- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

What AST SpaceMobile (ASTS)'s BlueBird 6 Launch and U.S. Build-Out Mean For Shareholders

Reviewed by Sasha Jovanovic

- AST SpaceMobile recently expanded its U.S. footprint with new manufacturing sites in Texas and Florida, while preparing to launch its next-generation BlueBird 6 satellite featuring a nearly 2,400-square-foot phased array with 10 times the data capacity of earlier models.

- This build-out, supported by extensive intellectual property and deep vertical integration, highlights the company’s push to industrialize space-based cellular broadband in partnership with major U.S. telecom and technology firms.

- Against this backdrop, we’ll examine how the BlueBird 6 launch plan reshapes AST SpaceMobile’s investment narrative over the coming periods.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is AST SpaceMobile's Investment Narrative?

To own AST SpaceMobile today, you really have to believe that space-based cellular broadband can mature from impressive demos into a scalable, commercially adopted network, and that AST can hold a meaningful slice of that opportunity. The latest news cuts both ways. On the positive side, the BlueBird 6 launch, with its much larger phased array and higher data capacity, directly targets the near term catalyst investors are watching: proof that the technology can handle real-world traffic ahead of the planned 2026 service rollouts with partners like AT&T, Verizon and stc. The expanded U.S. manufacturing footprint, deep vertical integration and thousands of patents support that scale-up story, but they also underline the key risk: this is an expensive, capital intensive build-out for a company that remains unprofitable, has issued new equity and has seen sharp share price swings around insider selling and funding events.

However, that same aggressive build-out makes AST extremely sensitive to capital markets and execution missteps that investors should be aware of. AST SpaceMobile's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

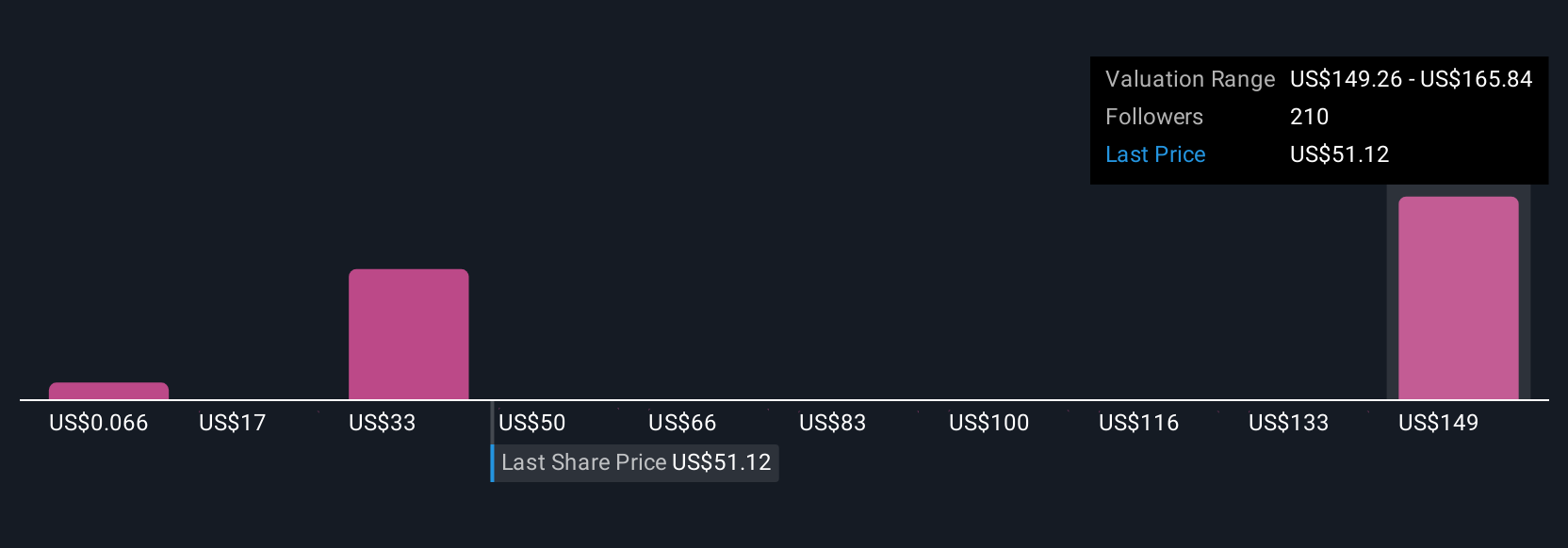

Across 61 fair value estimates from the Simply Wall St Community, views span from well under US$1 to nearly US$200, reflecting very different expectations around AST’s execution risks, funding needs and the payoff from BlueBird 6 and its new manufacturing build-out. This spread underlines how differently people weigh the upside of global direct-to-device coverage against the possibility that AST’s capital intensity and ongoing losses could pressure future returns, and invites you to compare multiple viewpoints before forming your own stance.

Explore 61 other fair value estimates on AST SpaceMobile - why the stock might be worth over 3x more than the current price!

Build Your Own AST SpaceMobile Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AST SpaceMobile research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AST SpaceMobile research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AST SpaceMobile's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTS

AST SpaceMobile

Designs and develops the constellation of BlueBird satellites in the United States.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026