- United States

- /

- Wireless Telecom

- /

- NasdaqGS:GOGO

Gogo (GOGO) Valuation in Focus Following FAA Approval and New Product Installations in Aviation Connectivity

Reviewed by Kshitija Bhandaru

Gogo (GOGO) just cleared a major hurdle in the aviation connectivity space, with recent approvals for its advanced Galileo FDX system by the FAA and a successful first installation on a Boeing Business Jet. These developments are helping Gogo expand its reach with high-speed in-flight broadband offerings.

See our latest analysis for Gogo.

Gogo’s latest product launches and regulatory wins have added excitement to the story, but it’s the stock’s momentum that really stands out. While the share price is up 8.9% year-to-date, the total shareholder return over the past year clocks in at an impressive 42%. Investors appear to be anticipating that these achievements could drive more growth, even after a volatile stretch in recent months.

If you’re interested in the pace of innovation within aviation and aerospace tech, now’s the perfect moment to browse other industry leaders with our See the full list for free.

With shares still trading at a notable discount to analyst price targets despite double-digit revenue growth and game-changing product rollouts, the key question is whether Gogo is genuinely undervalued or if the market has already priced in its growth potential.

Most Popular Narrative: 41.7% Undervalued

The narrative suggests Gogo shares are trading significantly below a level justified by potential future growth, particularly when compared with optimistic long-term analyst estimates. This invites further examination of a key factor driving investor optimism.

The launch of the Galileo HDX and FDX terminals is expected to diversify revenue streams and generate higher-margin service revenue beginning in 2026. This could increase earnings from new customers and lower competition risk from current single-network providers such as Starlink.

What is fueling this valuation perspective? The narrative centers on rapid profit expansion, anticipated margin improvements, and a forward-looking profit multiple that is usually associated with top-performing sectors. Interested in the forecast figures that underpin this outlook? Unlock the full story to see the projections that are considered most important.

Result: Fair Value of $15.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in new technology rollouts or intensifying competition from rivals like Starlink could challenge Gogo’s ambitious growth projections in the future.

Find out about the key risks to this Gogo narrative.

Another View: Market Multiples Tell a Different Story

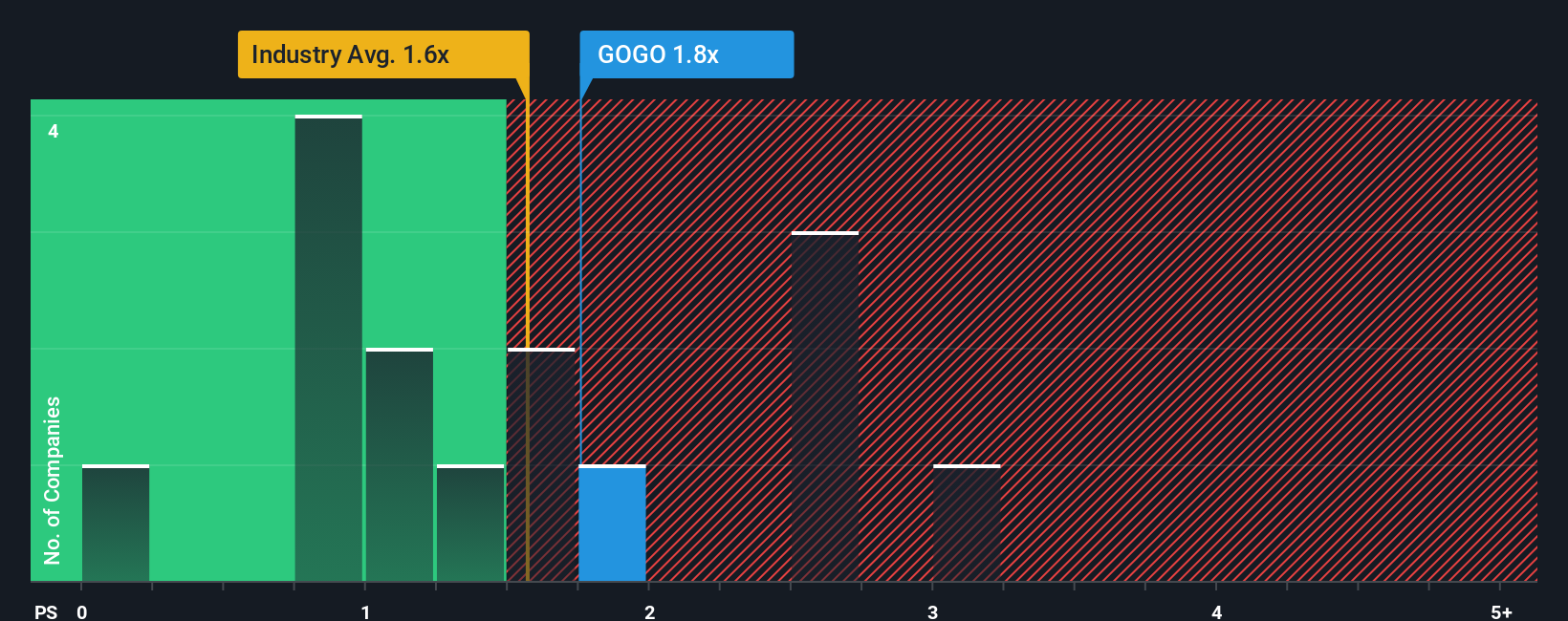

Looking at valuation through the lens of the price-to-sales ratio brings a different perspective. Gogo trades at a price-to-sales of 1.7x, which is more expensive than the global industry average of 1.5x and the fair ratio of 1.2x that the market could gravitate toward. This creates a valuation risk if sentiment shifts. Could the optimism already be reflected in today's price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gogo Narrative

If you see the story differently or want to dig into the data on your own terms, you’re free to build your own narrative in just a few minutes. Do it your way

A great starting point for your Gogo research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Uncover timely investment opportunities with our curated screeners and put yourself ahead of the market. Don’t let potential winners slip by while others take action.

- Target real growth potential and uncover overlooked value with these 888 undervalued stocks based on cash flows that could reshape your portfolio’s long-term returns.

- Pounce on the rise of artificial intelligence by checking out these 25 AI penny stocks, where innovation and explosive trends meet fresh investment talent.

- Boost your passive income strategy by tracking down these 18 dividend stocks with yields > 3% offering solid yields and steady financial performance for income-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GOGO

Gogo

Provides broadband connectivity services to the aviation industry in the United States and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives