- United States

- /

- Communications

- /

- NYSEAM:BKTI

Discovering US Undiscovered Gems In October 2025

Reviewed by Simply Wall St

In the midst of a U.S. market characterized by fluctuating indices and a prolonged government shutdown, small-cap stocks within the S&P 600 have been navigating through an environment of mixed earnings reports and shifting economic indicators. As investors seek opportunities beyond the well-trodden paths of large-cap giants, discovering lesser-known companies with strong fundamentals and growth potential becomes increasingly appealing in this dynamic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| Morris State Bancshares | 9.38% | 4.01% | 3.59% | ★★★★★★ |

| Oakworth Capital | 87.50% | 15.82% | 9.79% | ★★★★★★ |

| Affinity Bancshares | 43.51% | 4.54% | 8.05% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| First Northern Community Bancorp | NA | 8.05% | 12.27% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

First Financial (THFF)

Simply Wall St Value Rating: ★★★★★★

Overview: First Financial Corporation, with a market cap of $642.07 million, operates through its subsidiaries to offer a range of financial products and services across regions including west-central Indiana, east-central Illinois, western Kentucky, central and eastern Tennessee, and northern Georgia.

Operations: First Financial's primary revenue stream is its banking segment, generating $230.45 million. The company's market cap stands at $642.07 million.

First Financial, with total assets of US$5.6 billion and equity of US$587.7 million, shows a robust financial standing. The bank's earnings grew by 21% last year, outpacing the industry average of 13.7%. It has a sufficient allowance for bad loans at 0.3% of total loans, indicating prudent risk management. Total deposits stand at US$4.7 billion while loans are US$3.8 billion, supported by low-risk funding sources (93% from customer deposits). The company recently declared a dividend of $0.51 per share and completed a share buyback program worth $30 million, enhancing shareholder value amidst solid earnings growth projections.

- Click here and access our complete health analysis report to understand the dynamics of First Financial.

Gain insights into First Financial's past trends and performance with our Past report.

Xunlei (XNET)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Xunlei Limited operates an internet platform for digital media content in the People's Republic of China and has a market capitalization of approximately $552.39 million.

Operations: Xunlei's primary revenue stream is the operation of its online media platform, generating $355.83 million.

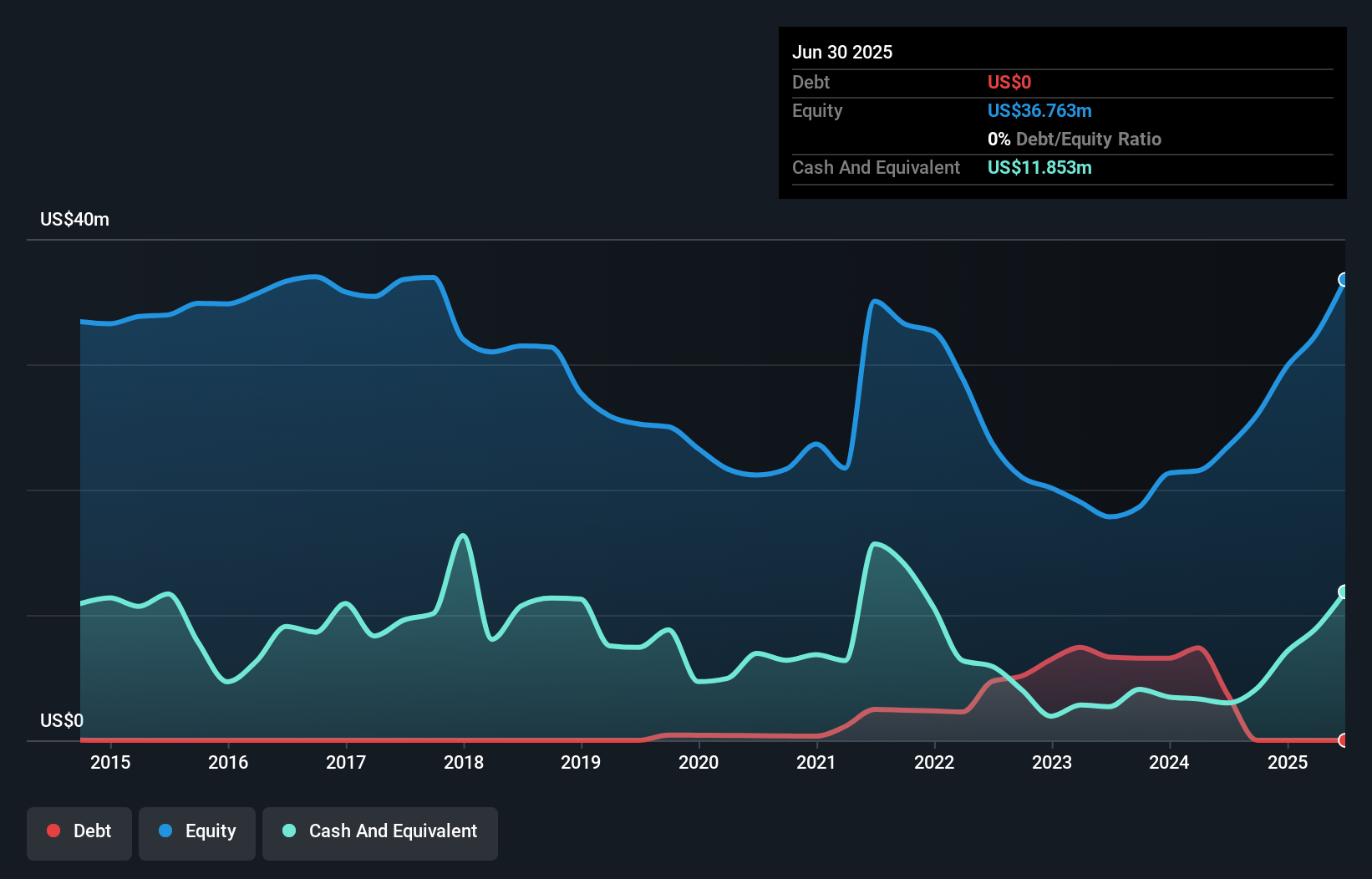

Xunlei, a nimble player in the tech space, has shown remarkable earnings growth of 4878.7% over the past year, outpacing the industry average of 16.3%. Its price-to-earnings ratio stands at a mere 0.8x compared to the broader US market's 18.9x, indicating potential undervaluation. Despite a slight increase in its debt-to-equity ratio from 6.1% to 6.5% over five years, Xunlei holds more cash than total debt, suggesting financial resilience. Recently added to the S&P Global BMI Index and reporting Q2 net income of US$727 million against last year's US$2 million highlights its impressive turnaround and growing market recognition.

- Take a closer look at Xunlei's potential here in our health report.

Examine Xunlei's past performance report to understand how it has performed in the past.

BK Technologies (BKTI)

Simply Wall St Value Rating: ★★★★★★

Overview: BK Technologies Corporation, with a market cap of $250.60 million, designs, manufactures, and markets wireless communications products through its subsidiary BK Technologies, Inc., serving both the United States and international markets.

Operations: BK Technologies generates revenue primarily from its Land Mobile Radio (LMR) Products and Solutions segment, which contributed $78.33 million. The company focuses on the design, manufacturing, and marketing of these products.

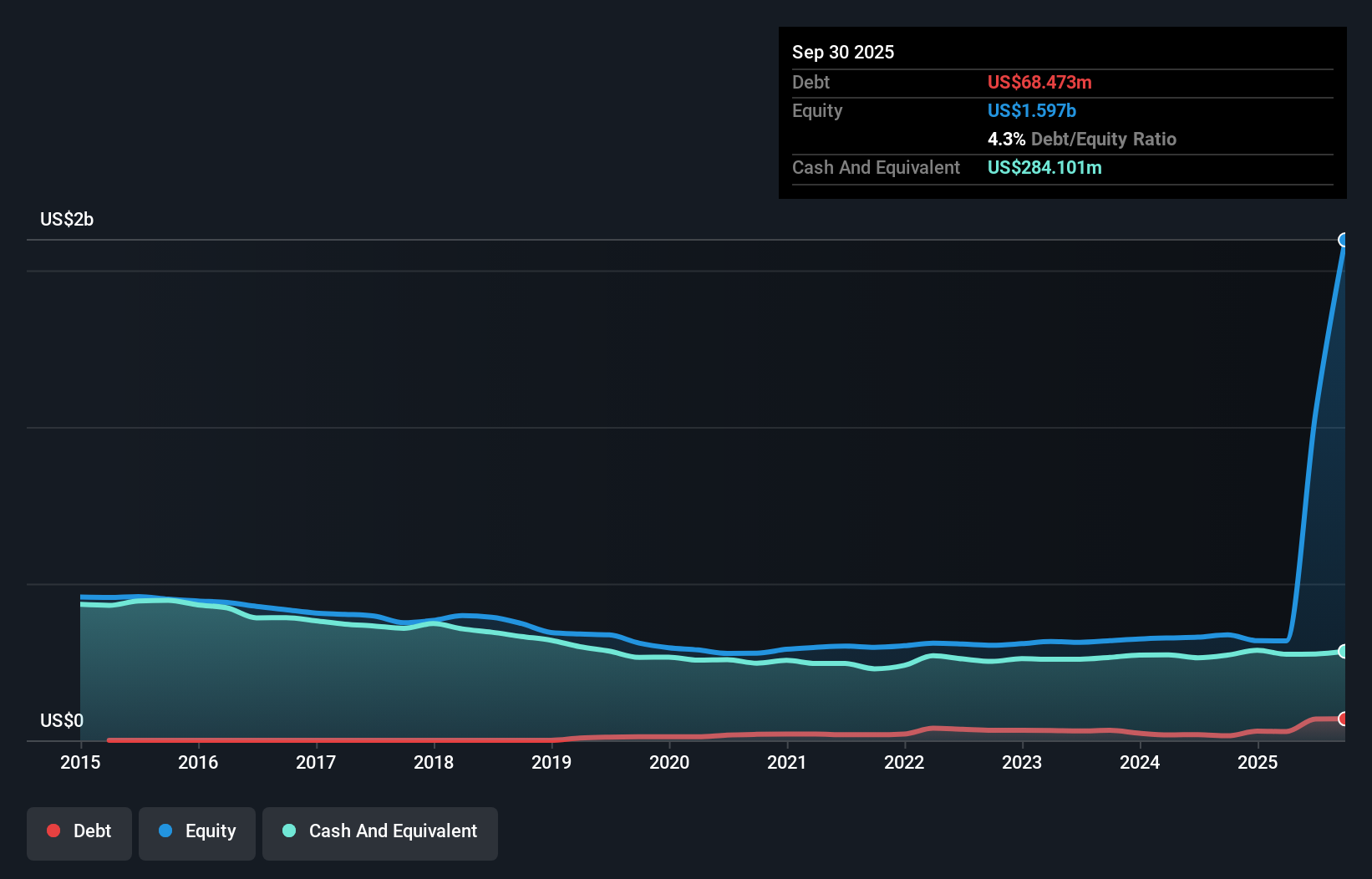

BK Technologies, a nimble player in public safety communications, is making waves with its robust earnings growth of 336.2% over the past year, outpacing the industry average of 30.6%. The company is debt-free, having reduced its debt from a 1.7% ratio five years ago to zero today. Trading at 89% below estimated fair value and offering high-quality earnings, BK seems undervalued compared to peers. Despite significant insider selling recently and market volatility concerns, the firm’s focus on digital modernization and government contracts positions it well for future growth in an evolving sector.

Next Steps

- Delve into our full catalog of 291 US Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if BK Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:BKTI

BK Technologies

Through its subsidiary, BK Technologies, Inc., designs, manufactures, and markets wireless communications products in the United States and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion