- United States

- /

- Biotech

- /

- NasdaqGS:TSVT

US Penny Stocks Spotlight: uCloudlink Group Among 3 Noteworthy Picks

Reviewed by Simply Wall St

As the U.S. stock market experiences a surge, with major indices like the S&P 500 and Dow Jones Industrial Average posting their best weekly gains in months, investors are looking for opportunities beyond traditional large-cap stocks. Penny stocks, often associated with smaller or newer companies, continue to intrigue investors due to their potential for significant growth when supported by solid financial health. Despite being a somewhat outdated term, penny stocks remain relevant as they offer a unique blend of affordability and growth potential; let's explore some noteworthy examples that stand out in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $108.36M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.89 | $6.46M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.91 | $11.73M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.73 | $2.08B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.275 | $10.12M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.97 | $90.09M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.57 | $61.94M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.13 | $20.04M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8937 | $80.38M | ★★★★★☆ |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

uCloudlink Group (NasdaqGM:UCL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: uCloudlink Group Inc. operates as a mobile data traffic sharing marketplace in the telecommunications industry with a market cap of $58.11 million.

Operations: The company's revenue primarily comes from its wireless communications services, totaling $87.41 million.

Market Cap: $58.11M

uCloudlink Group Inc. stands out in the penny stock landscape with a market cap of US$58.11 million and revenue of US$87.41 million, primarily from wireless communications services. The company's financial health is supported by more cash than total debt, with short-term assets exceeding liabilities. Despite a large one-off loss impacting recent results, uCloudlink maintains a net profit margin improvement and has not experienced significant shareholder dilution recently. Its strategic expansion through partnerships like WH Smith PLC's InMotion Entertainment Group could enhance market presence in North America and Europe, indicating potential growth avenues amidst its earnings volatility challenges.

- Unlock comprehensive insights into our analysis of uCloudlink Group stock in this financial health report.

- Review our growth performance report to gain insights into uCloudlink Group's future.

2seventy bio (NasdaqGS:TSVT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 2seventy bio, Inc. is a cell and gene therapy company specializing in the research, development, and commercialization of cancer treatments in the United States, with a market cap of approximately $134.65 million.

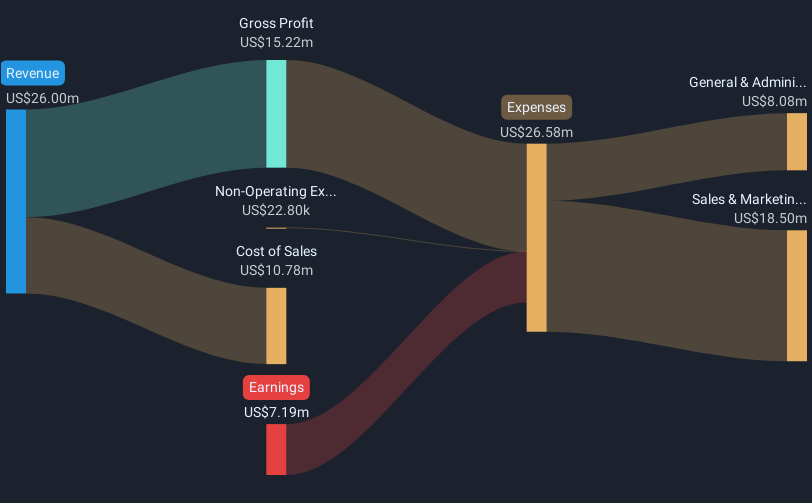

Operations: The company's revenue is primarily derived from its biotechnology segment, totaling $45.62 million.

Market Cap: $134.65M

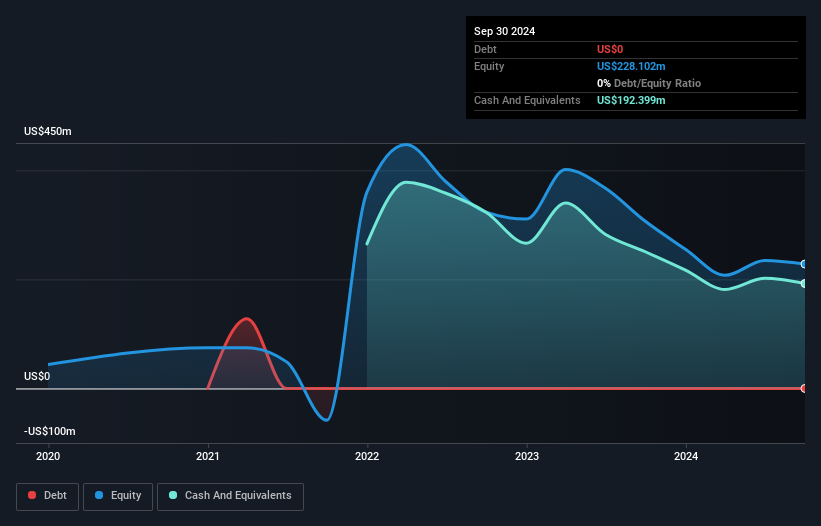

2seventy bio, Inc. is navigating the penny stock terrain with a market cap of US$134.65 million and revenue of US$45.62 million from its biotechnology segment, focusing on cancer treatments. Despite being unprofitable, it has reduced losses over five years by 12.3% annually and maintains a cash runway exceeding one year due to sufficient short-term assets covering liabilities. Recent inclusion in the NASDAQ Biotechnology Index may enhance visibility, while leadership changes like Jessica Snow's appointment as COO could influence strategic direction amidst high share price volatility and significant insider selling in recent months.

- Click here to discover the nuances of 2seventy bio with our detailed analytical financial health report.

- Gain insights into 2seventy bio's future direction by reviewing our growth report.

Mega Matrix (NYSEAM:MPU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Mega Matrix Inc. operates a streaming platform called FlexTV, specializing in vertical screen entertainment, with a market cap of $49.04 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: $49.04M

Mega Matrix Inc., with a market cap of US$49.04 million, operates the globally popular FlexTV platform, offering short-form streaming content in multiple languages across over 100 countries. Despite being pre-revenue and unprofitable, it has reduced losses by 31.8% annually over five years and maintains a debt-free status with sufficient cash runway for more than three years. Recent product launches like "Runaway Billionaire Becomes My Groom" highlight its commitment to high-quality content, while strategic moves such as the US$250 million Shelf Registration filing and partnership with 9Yards Cinema Production aim to bolster global expansion efforts in the entertainment sector.

- Get an in-depth perspective on Mega Matrix's performance by reading our balance sheet health report here.

- Understand Mega Matrix's track record by examining our performance history report.

Make It Happen

- Take a closer look at our US Penny Stocks list of 709 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TSVT

2seventy bio

A cell and gene therapy company, focuses on the research, development, and commercialization of treatments for cancer in the United States.

Excellent balance sheet with reasonable growth potential.