- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ATNI

Benign Growth For ATN International, Inc. (NASDAQ:ATNI) Underpins Stock's 38% Plummet

Unfortunately for some shareholders, the ATN International, Inc. (NASDAQ:ATNI) share price has dived 38% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 49% share price drop.

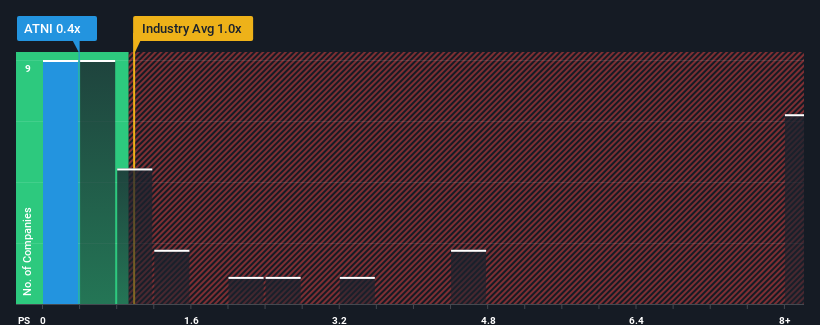

Following the heavy fall in price, ATN International may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Telecom industry in the United States have P/S ratios greater than 1x and even P/S higher than 3x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for ATN International

How Has ATN International Performed Recently?

ATN International certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think ATN International's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, ATN International would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.2% last year. This was backed up an excellent period prior to see revenue up by 63% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 2.5% over the next year. Meanwhile, the broader industry is forecast to expand by 1.5%, which paints a poor picture.

In light of this, it's understandable that ATN International's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

ATN International's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that ATN International maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - ATN International has 4 warning signs (and 3 which are potentially serious) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ATNI

ATN International

Through its subsidiaries, provides digital infrastructure and communications services to residential, business, and government customers in the United States, Guyana, the US Virgin Islands, Bermuda, and internationally.

Undervalued with moderate growth potential.