- United States

- /

- Wireless Telecom

- /

- NasdaqCM:FNGR

Further weakness as FingerMotion (NASDAQ:FNGR) drops 11% this week, taking three-year losses to 79%

As every investor would know, not every swing hits the sweet spot. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of FingerMotion, Inc. (NASDAQ:FNGR), who have seen the share price tank a massive 79% over a three year period. That would certainly shake our confidence in the decision to own the stock. Furthermore, it's down 46% in about a quarter. That's not much fun for holders.

Since FingerMotion has shed US$13m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for FingerMotion

FingerMotion isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, FingerMotion grew revenue at 35% per year. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price down 21% a year in the same time period. You'd want to take a close look at the balance sheet, as well as the losses. Ultimately, revenue growth doesn't amount to much if the business can't scale well. If the company is low on cash, it may have to raise capital soon.

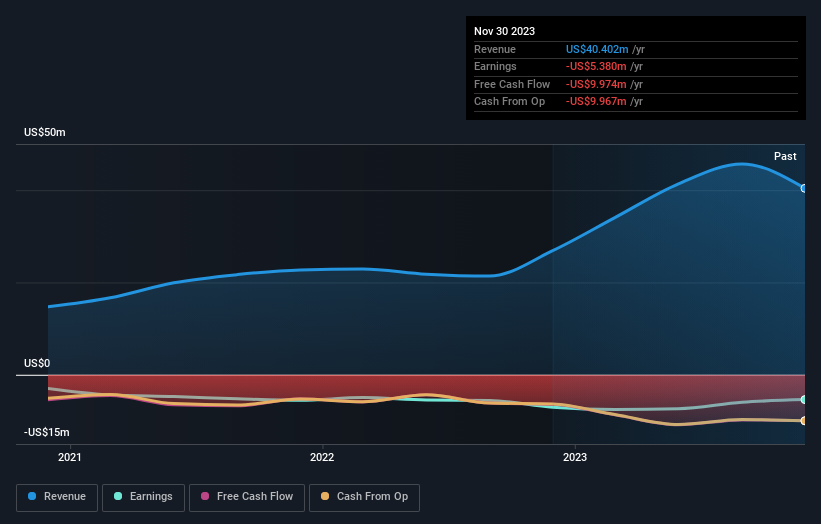

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of FingerMotion's earnings, revenue and cash flow.

A Different Perspective

It's good to see that FingerMotion has rewarded shareholders with a total shareholder return of 43% in the last twelve months. That certainly beats the loss of about 11% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand FingerMotion better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with FingerMotion (including 2 which shouldn't be ignored) .

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FNGR

FingerMotion

A mobile data specialist company, provides mobile payment and recharge platform system in China.

Adequate balance sheet low.

Market Insights

Community Narratives