- United States

- /

- Wireless Telecom

- /

- NasdaqGS:TMUS

T-Mobile US (NasdaqGS:TMUS) Announces Samsung Galaxy S25 Edge Deals And 5-Year Price Guarantee

Reviewed by Simply Wall St

T-Mobile US (NasdaqGS:TMUS) announced the launch of the Samsung Galaxy S25 Edge, featuring customer-centric promotions like a free device upon trade-in. This positive development for consumers did not, however, translate into immediate stock gains, as T-Mobile’s shares fell 6% over the past week. The company's initiatives in 5G technology and advertising solutions align with their innovative strategy but did not counteract the market's broader uptrend. With the overall market rising by 4% during the same period, T-Mobile's initiatives and partnerships add context to their trajectory amid larger market dynamics.

You should learn about the 2 risks we've spotted with T-Mobile US.

The recent unveiling of the Samsung Galaxy S25 Edge at T-Mobile US, despite being consumer-friendly, hasn't positively impacted short-term share performance, resulting in a 6% decline over the past week. This comes even as the broader market rose by 4% in the same timeframe. Looking at a broader picture, however, T-Mobile's total return, including share price and dividends, stands at more than double over the past five years, with a 146.58% increase from May 2020 to May 2025, showcasing a robust long-term growth trajectory.

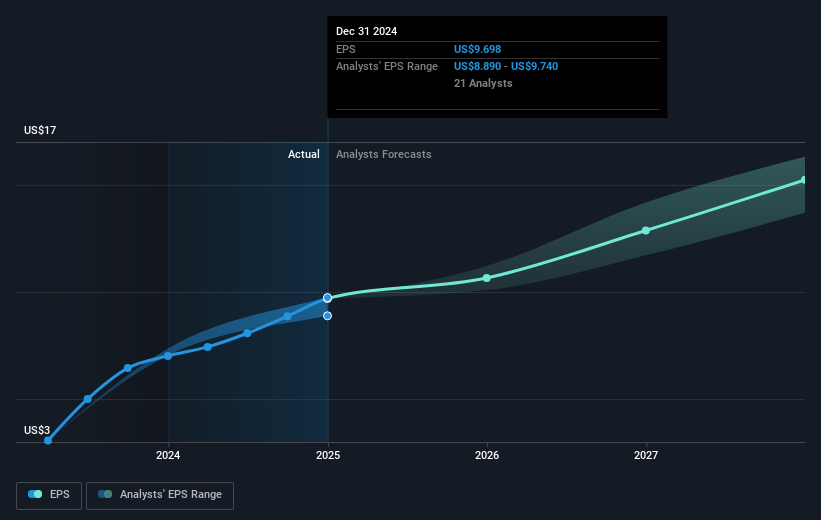

In the past year, T-Mobile underperformed the US Wireless Telecom industry, which saw a substantial 47.3% increase, while T-Mobile's shares also exceeded the overall US market's 11.6% return. These figures suggest that while recent market movements have not been favorable, the company's longer-term growth and industry position remain strong. The launch of new technologies and devices like the S25 Edge could contribute to revenue and earnings enhancements, aligning with analyst expectations of a 5.1% annual revenue growth and improved profit margins. The current share price of US$253.8 remains just under the analyst consensus price target of US$269.25, suggesting that, in general, analysts believe the share is fairly valued, and the innovative drive might bolster T-Mobile's future potential.

Assess T-Mobile US' future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if T-Mobile US might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TMUS

T-Mobile US

Provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives