- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:IRDM

Some Shareholders Feeling Restless Over Iridium Communications Inc.'s (NASDAQ:IRDM) P/S Ratio

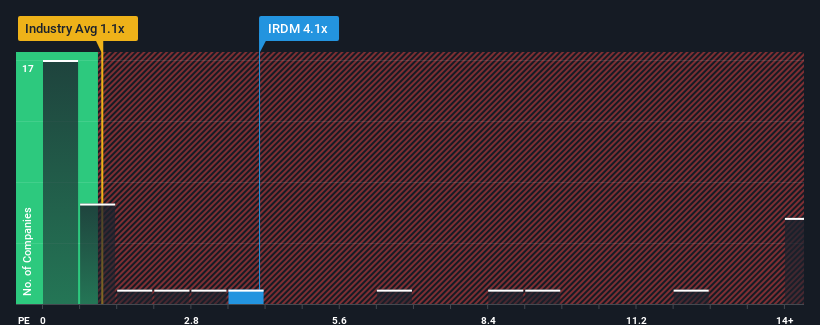

When you see that almost half of the companies in the Telecom industry in the United States have price-to-sales ratios (or "P/S") below 1.1x, Iridium Communications Inc. (NASDAQ:IRDM) looks to be giving off strong sell signals with its 4.1x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Iridium Communications

What Does Iridium Communications' Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Iridium Communications has been doing quite well of late. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Iridium Communications.Is There Enough Revenue Growth Forecasted For Iridium Communications?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Iridium Communications' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.1% last year. Pleasingly, revenue has also lifted 35% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 2.7% per annum as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 181% per year, which is noticeably more attractive.

With this information, we find it concerning that Iridium Communications is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've concluded that Iridium Communications currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Iridium Communications is showing 3 warning signs in our investment analysis, and 1 of those is significant.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRDM

Iridium Communications

Provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide.

Fair value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026