- United States

- /

- Wireless Telecom

- /

- NasdaqCM:FNGR

Further weakness as FingerMotion (NASDAQ:FNGR) drops 13% this week, taking one-year losses to 74%

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But it's not unreasonable to try to avoid truly shocking capital losses. It must have been painful to be a FingerMotion, Inc. (NASDAQ:FNGR) shareholder over the last year, since the stock price plummeted 74% in that time. That'd be enough to make even the strongest stomachs churn. To make matters worse, the returns over three years have also been really disappointing (the share price is 67% lower than three years ago). The falls have accelerated recently, with the share price down 56% in the last three months.

If the past week is anything to go by, investor sentiment for FingerMotion isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for FingerMotion

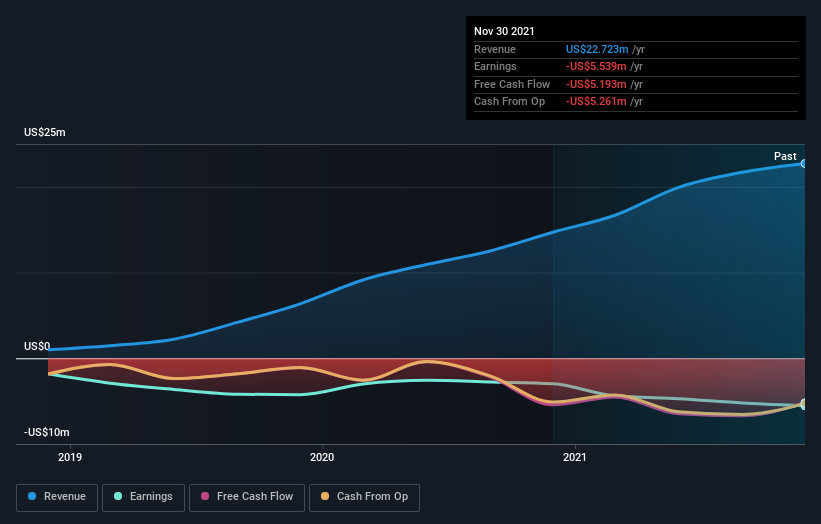

Given that FingerMotion didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year FingerMotion saw its revenue grow by 54%. That's well above most other pre-profit companies. So the hefty 74% share price crash makes us think the company has somehow offended market participants. There's clearly something unusual going on here such as an acquisition that hasn't delivered expected profits. What is clear is that the market is not judging the company on its revenue growth right now. Of course, investors do over-react when they are stressed out, so the sell-off could be unjustifiably severe.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

FingerMotion shareholders are down 74% for the year, but the broader market is up 0.5%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 19% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - FingerMotion has 5 warning signs (and 2 which don't sit too well with us) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FNGR

FingerMotion

A mobile data specialist company, provides mobile payment and recharge platform system in China.

Excellent balance sheet slight.

Market Insights

Community Narratives