- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:LILA

Liberty Latin America (NASDAQ:LILA) Use Of Debt Could Be Considered Risky

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Liberty Latin America Ltd. (NASDAQ:LILA) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Liberty Latin America

What Is Liberty Latin America's Debt?

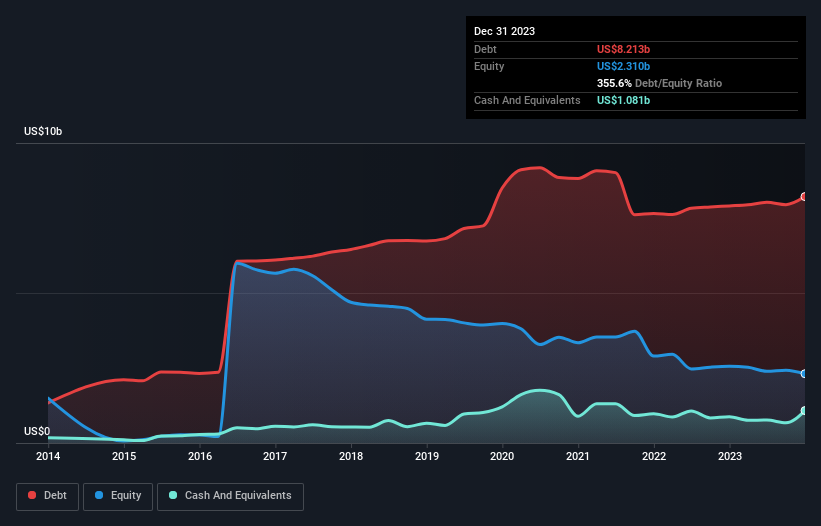

The chart below, which you can click on for greater detail, shows that Liberty Latin America had US$8.21b in debt in December 2023; about the same as the year before. However, because it has a cash reserve of US$1.08b, its net debt is less, at about US$7.13b.

How Healthy Is Liberty Latin America's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Liberty Latin America had liabilities of US$2.13b due within 12 months and liabilities of US$9.15b due beyond that. Offsetting these obligations, it had cash of US$1.08b as well as receivables valued at US$903.3m due within 12 months. So its liabilities total US$9.30b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the US$1.56b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Liberty Latin America would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Liberty Latin America's debt to EBITDA ratio (4.4) suggests that it uses some debt, its interest cover is very weak, at 1.0, suggesting high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. More concerning, Liberty Latin America saw its EBIT drop by 9.7% in the last twelve months. If that earnings trend continues the company will face an uphill battle to pay off its debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Liberty Latin America can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Liberty Latin America recorded free cash flow of 40% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

To be frank both Liberty Latin America's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. Having said that, its ability to convert EBIT to free cash flow isn't such a worry. Taking into account all the aforementioned factors, it looks like Liberty Latin America has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. Given our concerns about Liberty Latin America's debt levels, it seems only prudent to check if insiders have been ditching the stock.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:LILA

Liberty Latin America

Provides fixed, mobile, and subsea telecommunications services in Puerto Rico, Panama, Costa Rica, Jamaica, Latin America and the Caribbean, the Bahamas, Trinidad and Tobago, Barbados, Curacao, Chile, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives