- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:CCOI

Cogent Communications (CCOI): Assessing Valuation as Investor Interest Rises

Reviewed by Kshitija Bhandaru

Cogent Communications Holdings (CCOI) shares have edged up in recent trading, drawing attention from investors looking at the telecom sector’s evolving performance. The company’s year-to-date and one-year returns show a mixed picture, reflecting shifting sentiment.

See our latest analysis for Cogent Communications Holdings.

While Cogent’s 1-year total shareholder return remains slightly in the red, recent share price moves suggest investors are watching for a potential shift in sentiment. The longer-term trend shows modest underperformance, but momentum hints are emerging as the company works through sector changes.

Curious how other companies are navigating market shifts? Now is the perfect time to broaden your scope and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst price targets and some measures of intrinsic value, investors are left to wonder if the recent weakness signals an undervalued opportunity or if the market has already accounted for future growth prospects.

Most Popular Narrative: 15% Undervalued

Cogent Communications Holdings is trading well below the narrative’s fair value estimate, presenting a meaningful gap compared to the last close price. This sets up a compelling case for what’s potentially driving analyst expectations higher than current market levels.

Cogent is seeing rising demand for high-capacity data connectivity driven by surging global internet traffic from video streaming, AI, and cloud computing, as evidenced by strong growth in NetCentric/wavelength revenues (27% sequential, 150% YoY) and a large wavelength opportunity pipeline (4,687 opportunities). This is poised to accelerate top-line revenue growth as the company captures more of the North American wavelength market.

Ready to discover what’s fueling this bullish outlook? There's a bold quantitative thesis under the surface, one that hinges on rising margins and revenue momentum not yet seen in the company’s recent bottom line. Unpack the forecasts and see which financial shifts could drive the next big move.

Result: Fair Value of $47.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued pricing pressure across bandwidth services and uncertainty around monetizing noncore assets could quickly challenge this optimistic outlook.

Find out about the key risks to this Cogent Communications Holdings narrative.

Another View: Market Ratios Suggest Premium Pricing

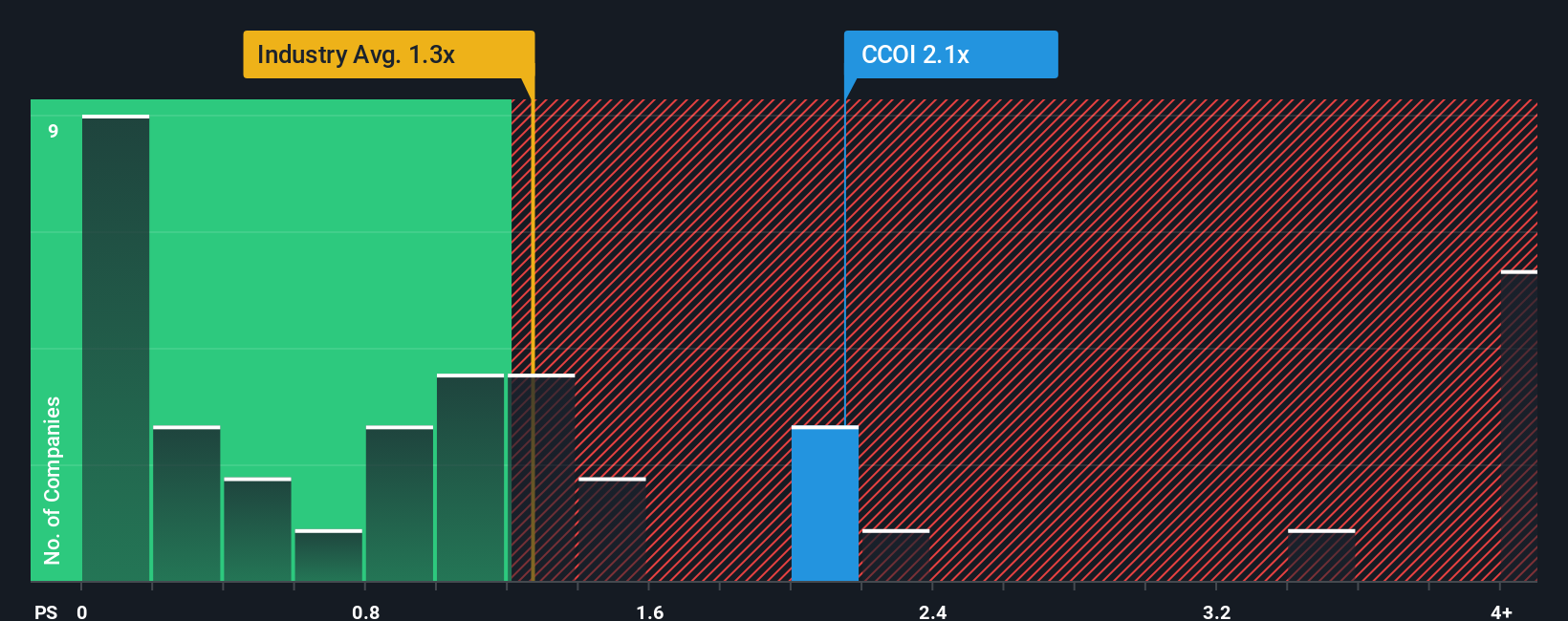

Looking at Cogent Communications Holdings through the lens of traditional price-to-sales ratios, the stock trades at 2.1 times sales. This is not only higher than the US Telecom industry average of 1.2 times sales, but also significantly above the fair ratio of 0.9. Such a premium suggests investors may be paying up for growth potential, which increases the risk if that growth does not materialize.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cogent Communications Holdings Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, you can craft your own take in just a few minutes. Do it your way

A great starting point for your Cogent Communications Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss out on exciting opportunities beyond this stock. Use the Simply Wall Street Screener to discover hidden gems and power up your investing strategy today.

- Target fresh potential by checking out these 3568 penny stocks with strong financials, which combine strong financials with attractive price points and are designed for spotting tomorrow’s winners early.

- Tap into the AI revolution by exploring these 24 AI penny stocks, where breakthrough innovation is fueling rapid growth and transforming the way industries work.

- Boost your portfolio’s income with these 19 dividend stocks with yields > 3%, which offer solid yields above 3 percent and steady cash flow for long-term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCOI

Cogent Communications Holdings

Through its subsidiaries, provides high-speed Internet access, private network, and data center colocation space services in North America, South America, Europe, Oceania, and Africa.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives