- United States

- /

- Wireless Telecom

- /

- NasdaqGS:GOGO

Is Gogo Set for Liftoff After Q1 Earnings and Stock Dip?

Reviewed by Bailey Pemberton

If you have been watching Gogo stock lately, you are far from alone. Investors are weighing whether it is time to buckle in for the next leg up or prepare for more turbulence ahead. With the price closing recently at $8.90, Gogo flashed a modest 0.5% gain over the past week, but that comes on the back of a tougher 30-day stretch where shares dropped 9.1%. Zooming out, it has been a wild ride: up 7.2% year-to-date and 26.8% over the past year, but still negative across longer multi-year horizons. These swings reflect shifts in growth sentiment and changing perceptions of risk as the in-flight connectivity sector adapts to new technologies and market dynamics.

What stands out is how investors are shifting focus, especially as broader market narratives touch on themes that affect Gogo, such as tech innovation and evolving airline priorities. While near-term volatility is hard to ignore, Gogo’s value score offers an important perspective. On a scale where 6 signals possible undervaluation, Gogo scores a 4, passing four out of six checks. That puts it squarely in the “potentially undervalued” camp according to standard valuation screens, which is exactly where things get interesting.

So, how do these valuation checks really stack up? Before we dive into the specifics of each method and what they reveal about Gogo’s true worth, stick around. There is a smarter way to view valuation that could change how you look at the stock for good.

Approach 1: Gogo Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach essentially determines what all those future dollars are worth in the present. For Gogo, the model uses a two-stage method focused on Free Cash Flow to Equity.

As of the latest reporting, Gogo produced $13.2 million in Free Cash Flow. Analysts provide forecasts up to five years out, and after that, projections are extended using trend estimates. By 2027, Gogo's annual FCF is projected to reach $127 million. Extrapolating further, Simply Wall St forecasts indicate a steady climb in FCF over the next decade, with most years expected to see incremental gains.

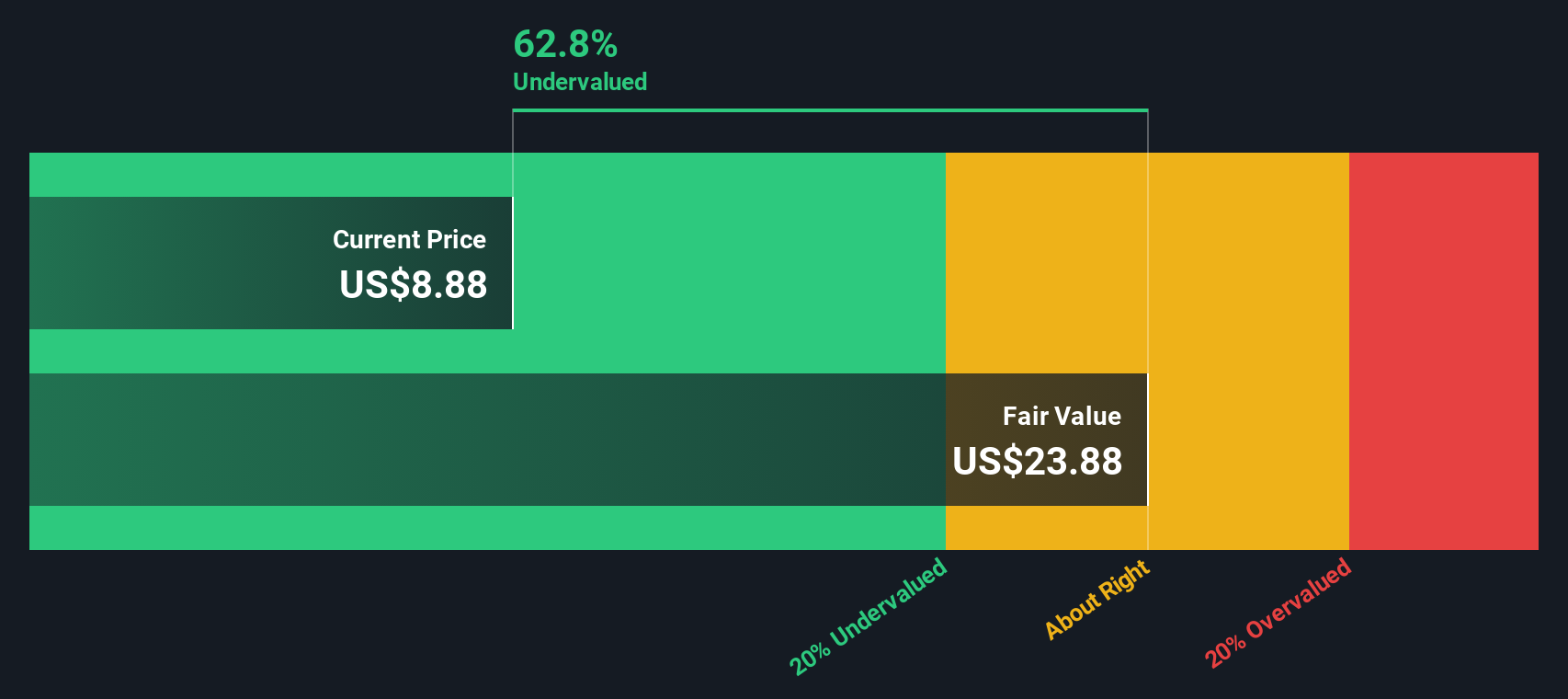

The DCF calculation yields an intrinsic fair value of $23.88 per share for Gogo. With the current share price sitting at $8.90, this implies the stock is trading at a 62.7% discount to its estimated intrinsic value, suggesting substantial undervaluation based on this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Gogo is undervalued by 62.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Gogo Price vs Sales

The Price-to-Sales (P/S) ratio is often a key metric for valuing companies like Gogo, especially in tech-driven industries and when earnings can be volatile. It gives investors a sense of how much they are paying for each dollar of the company’s revenues. For profitable companies that are still focused on growth or have inconsistent net earnings, the P/S ratio can offer a broader perspective than just looking at profits alone.

Growth expectations and risk levels play a huge role in what is considered a “normal” or “fair” P/S ratio for a stock. Companies expecting rapid growth or those considered less risky can often justify a higher P/S ratio, while lower growth or increased uncertainty usually means investors demand a discount.

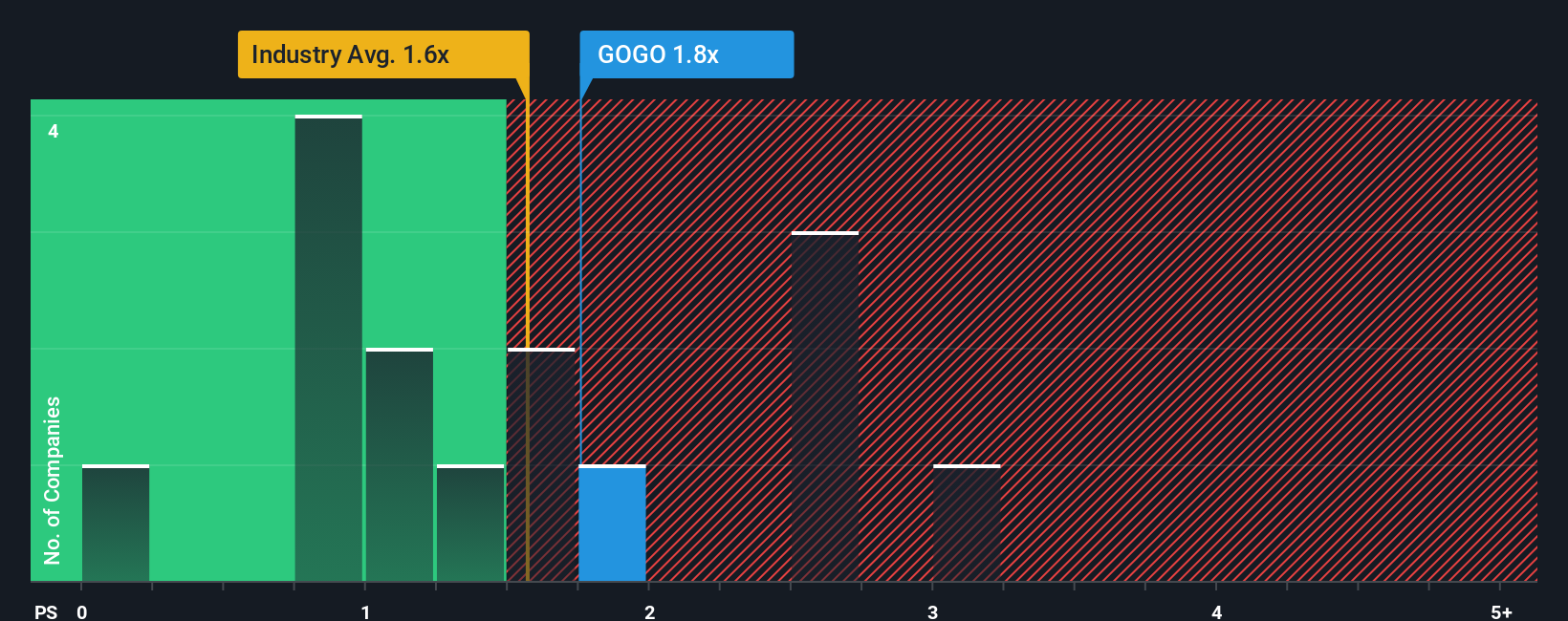

Gogo’s current P/S ratio stands at 1.71x, right around its peer average of 1.75x and slightly above the Wireless Telecom industry average of 1.54x. Instead of just comparing to these benchmarks, Simply Wall St introduces the “Fair Ratio,” which evaluates what Gogo’s P/S should be by factoring in its earnings growth outlook, profit margins, industry trends and market capitalization, along with unique risk considerations. This makes the Fair Ratio, currently 1.20x for Gogo, a more comprehensive and tailored yardstick than conventional peer or sector averages.

Since Gogo’s actual P/S of 1.71x is noticeably higher than its Fair Ratio of 1.20x, the stock appears to be trading at a premium to its fundamentals according to this metric.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Gogo Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a practical tool that connects your story about Gogo with a financial forecast and a fair value estimate.

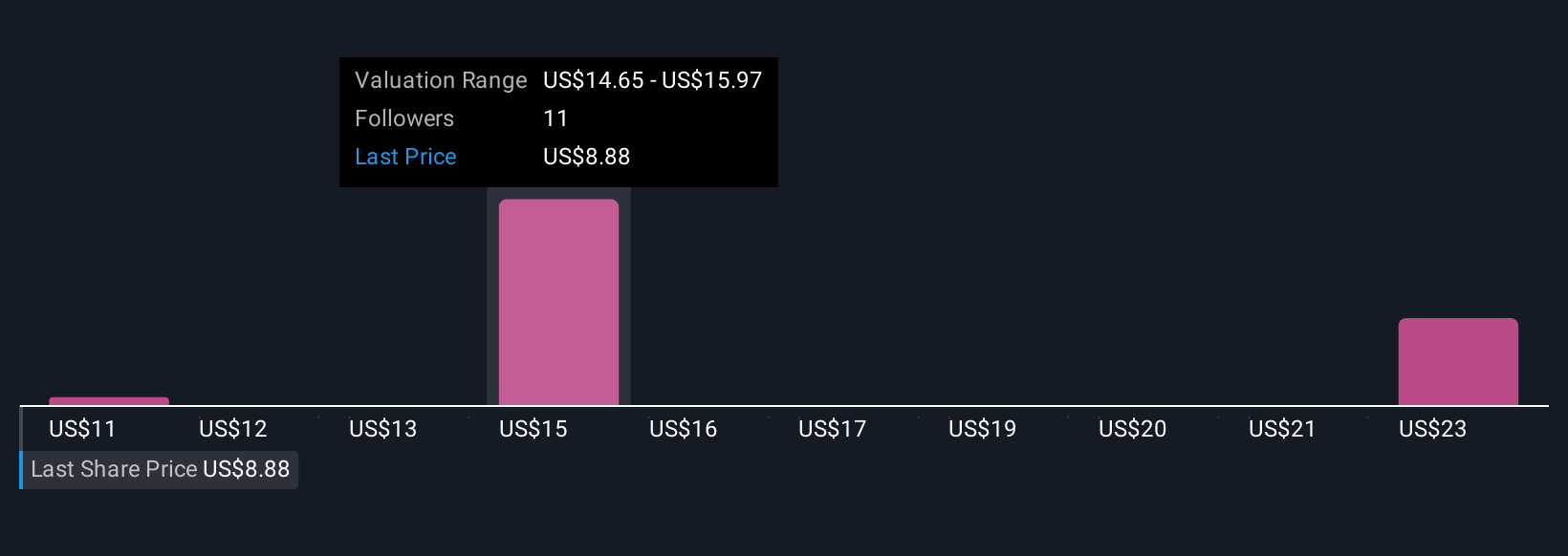

In simple terms, a Narrative lets you express your view of the company behind the numbers, laying out your forecasts for things like future revenue, profit margins, and the fair price you'd pay for Gogo shares, all in one place. Instead of relying solely on static ratios or analyst targets, Narratives help you link the company's real story, current catalysts, and your expectations directly to a current fair value calculation.

These Narratives are fully accessible from Simply Wall St’s Community page, making it easy to see how thousands of other investors are thinking, and to build your own dynamic outlook. No math PhD required. When new news or earnings come out, your Narrative automatically refreshes, so you are always comparing your fair value with the latest share price and market context.

For example, right now some Gogo investors have built bullish Narratives forecasting aggressive broadband expansion and set their fair value at $17.5, while others are more cautious, seeing tech risks and competition, with a fair value near $14.0. This helps you see the full spectrum of investor perspectives in real time.

Do you think there's more to the story for Gogo? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOGO

Gogo

Provides broadband connectivity services to the aviation industry in the United States and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives