- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ATNI

ATN International (NASDAQ:ATNI) Has Re-Affirmed Its Dividend Of US$0.17

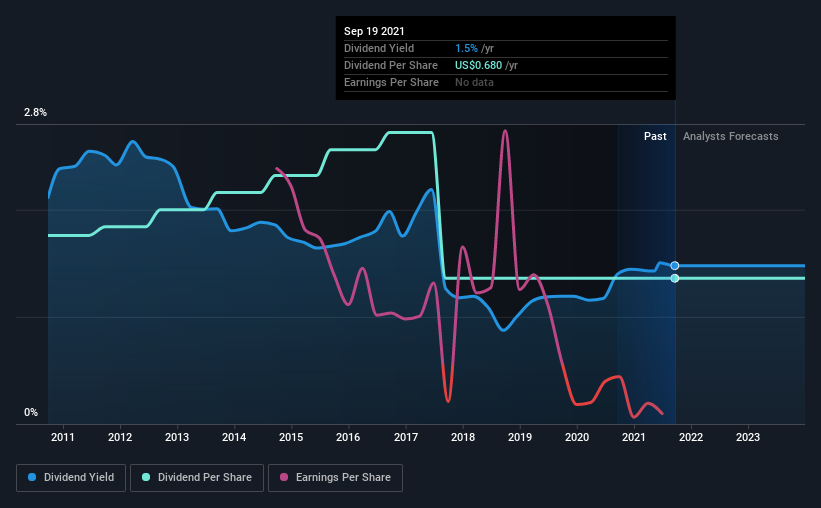

The board of ATN International, Inc. (NASDAQ:ATNI) has announced that it will pay a dividend on the 8th of October, with investors receiving US$0.17 per share. The dividend yield is 1.5% based on this payment, which is a little bit low compared to the other companies in the industry.

View our latest analysis for ATN International

ATN International Might Find It Hard To Continue The Dividend

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Despite not generating a profit, ATN International is still paying a dividend. The company is also yet to generate cash flow, so the dividend sustainability is definitely questionable.

Over the next year, EPS is forecast to expand by 86.1%. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. Unless this happens fairly soon, the dividend could start to come under pressure.

Dividend Volatility

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. Since 2011, the dividend has gone from US$0.88 to US$0.68. This works out to be a decline of approximately 2.5% per year over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Earnings per share has been sinking by 39% over the last five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

ATN International's Dividend Doesn't Look Great

Overall, while some might be pleased that the dividend wasn't cut, we think this may help ATN International make more consistent payments in the future. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 2 warning signs for ATN International that you should be aware of before investing. We have also put together a list of global stocks with a solid dividend.

When trading ATN International or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade ATN International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:ATNI

ATN International

Through its subsidiaries, provides digital infrastructure and communications services to residential, business, and government customers in the United States, Guyana, the US Virgin Islands, Bermuda, and internationally.

Undervalued with moderate growth potential.