- United States

- /

- Communications

- /

- OTCPK:BDRL.Q

How Much is Blonder Tongue Laboratories, Inc.'s (NYSEMKT:BDR) CEO Getting Paid?

Bob Pallé has been the CEO of Blonder Tongue Laboratories, Inc. (NYSEMKT:BDR) since 2015. First, this article will compare CEO compensation with compensation at similar sized companies. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for Blonder Tongue Laboratories

How Does Bob Pallé's Compensation Compare With Similar Sized Companies?

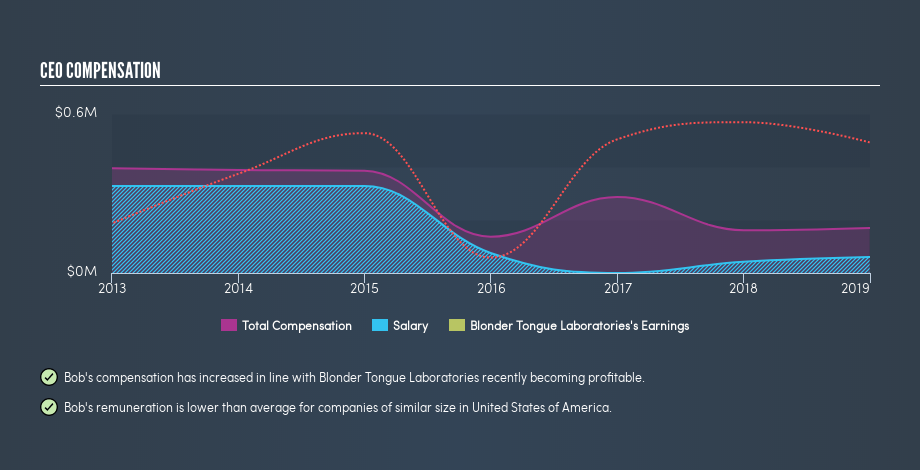

According to our data, Blonder Tongue Laboratories, Inc. has a market capitalization of US$9.5m, and pays its CEO total annual compensation worth US$170k. (This figure is for the year to December 2018). While we always look at total compensation first, we note that the salary component is less, at US$60k. We examined a group of similar sized companies, with market capitalizations of below US$200m. The median CEO total compensation in that group is US$474k.

A first glance this seems like a real positive for shareholders, since Bob Pallé is paid less than the average total compensation paid by similar sized companies. However, before we heap on the praise, we should delve deeper to understand business performance.

You can see, below, how CEO compensation at Blonder Tongue Laboratories has changed over time.

Is Blonder Tongue Laboratories, Inc. Growing?

Over the last three years Blonder Tongue Laboratories, Inc. has grown its earnings per share (EPS) by an average of 110% per year (using a line of best fit). It saw its revenue drop -9.9% over the last year.

This shows that the company has improved itself over the last few years. Good news for shareholders. Revenue growth is a real positive for growth, but ultimately profits are more important.

Has Blonder Tongue Laboratories, Inc. Been A Good Investment?

Most shareholders would probably be pleased with Blonder Tongue Laboratories, Inc. for providing a total return of 53% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Blonder Tongue Laboratories, Inc. is currently paying its CEO below what is normal for companies of its size. Since the business is growing, many would argue this suggests the pay is modest. And given most shareholders are probably very happy with recent returns, you might even think that Bob Pallé deserves a raise!

Most shareholders like to see a modestly paid CEO combined with strong performance by the company. But it is even better if company insiders are also buying shares with their own money. Whatever your view on compensation, you might want to check if insiders are buying or selling Blonder Tongue Laboratories shares (free trial).

If you want to buy a stock that is better than Blonder Tongue Laboratories, this free list of high return, low debt companies is a great place to look.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OTCPK:BDRL.Q

Blonder Tongue Laboratories

A technology-development and manufacturing company, provides television (TV) signal encoding, transcoding, digital transport, and broadband product solutions in the United States.

Low risk with weak fundamentals.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)