IDT (IDT) Q1: EPS Outperformance Reinforces Bullish Margin-Expansion Narrative

Reviewed by Simply Wall St

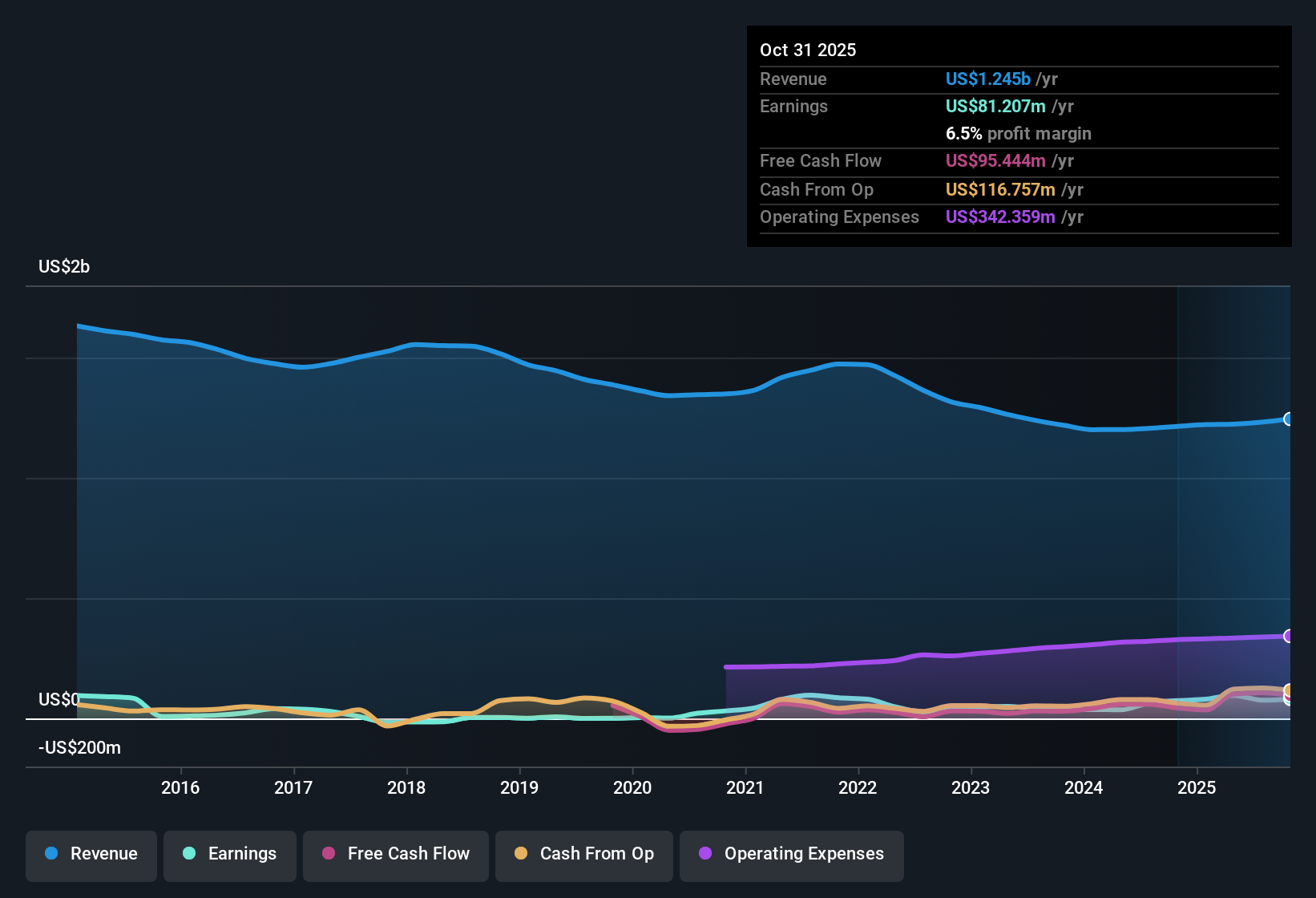

IDT (IDT) just opened fiscal 2026 with Q1 revenue of $322.8 million and basic EPS of $0.89, setting the tone for another data heavy year for investors tracking its earnings trajectory. The company has seen quarterly revenue move from $309.6 million in Q1 2025 to $322.8 million in Q1 2026, while basic EPS stepped up from $0.68 to $0.89 over the same stretch, framing a story in which profit per share is edging ahead of the top line. With net income and margins nudging higher in the background, this latest print gives investors more to work with on how sustainable IDT's profitability really looks.

See our full analysis for IDT.With the headline numbers on the table, the next step is to weigh them against the dominant narratives around IDT to see where the data backs the story and where it starts to push back.

See what the community is saying about IDT

Margins Edge Higher While Revenue Slows

- Over the last 12 months, net profit margin ticked up to 6.5% from 6.1%, even though trailing revenue growth was modest, rising from about $1,205.8 million to $1,244.7 million.

- Consensus narrative highlights new NRS features and BOSS Money margin focus as growth drivers, and the margin data partly backs that up:

- Fintech initiatives like BOSS Money are described as boosting gross profit and adjusted EBITDA, which fits with the small but real lift in net margin from 6.1% to 6.5%.

- At the same time, analysts still model revenue to slip about 1% per year, so the story leans heavily on continued efficiency gains rather than top line expansion.

Earnings Climb As Top Line Plateaus

- Trailing 12 month net income rose from $64.5 million to $81.2 million, and Basic EPS over that window stepped up from $2.55 to $3.22 even though trailing revenue only moved from about $1,205.8 million to $1,244.7 million.

- Skeptics focus on revenue pressure and capital allocation, and the numbers give them a few angles to watch:

- Forecasts call for revenue to decline roughly 1% annually over the next three years, so the recent earnings growth will need ongoing margin lifts to stay intact.

- Plans to keep spending on buybacks and dividends lean on today’s strong cash generation, which could become a trade off if growth slows or acquisitions for expansion prove more expensive than expected.

Valuation Signals Pull In Different Directions

- At a share price of $48.78, IDT trades on a trailing P E of 15.1 times, above the peer average of 7.5 times but slightly below the Global Telecom industry average of 16.3 times, and well under a DCF fair value of about $298.07.

- Supporters and critics can both find ammo in these numbers when they line them up against the narratives:

- On one side, the large gap between $48.78 and the $298.07 DCF fair value, together with earnings growth of 5.5% annually over five years and 9.7% in the last year, looks appealing to optimists.

- On the other, a P E that is roughly double the 7.5 times peer average leaves less room for disappointment if the forecast 8.3% yearly earnings growth slips or the expected revenue decline accelerates.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for IDT on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Read the figures another way? Turn that angle into a focused narrative in just a few minutes and share it with investors: Do it your way.

A great starting point for your IDT research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

IDT’s earnings and margins are improving, but muted and potentially declining revenue leaves the growth story leaning heavily on continued efficiency gains.

If you want clearer momentum in both sales and profits, use our stable growth stocks screener (2088 results) to quickly focus on companies delivering steadier, more reliable expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IDT

IDT

Provides communications and payment services in the United States, the United Kingdom, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026