- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:CNSL

Consolidated Communications Holdings (NASDAQ:CNSL) Takes On Some Risk With Its Use Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Consolidated Communications Holdings, Inc. (NASDAQ:CNSL) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Consolidated Communications Holdings

What Is Consolidated Communications Holdings's Net Debt?

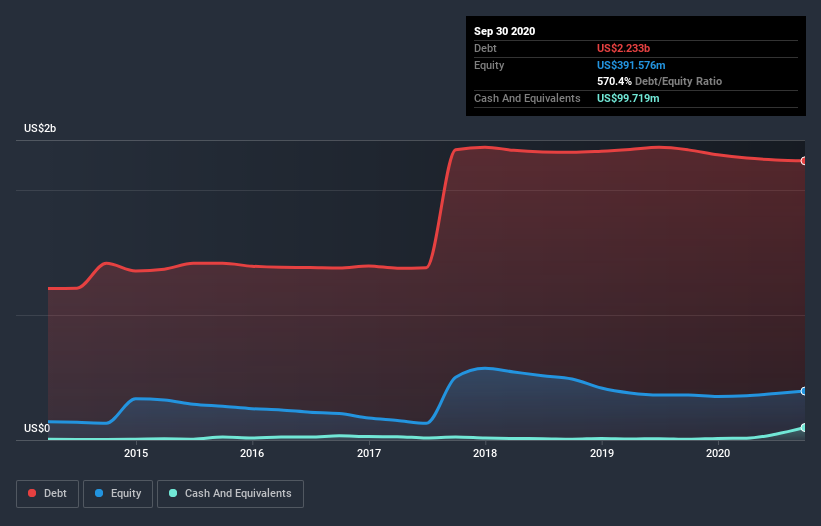

As you can see below, Consolidated Communications Holdings had US$2.23b of debt, at September 2020, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has US$99.7m in cash leading to net debt of about US$2.13b.

How Healthy Is Consolidated Communications Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Consolidated Communications Holdings had liabilities of US$263.1m due within 12 months and liabilities of US$2.73b due beyond that. On the other hand, it had cash of US$99.7m and US$124.3m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.77b.

This deficit casts a shadow over the US$482.0m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Consolidated Communications Holdings would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't worry about Consolidated Communications Holdings's net debt to EBITDA ratio of 4.4, we think its super-low interest cover of 1.6 times is a sign of high leverage. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. However, it should be some comfort for shareholders to recall that Consolidated Communications Holdings actually grew its EBIT by a hefty 114%, over the last 12 months. If it can keep walking that path it will be in a position to shed its debt with relative ease. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Consolidated Communications Holdings's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Consolidated Communications Holdings actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

While Consolidated Communications Holdings's level of total liabilities has us nervous. For example, its conversion of EBIT to free cash flow and EBIT growth rate give us some confidence in its ability to manage its debt. When we consider all the factors discussed, it seems to us that Consolidated Communications Holdings is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Consolidated Communications Holdings (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Consolidated Communications Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CNSL

Consolidated Communications Holdings

Provides broadband and business communication solutions for consumer, commercial, and carrier channels in the United States.

Fair value very low.

Similar Companies

Market Insights

Community Narratives