALFCF, creating optionality for future shareholder returns, and enhancing earnings growth.

Want to uncover why analysts see so much upside potential? This narrative is powered by aggressive profit forecasts, ambitious margin assumptions, and a future valuation multiple that could defy expectations. Dive in to discover which bold projections underpin this strikingly high fair value—there is more to the story than meets the eye.

Result: Fair Value of $9.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained currency devaluation in Nigeria or increased customer concentration risk could quickly challenge even the most optimistic growth outlook for IHS Holding.

Find out about the key risks to this IHS Holding narrative.

Another View: What Do Multiples Say?

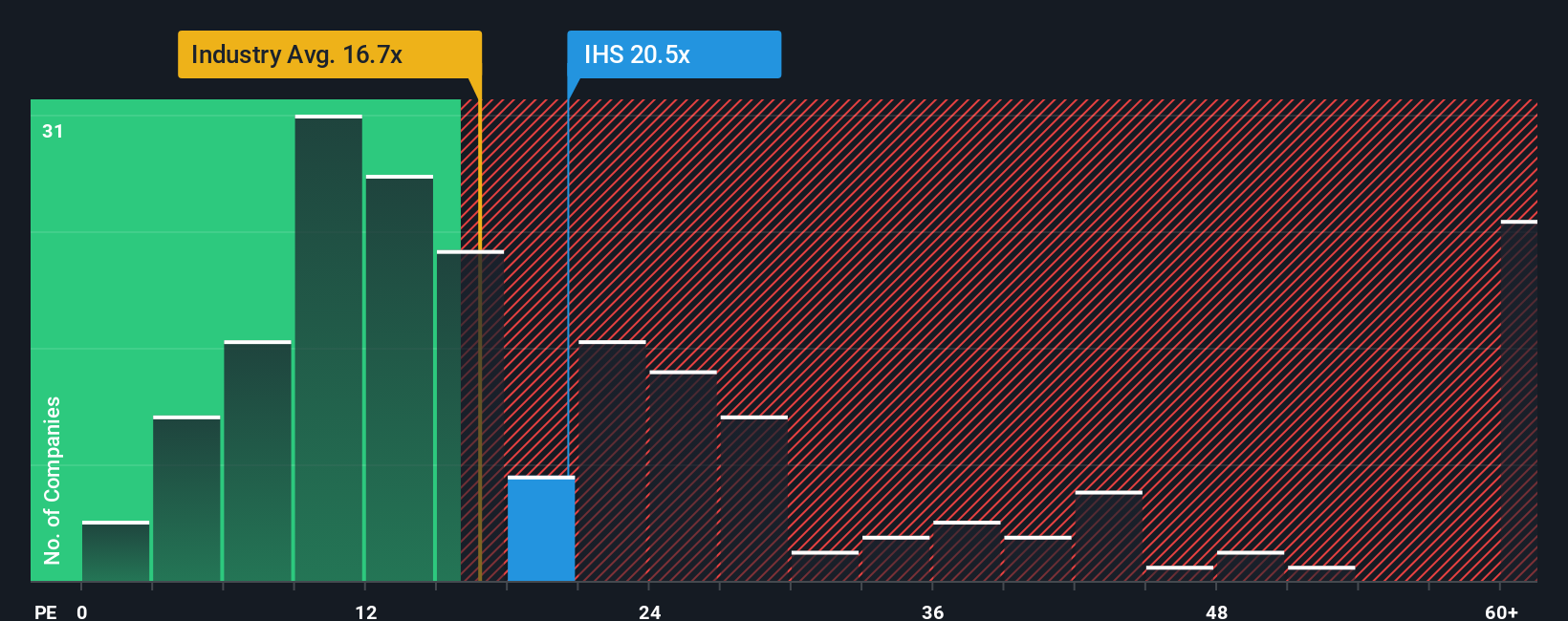

While fair value estimates point to IHS Holding being significantly undervalued, a different picture emerges when we compare its price-to-earnings ratio against the market. Currently at 20.1x, IHS trades above both its peer average (18.9x) and the global telecom average (17x), and even slightly above the "fair ratio" of 20x suggested by our analysis. This raises an important question: does the market expect more risk or less upside than models suggest?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IHS Holding Narrative

If you want a different perspective or prefer your own analysis, you can craft your own IHS Holding narrative in just a few minutes. Do it your way

A great starting point for your IHS Holding research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Want to get ahead of the next big trend? Take action with these hand-picked stock ideas and don’t let game-changing opportunities pass you by.

- Capture unbeatable income by checking out these 17 dividend stocks with yields > 3%. This list features stocks with yields that outshine the market average.

- Supercharge your portfolio by targeting potential bargains through these 877 undervalued stocks based on cash flows. Here, you’ll find companies trading below what their real cash flows suggest.

- Stay on the cutting edge in healthcare innovation by tapping into these 33 healthcare AI stocks. AI-fueled breakthroughs are creating brand-new opportunities in this space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IHS

IHS Holding

Develops, owns, and operates shared communications infrastructure in Nigeria, Sub-Saharan Africa, the Middle East and North Africa, and Latin America.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives