- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TMUS

T-Mobile US (NasdaqGS:TMUS) Unveils T-Priority for First Responders and Partners with OpenAI for IntentCX

Reviewed by Simply Wall St

Click here to discover the nuances of T-Mobile US with our detailed analytical report.

Strengths: Core Advantages Driving Sustained Success For T-Mobile US

T-Mobile US has demonstrated robust financial health, underpinned by substantial customer growth and network performance. The company achieved its highest-ever Q2 postpaid phone net adds, surpassing 100 million customer connections, as highlighted by CEO Mike Sievert in the latest earnings call. Additionally, T-Mobile's network performance has been exceptional, sweeping every category for overall network performance in the latest Opensignal and Ookla tests. Financially, the company reported a record adjusted free cash flow quarter, growing 54% year-over-year, and capturing a record share of industry broadband net adds. TMUS is considered good value based on its Price-To-Earnings Ratio (24.3x) compared to the peer average (35.5x), and it is trading below its estimated fair value ($196.68 versus $568.08), indicating potential for growth.

Weaknesses: Critical Issues Affecting T-Mobile US's Performance and Areas For Growth

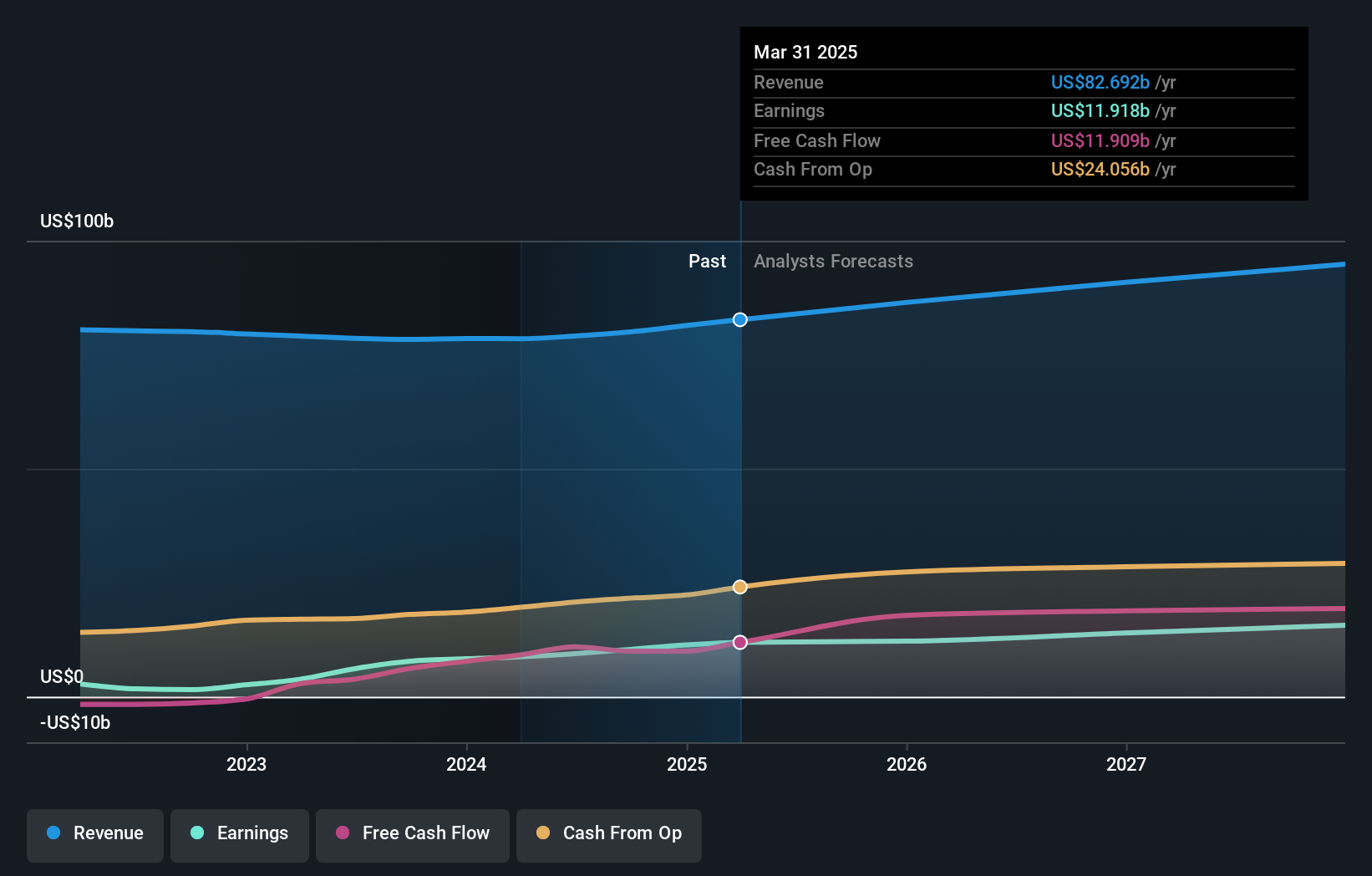

Despite its strengths, T-Mobile faces several challenges. The company expects a year-over-year impact of $350 million to $450 million due to the Affordable Connectivity Program (ACP), driven primarily by wholesale providers, as noted by CFO Peter Osvaldik. Additionally, the incorporation of Mint and Ultra resulted in a small benefit to core EBITDA, as revenue was largely offset by SG&A expenses. TMUS is expensive based on its Price-To-Earnings Ratio (24.3x) compared to the Global Wireless Telecom industry average (17x). Furthermore, the company's earnings are forecast to grow at 12.2% per year, slower than the US market's 15.2% per year, and its revenue growth is projected at 4.3% per year, trailing the US market's 8.7% per year.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

T-Mobile has several strategic opportunities for growth. The partnership with Metronet aims to expand to 6.5 million homes by 2030, providing greater consumer choice, as highlighted by CEO Mike Sievert. Strategic alliances, such as the multi-year agreement with OpenAI to develop the IntentCX platform, are expected to revolutionize customer experience and set new benchmarks for customer success. Additionally, the company's focus on diversifying its customer base, including growth in the top 100 markets and smaller rural areas, presents a significant opportunity to enhance market position. The introduction of innovative products like the T-Priority solution for first responders further underscores T-Mobile's commitment to leveraging its strengths to capitalize on emerging market opportunities.

Threats: Key Risks and Challenges That Could Impact T-Mobile US's Success

T-Mobile faces several external threats that could impact its growth and market share. The competitive landscape remains intense, with bundled offers potentially affecting churn rates, as noted by CEO Mike Sievert. Economic factors also pose a risk, particularly in the value consumer market, where T-Mobile aims to maintain its position. Regulatory risks are another significant concern, with the company providing a comprehensive list of risk factors in its SEC filings, as mentioned by Quan Yao, Senior Vice President of Investor Relations. Additionally, the high level of debt and significant insider selling over the past three months could pose financial challenges and impact investor confidence.

Conclusion

T-Mobile US's strong financial health, marked by significant customer growth and superior network performance, positions the company well for sustained success. However, challenges such as the financial impact of the Affordable Connectivity Program and slower-than-market earnings and revenue growth rates need to be addressed. Strategic opportunities, including partnerships and market diversification, present avenues for future growth. Despite facing external threats like intense competition and economic risks, T-Mobile's current trading price below its estimated fair value indicates potential for growth, making it a compelling option for investors.

Next Steps

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NasdaqGS:TMUS

T-Mobile US

Provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands.

Good value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion