- United States

- /

- Wireless Telecom

- /

- NYSE:AD

Did RBC’s Tower-Focused Initiation Just Shift Array Digital Infrastructure’s (AD) Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this week, RBC Capital initiated coverage on Array Digital Infrastructure, now exclusively focused on US tower operations after divesting its UScellular wireless business.

- The firm is anticipated to begin regular dividend payments after the closure of pending spectrum transactions, with near-term colocation opportunities adding further potential.

- We'll consider how the analyst’s positive outlook, centered on Array Digital's new tower-focused strategy, influences the company's investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Array Digital Infrastructure Investment Narrative Recap

To be a shareholder in Array Digital Infrastructure today, you need to believe that its pure-play US tower model offers sustainable value in the evolving digital infrastructure sector. The recent coverage initiation from RBC Capital recognizes this transition, but does not materially alter the biggest short-term catalyst: regular dividends following the spectrum transaction closure. The primary risk remains regulatory uncertainties around these pending deals, given their direct impact on cash flows and future payouts.

The most relevant company announcement is the declaration and payment of a special cash dividend of US$23.00 per share, funded by recent asset sales. This distribution underscores the company's intent to reward shareholders as they shift focus exclusively to tower operations, reinforcing the importance of timely and successful spectrum transactions to support ongoing dividend policies. However, investors should be aware that regulatory delays could affect...

Read the full narrative on Array Digital Infrastructure (it's free!)

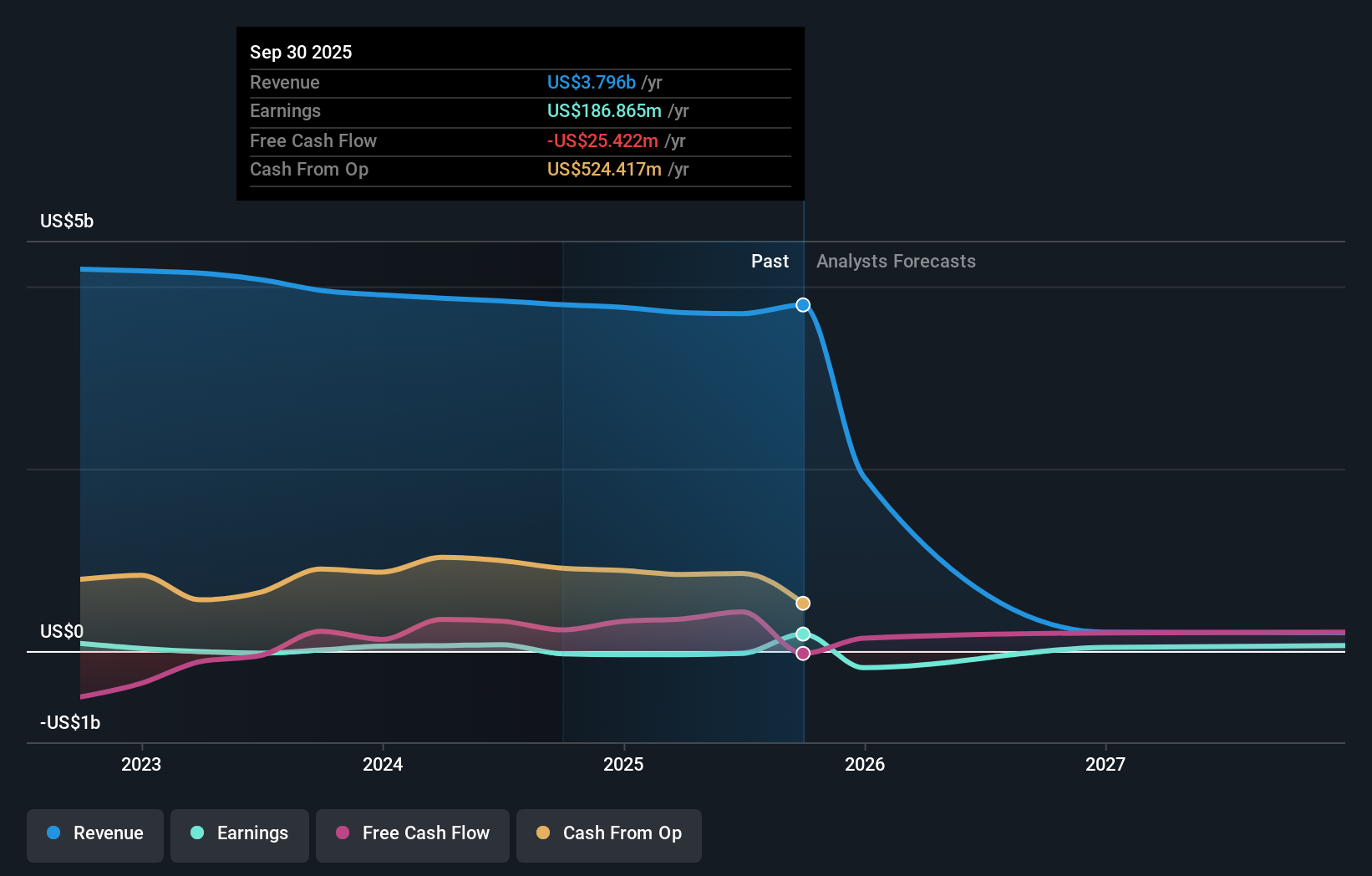

United States Cellular's narrative projects $3.6 billion in revenue and $173.7 million in earnings by 2028. This requires a 0.8% yearly revenue decline and a $212.7 million increase in earnings from -$39.0 million today.

Uncover how Array Digital Infrastructure's forecasts yield a $75.50 fair value, a 51% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provided 1 fair value estimate for Array Digital Infrastructure, all at US$75.50 per share. While analyst consensus highlights dependence on regulatory approvals for key transactions, you should consider a wide range of possible outcomes as opinions often differ sharply among market participants.

Explore another fair value estimate on Array Digital Infrastructure - why the stock might be worth just $75.50!

Build Your Own Array Digital Infrastructure Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Array Digital Infrastructure research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Array Digital Infrastructure research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Array Digital Infrastructure's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AD

Array Digital Infrastructure

Provides wireless telecommunications services in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Apple Inc. (AAPL) — Durable Compounder With Services-Led Earnings Upside

Mota-Engil's Intrinsic and Historical Valuation

Ferrari's Intrinsic and Historical Valuation

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

The "Sleeping Giant" Stumbles, Then Wakes Up