- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:IRDM

Does Iridium Stock Deserve a Second Look After Its 38% Slide in 2024?

Reviewed by Bailey Pemberton

If you're trying to figure out what to do with Iridium Communications stock right now, you're not alone. The satellite communications specialist has had a wild ride lately. Just last week, the stock dipped 2.0%, bouncing back from a 3.3% climb over the past month. However, if you zoom out, the story gets a bit murkier. Shares are down nearly 38% year-to-date and have dropped 36.4% over the last twelve months. Even the longer-term returns tell a tale of volatility, with a 58.6% slip over three years and 31.2% for five years. Investors have been reassessing satellite sector risks, especially as new players and evolving technologies have shaken up the market. Recent developments in commercial satellite launches and shifting demand for global connectivity seem to have changed how the market is pricing future growth.

With all these moves, you might be wondering whether Iridium is simply out of favor, or if its stock is undervalued enough to justify a closer look. According to our valuation scorecard, Iridium checks 3 out of 6 boxes for undervaluation, giving it a score of 3. But does this make it a bargain, or just cheap for a reason? Let's dig into how the usual valuation metrics stack up, and stick around for a fresh perspective on what this all means for real-world returns.

Why Iridium Communications is lagging behind its peers

Approach 1: Iridium Communications Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model projects a company’s future cash flows and then discounts those figures back to their value today, revealing what the business might be worth if those projections come true. This approach emphasizes the power of future cash generation, rather than focusing solely on past earnings or accounting figures.

For Iridium Communications, the latest 12-month Free Cash Flow stands at $333.37 million. Analysts forecast that this figure will steadily increase, with $328.02 million projected in 2026 and $435.85 million by 2029. These analyst estimates guide the outlook for the next five years, while approaches like Simply Wall St extrapolate beyond this period, keeping in mind long-term structural factors. Further out, projections suggest Free Cash Flow could surpass $589 million by 2035, though those later figures should be seen as increasingly speculative.

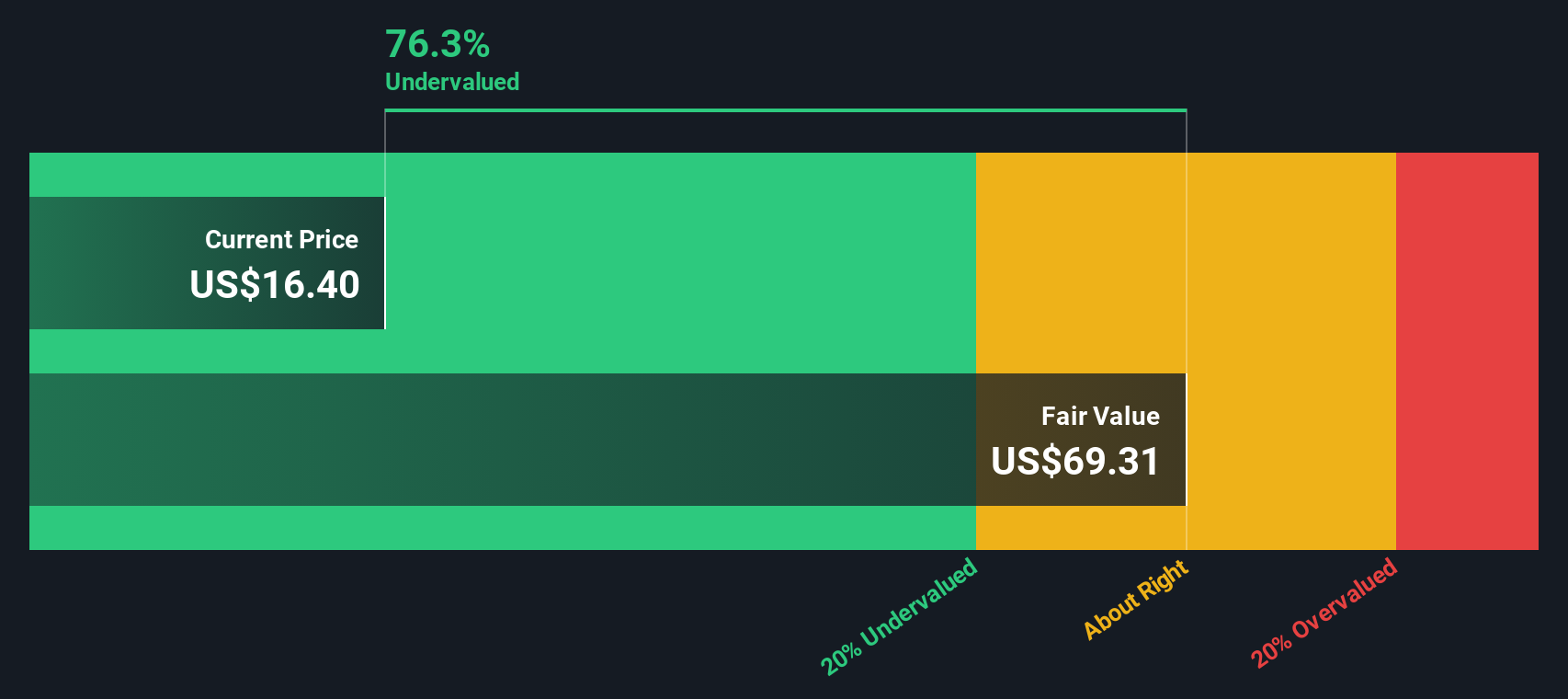

The DCF valuation indicates that Iridium’s estimated fair value is $102.74 per share. With the current market price sitting at an 82.1% discount to this intrinsic figure, the model signals Iridium may be strongly undervalued at present, based primarily on its future cash flow potential and robust long-range forecasts.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Iridium Communications is undervalued by 82.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

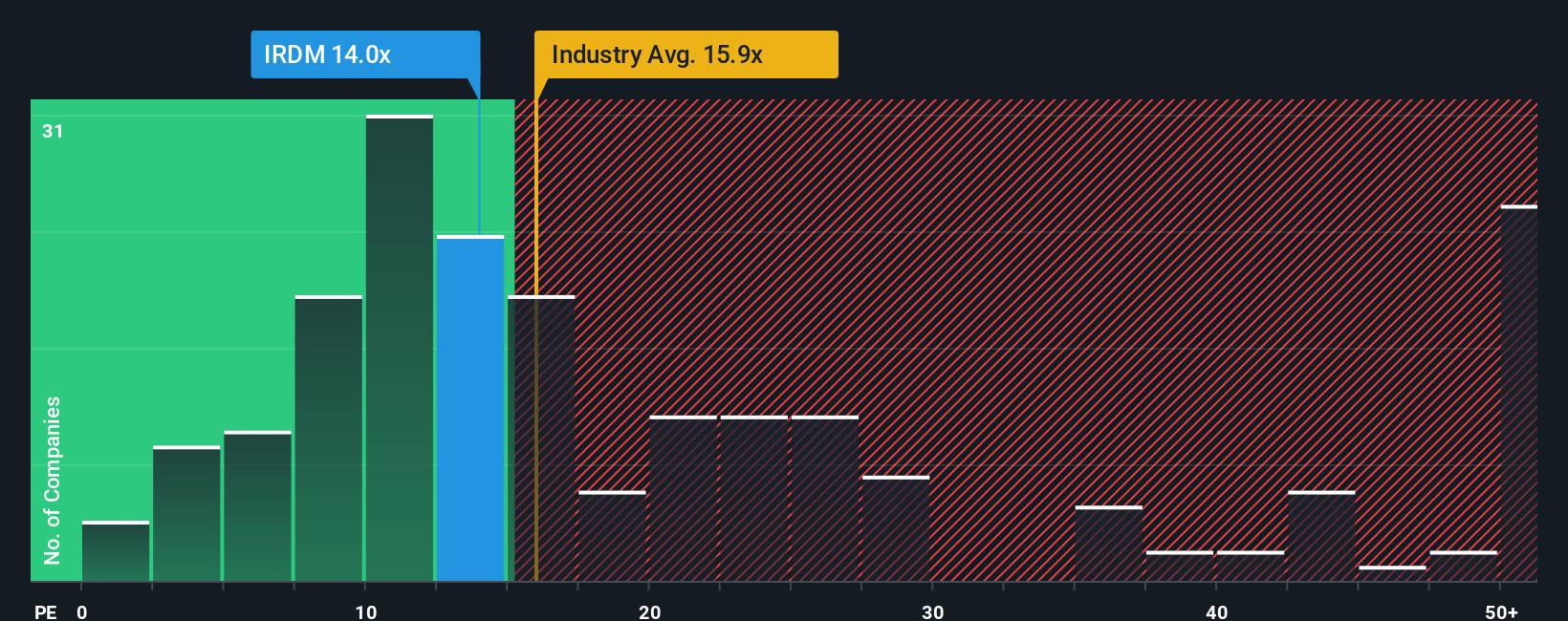

Approach 2: Iridium Communications Price vs Earnings (PE)

For companies already generating steady profits, the Price-to-Earnings (PE) ratio is one of the most widely used valuation methods. The PE ratio gives investors a sense of how much they are paying for every dollar of the company's earnings, making it especially relevant for profitable businesses like Iridium Communications.

Determining a "normal" or fair PE ratio depends on a variety of factors, such as expectations for future growth, industry risks, and how stable or cyclical a company’s profits are. Faster-growing or more resilient companies often merit higher multiples, while firms facing higher risks or slower growth typically trade at lower ones.

Currently, Iridium trades at a PE ratio of 17.2x. Compared to the Telecom industry average of 17.0x and a peer group average of 20.9x, Iridium is valued at roughly the same level as its sector, though trailing its peers slightly. To add an extra layer of context, Simply Wall St’s proprietary Fair Ratio for Iridium is 17.1x. This measure considers not just industry averages or peer comparisons but also factors like Iridium’s specific earnings growth, risk profile, profit margins, market cap, and sector trends.

The Fair Ratio provides a more tailored benchmark for valuation. It goes beyond simple industry averages or peer multiples and adapts for company-specific strengths and weaknesses. In Iridium’s case, the current PE of 17.2x is virtually identical to the Fair Ratio of 17.1x. That suggests the stock is trading very close to what would be considered a fair price based on its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Iridium Communications Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is much more than just a price target; it’s your own story about how you believe a company like Iridium will perform, complete with your expectations for revenue, earnings, and margins.

Narratives allow investors to link the company's real-world story to financial forecasts, and then directly to a fair value. On Simply Wall St’s Community page, millions of investors use Narratives to quickly compare their assumptions and see how those ideas stack up to current prices and consensus views.

Instead of just looking at static metrics, Narratives help you decide when to buy or sell by tracking the gap between your Fair Value and the current Price. These Narratives update automatically as new earnings or news emerges, keeping your logic fresh.

For example, one investor’s Narrative for Iridium sees bold long-term upside, estimating a fair value of $38.60 based on growth in secure satellite services, while another, focused on competitive risks, sees fair value closer to $16.00. Narratives make it easy to compare these perspectives and empower you to build, challenge, and share your own view on Iridium, turning company analysis into an accessible, dynamic process for everyone.

Do you think there's more to the story for Iridium Communications? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRDM

Iridium Communications

Provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives