- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:IRDM

Iridium Communications (IRDM): Evaluating Valuation After New $85.8 Million U.S. Space Force Contract Win

Reviewed by Simply Wall St

Iridium Communications (IRDM) just landed a fresh 5 year contract with the U.S. Space Force worth up to $85.8 million, extending its role in mission critical defense communications.

See our latest analysis for Iridium Communications.

Even with this new Space Force win and a fresh dividend declaration, the share price has slid sharply this year, with a year to date share price return of negative 40.68 percent and a one year total shareholder return of negative 42.1 percent. This suggests sentiment is still rebuilding rather than overheating.

If this contract has you thinking more broadly about defense and space exposure, it could be worth exploring aerospace and defense stocks for other potential ideas in the same orbit.

With shares trading well below analyst targets despite steady revenue and earnings growth, is Iridium a discounted way to play secure satellite communications, or is the market already discounting its future growth trajectory?

Most Popular Narrative Narrative: 41.0% Undervalued

With Iridium Communications last closing at $17.54 against a narrative fair value of $29.75, the spread points to a sizable perceived upside grounded in long term cash flows.

The company's fully deployed next gen constellation and declining capex profile are freeing up significant cash flow for buybacks and steady dividend increases, directly boosting per share earnings potential and making Iridium's free cash flow yield structurally attractive.

Curious how modest top line expansion, rising margins, and shrinking share count combine into that higher valuation claim? The narrative leans on surprisingly ambitious earnings power and a richer future multiple. Want to see the exact growth path behind that conviction and the discount rate used to get there? Read on for the full breakdown.

Result: Fair Value of $29.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating customer shifts to lower value plans and intensifying satellite competition could compress Iridium’s growth, margins, and ultimately challenge that upside narrative.

Find out about the key risks to this Iridium Communications narrative.

Another Angle on Valuation

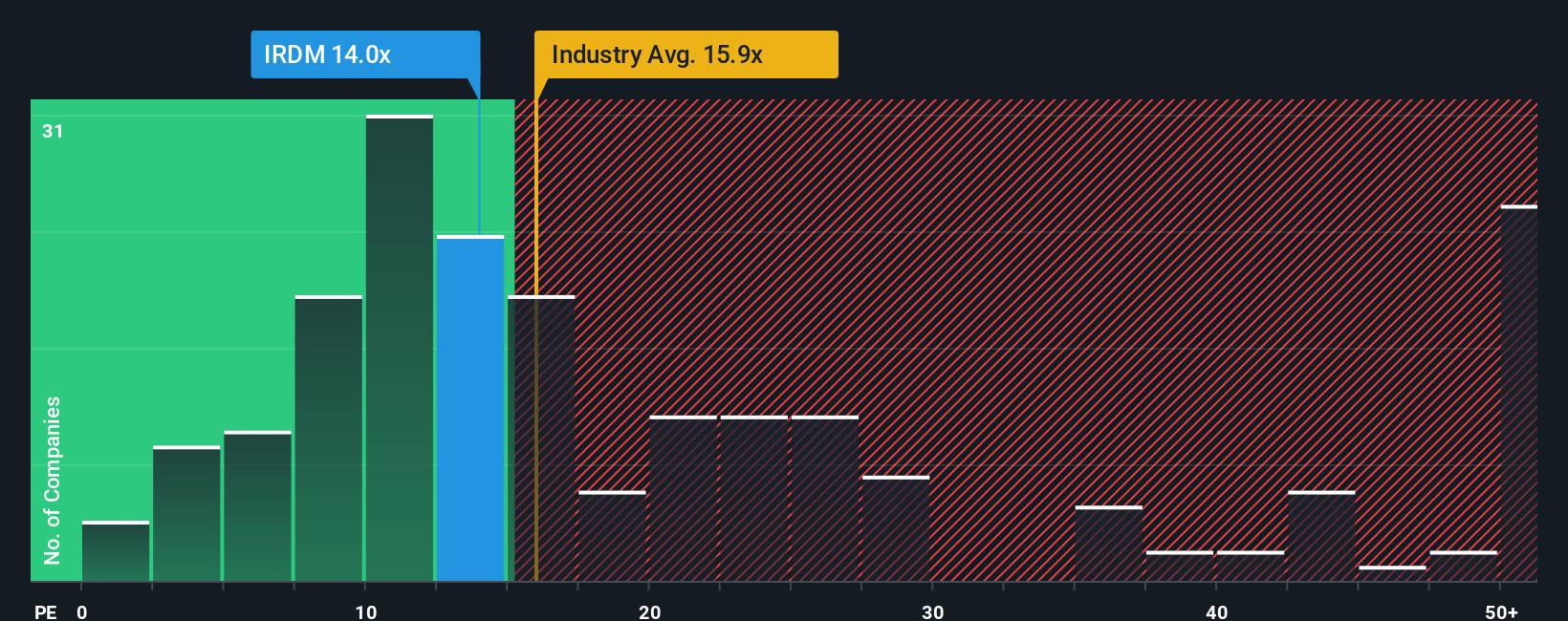

On earnings, the picture looks very different. Iridium trades on a 14.6x P/E, above its fair ratio of 14.4x and well above peers at 6.7x, yet still below the global telecom average of 16.3x. That mix of relative cheapness and peer premium raises a simple question: is this really a deep value story or just fairly priced risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Iridium Communications Narrative

If this perspective is not quite how you see things, or you would rather dig into the numbers yourself, you can build a custom view in just a few minutes, Do it your way.

A great starting point for your Iridium Communications research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put Simply Wall St’s powerful Screener to work and uncover fresh opportunities that could reshape your portfolio’s returns this year.

- Capture early stage potential by targeting these 3572 penny stocks with strong financials that already back their small size with robust financial strength.

- Ride the next wave of innovation by zeroing in on these 26 AI penny stocks at the forefront of applied artificial intelligence.

- Lock in attractive entry points with these 910 undervalued stocks based on cash flows that the market has not fully priced for their long term cash flow power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRDM

Iridium Communications

Provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide.

Fair value with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026