- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TMUS

T-Mobile US (NasdaqGS:TMUS) Unveils New First Responder Plans and Secures New York City 5G Deal

Reviewed by Simply Wall St

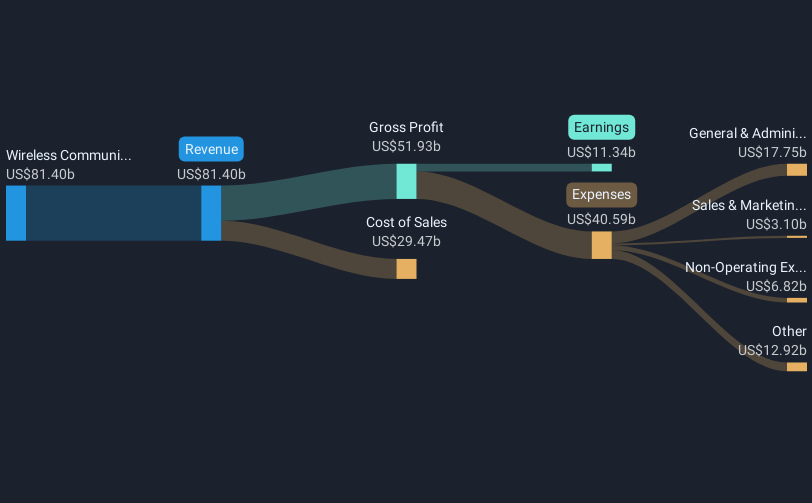

T-Mobile US (NasdaqGS:TMUS) recently announced two new Essentials plans for first responders and military families, offering them competitive pricing compared to peers like AT&T and Verizon. The company's partnership with New York City aims to enhance public safety using its expansive 5G standalone network. In the last month, the stock rose by 21%, likely influenced by its Q4 2024 financial report, which showed a revenue climb to $21.87 billion, and a dividend declaration. The market saw a general decline, with major indexes ending lower; however, TMUS outperformed, possibly buoyed by its recent initiatives and financial results. The market's general performance was flat last week, with an upward trajectory over the year. Despite the broader market struggles, TMUS's shares stood out likely due to these tactical moves and financial strengths amidst mixed market signals.

Click to explore a detailed breakdown of our findings on T-Mobile US.

T-Mobile US has experienced remarkable growth in its total shareholder returns over the last five years, achieving an impressive 197.01% return. This period has showcased substantial earnings growth, averaging 32.6% annually, with an accelerated pace noted in the previous year reaching 36.3%. The company's initiatives to enhance its 5G network have likely bolstered its performance, particularly through collaborations with Ericsson and Nokia, which were established early in this timeframe. Additionally, T-Mobile's proactive approach to expanding its customer offerings, including significant product launches, has contributed to its robust financial standing as it distinguished itself within the wireless telecom industry.

Despite a high level of debt, T-Mobile's financial strategy has included share buybacks totaling over US$4.6 billion in early 2025, reflecting a strong cash position. However, in the past year, TMUS's returns underperformed the industry but still surpassed the US market's return of 20.8%. High-quality earnings and improved profit margins have further supported the company's long-term growth story. As a result, T-Mobile has maintained its position as a key player in the competitive telecom landscape.

- Discover whether T-Mobile US is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Understand the uncertainties surrounding T-Mobile US' market positioning with our detailed risk analysis report.

- Is T-Mobile US part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMUS

T-Mobile US

Provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives