- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:ASTS

Is AST SpaceMobile’s Soaring Stock Justified After Major AT&T Satellite Milestone?

Reviewed by Bailey Pemberton

If you're reading this, chances are you're trying to figure out what comes next for AST SpaceMobile, especially after a stretch of eye-popping performance. The stock just closed at 74.75 and, if you've been watching even a little bit, you know this name has been on a wild upward climb. Over the past week alone, AST SpaceMobile shares have surged 52.3%, with a full 76.3% gain in the last month. Year-to-date returns have soared to 245.4%. For those who've stuck with it over the past year, they're looking at a 208.9% gain. Going back three or five years, the stock is up 946.9% and 638.6%, respectively. That's not just growth; that's a rocket ride.

What has pushed these shares so dramatically higher? Analysts and investors have pointed to growing optimism around the company's ability to deliver on its unique mobile satellite technology, an area that has seen increased interest as markets look for future communications leaders. But as the price leaps higher, the big question becomes: is this momentum grounded by value, or fueled only by hype?

If you're weighing whether to hold, buy, or sell, valuation is everything. Here's where it gets interesting: On a classic valuation scorecard, AST SpaceMobile earns a 2 out of 6, meaning it's currently undervalued on two major checks but not across the board. In the next section, we'll walk through how those valuation methods work and what they reveal. For those looking for a deeper edge, stay tuned. I'll show you an even smarter way to think about what this company is really worth at the end.

AST SpaceMobile scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AST SpaceMobile Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's underlying worth by projecting its future free cash flows and then discounting those amounts back to their value today. For AST SpaceMobile, the model in use is the 2 Stage Free Cash Flow to Equity, which takes into account detailed analyst forecasts as well as longer-term market assumptions.

Currently, AST SpaceMobile's Free Cash Flow (FCF) stands at a deficit of $483.4 Million. According to analyst projections, cash flows are expected to remain negative over the next few years, with a low point of negative $739.1 Million in 2026. However, the outlook turns positive by 2028, and the company’s FCF is projected to jump to $766.6 Million in 2029. By 2035, Simply Wall St estimates suggest AST SpaceMobile could generate over $4.31 Billion in annual free cash flow.

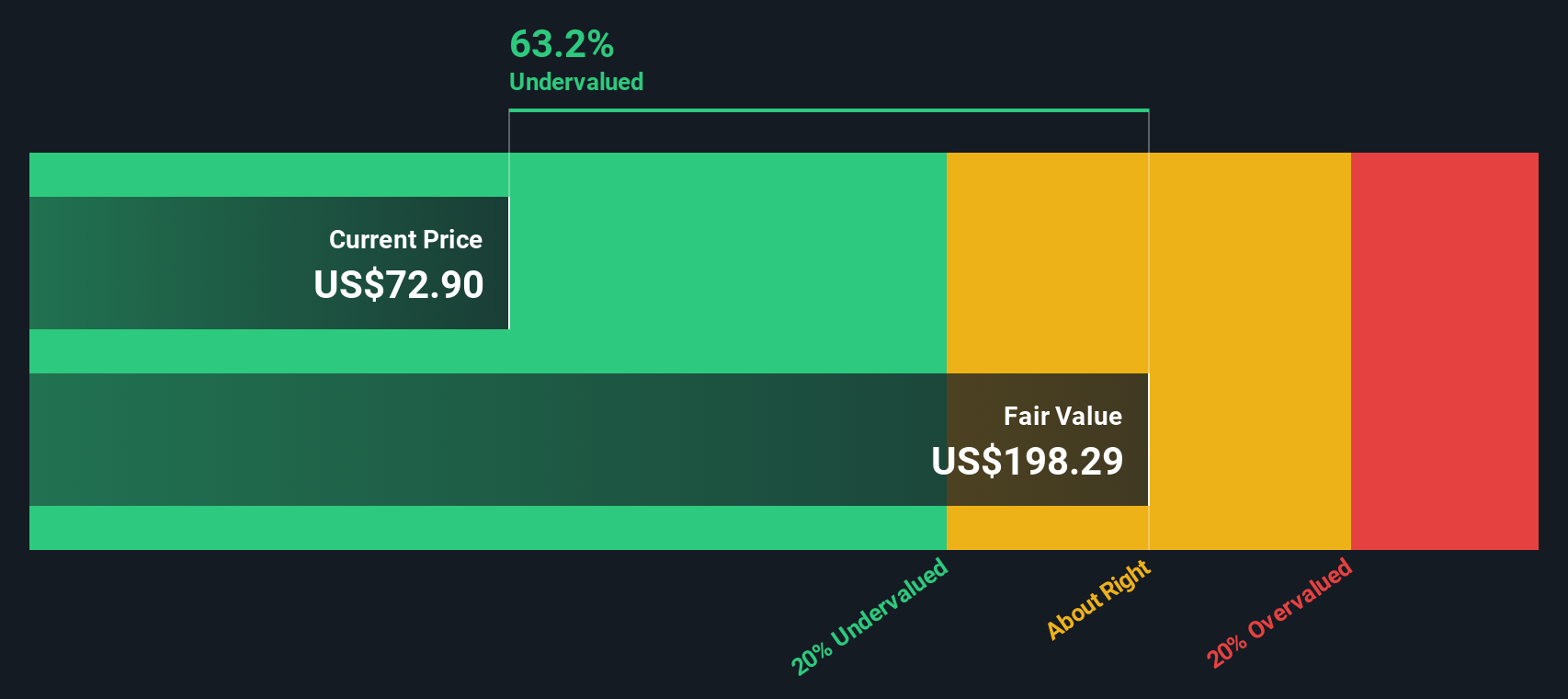

The DCF calculation based on these projections assigns a fair value of $201.38 per share to AST SpaceMobile. When compared to the recent closing price of $74.75, this suggests the stock is trading at a steep 62.9% discount, indicating significant undervaluation based on expected future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AST SpaceMobile is undervalued by 62.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: AST SpaceMobile Price vs Book

The price-to-book (P/B) ratio is a common way to value companies, especially in capital-intensive sectors like telecom where current profits may be less relevant than the value of assets on the balance sheet. This multiple is particularly helpful for assessing businesses that may not yet be profitable but hold significant underlying value in their technology, spectrum, or other tangible assets.

Growth prospects and risk profile play a crucial role in what the “right” P/B ratio should be. A company with high growth expectations and lower risk typically commands a higher P/B multiple. By contrast, a business facing slower prospects or higher uncertainty usually trades at a discount to book value.

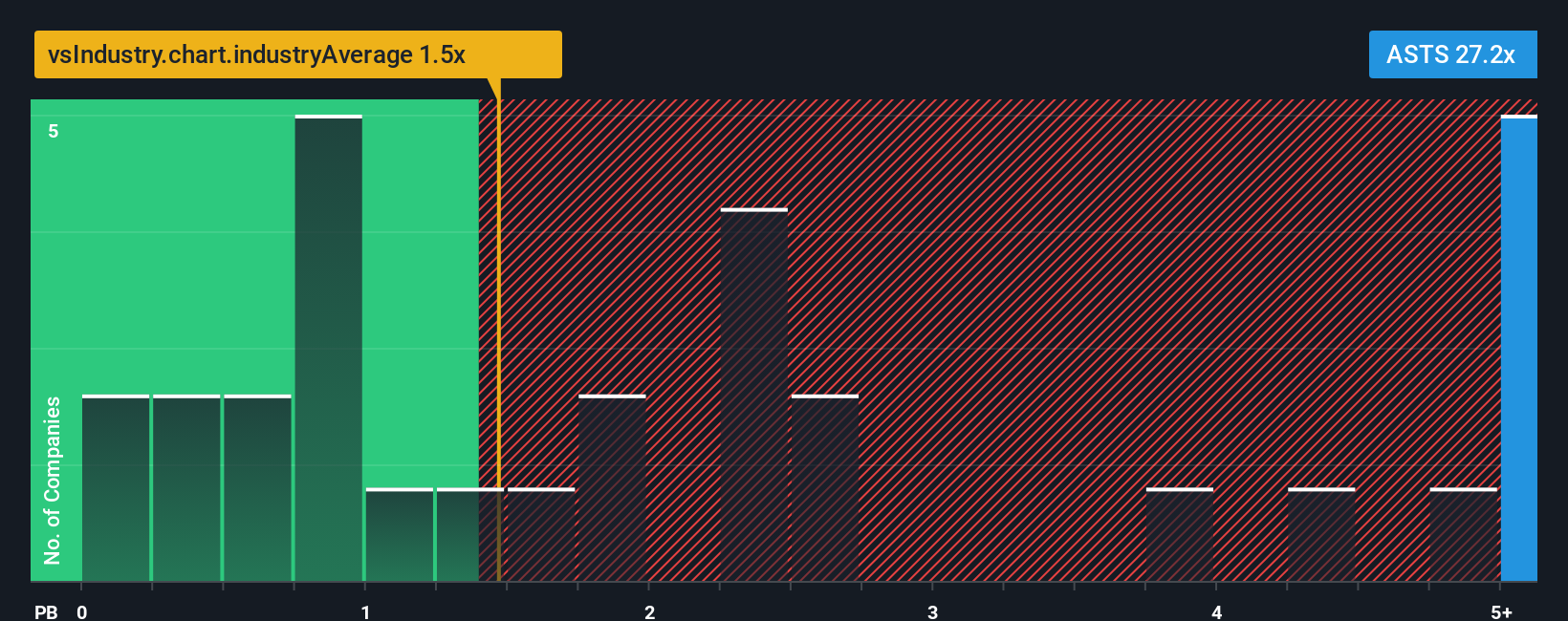

Looking at the numbers, AST SpaceMobile currently trades at a price-to-book ratio of 23.43x. This is much higher than both the telecom industry average of 1.46x and the peer average of 4.83x. This suggests the market is pricing in substantial future growth or technological breakthroughs.

This is where the Simply Wall St “Fair Ratio” comes in. Unlike straightforward peer or industry comparisons, the Fair Ratio is tailored to AST SpaceMobile by factoring in its growth outlook, balance sheet risks, profit margins, business model, and even company size. This creates a more comprehensive benchmark for investors who want a real sense of what’s warranted for the stock, not just what’s average for the sector.

Comparing AST SpaceMobile’s actual P/B against its Fair Ratio reveals a meaningful premium. This indicates the shares may be well ahead of their current asset value when accounting for all the unique risks and growth opportunities.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AST SpaceMobile Narrative

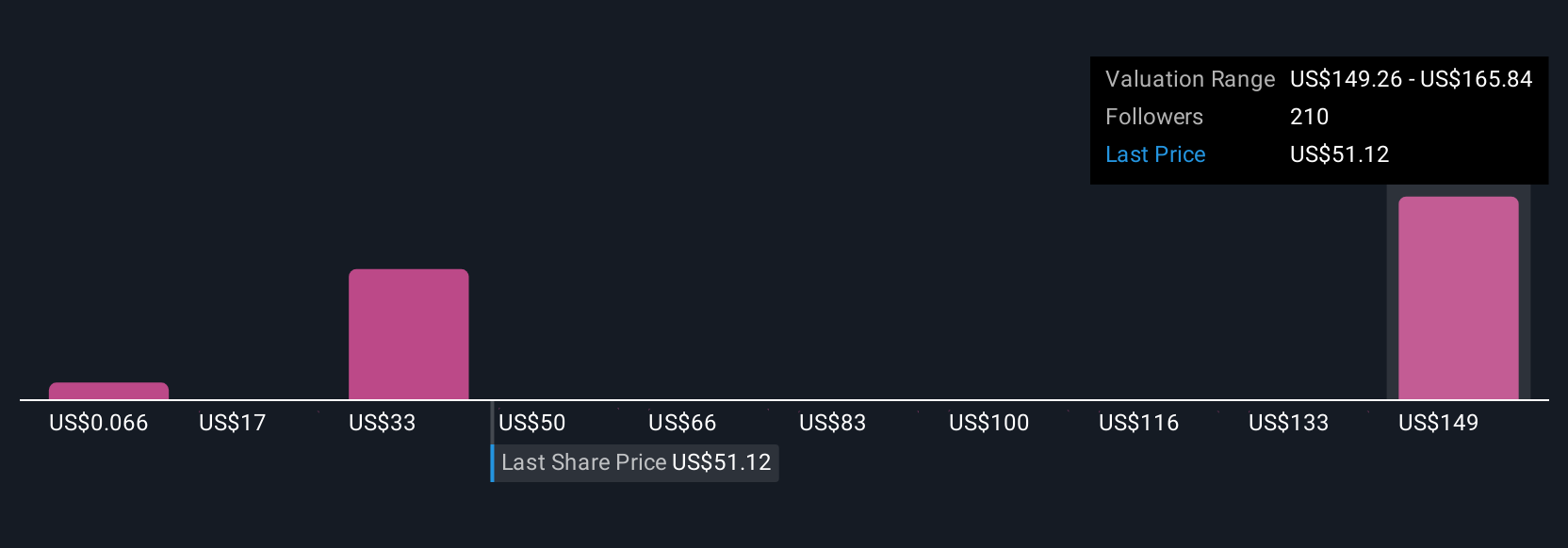

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a story you create about a company, your personal take on where it's heading, backed by your own estimates for future revenue, profits, and margins. This approach links the company’s big picture to your own forecast and, ultimately, a fair value based on those expectations.

Narratives are available right now on Simply Wall St’s Community page, where millions of investors share and refine their perspectives. They are designed to be easy and intuitive, giving you a clear framework to justify when you would buy or sell by comparing your Fair Value to the current Price. Best of all, Narratives are dynamic, automatically updating as new developments or earnings reports are released.

For example, one AST SpaceMobile Narrative might predict breakthrough satellite deals and a fair value of $220 per share, while a more cautious Narrative foresees regulatory delays, putting fair value closer to $35. Narratives help you see these viewpoints side by side, so you can make genuinely informed decisions powered by both data and your own thesis.

Do you think there's more to the story for AST SpaceMobile? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTS

AST SpaceMobile

Designs and develops the constellation of BlueBird satellites in the United States.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)