- United States

- /

- Commercial Services

- /

- NYSE:NL

US Undiscovered Gems To Explore In April 2025

Reviewed by Simply Wall St

As the U.S. market navigates a volatile landscape marked by tariff exemptions and fluctuating tech stock performances, small-cap stocks within the S&P 600 have shown resilience amid broader economic uncertainties. In such an environment, identifying undiscovered gems requires a keen eye for companies with strong fundamentals and growth potential that can withstand market turbulence and capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 32.14% | 14.78% | 4.37% | ★★★★★★ |

| Omega Flex | NA | -0.52% | 0.74% | ★★★★★★ |

| Cashmere Valley Bank | 15.62% | 5.80% | 3.51% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Photronics (NasdaqGS:PLAB)

Simply Wall St Value Rating: ★★★★★★

Overview: Photronics, Inc. is a company that manufactures and sells photomask products and services globally, with a market capitalization of approximately $1.15 billion.

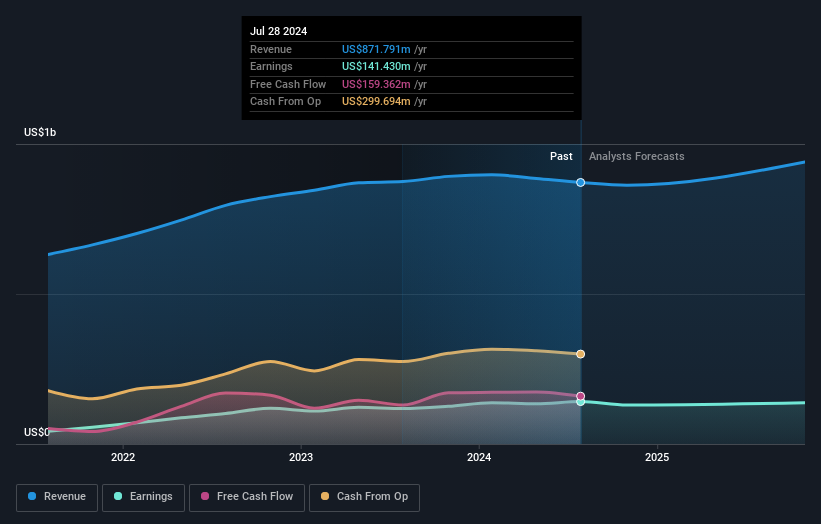

Operations: Photronics generates revenue primarily from the manufacture of photomasks, totaling approximately $862.75 million. The company's market capitalization stands at about $1.15 billion.

Photronics, a nimble player in the semiconductor space, is making strategic moves to bolster its presence in high-end IC markets. With no debt on its balance sheet and earnings growth of 7.2% over the past year, it outpaced the industry average of -5.9%. Trading at a compelling value—51.5% below estimated fair value—it remains attractive despite challenges like significant insider selling and geopolitical tensions affecting European sales. Recent earnings showed net income rising to US$42.85 million from US$26.18 million last year, while basic EPS improved to US$0.69 from US$0.43, indicating robust operational performance amidst market headwinds.

IDT (NYSE:IDT)

Simply Wall St Value Rating: ★★★★★★

Overview: IDT Corporation operates in the communications and payment services sectors across the United States, the United Kingdom, and internationally, with a market capitalization of approximately $1.23 billion.

Operations: IDT generates revenue primarily from its Traditional Communications segment, accounting for $878.90 million, followed by Fintech at $140.08 million and National Retail Solutions (NRS) at $117.26 million. The Net2phone segment contributes $85.15 million to the total revenue mix.

IDT, a nimble player in the telecom sector, is trading at 61.5% below its estimated fair value, showcasing potential upside. The company reported an impressive earnings growth of 116.2% over the past year, outpacing the telecom industry's 50.7%. Notably debt-free for five years, IDT's financial health seems robust with significant free cash flow generation—US$59.27 million as of July 2024—and strategic share repurchases totaling US$58.36 million since January 2016 reflect confidence in its future prospects despite recent insider selling and reliance on BOSS Money for working capital needs.

NL Industries (NYSE:NL)

Simply Wall St Value Rating: ★★★★★★

Overview: NL Industries, Inc. operates in the component products industry across Europe, North America, the Asia Pacific, and internationally with a market cap of $387.85 million.

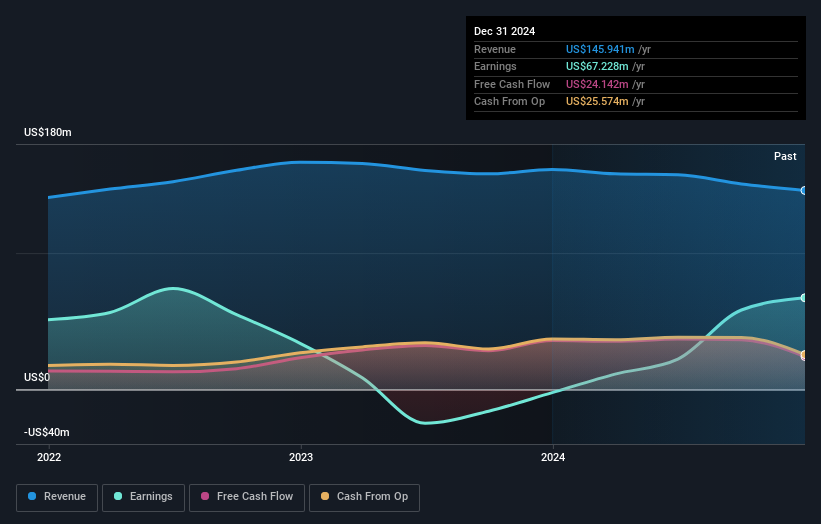

Operations: NL Industries generates revenue primarily from its component products segment, which amounts to $145.90 million.

NL Industries, a small player in the market, recently turned profitable with net income of US$67.23 million for 2024, bouncing back from a US$2.31 million loss the previous year. The company's debt to equity ratio has improved over five years from 0.2% to 0.1%, indicating prudent financial management. Despite legal challenges requiring a US$56.1 million settlement payment related to environmental issues, NL's cash position remains strong enough to cover its total debt obligations comfortably. Trading at 34% below estimated fair value suggests potential upside if operational improvements continue alongside high-quality earnings performance and positive free cash flow trends.

- Delve into the full analysis health report here for a deeper understanding of NL Industries.

Examine NL Industries' past performance report to understand how it has performed in the past.

Summing It All Up

- Investigate our full lineup of 283 US Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NL Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NL

NL Industries

Through its subsidiaries, operates in the component products industry in Europe, North America, the Asia Pacific, and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives