Assessing Vishay Intertechnology’s (VSH) Valuation as New ESD Diodes and Industrial Trimmers Signal Ongoing Innovation

Reviewed by Simply Wall St

If you are following Vishay Intertechnology (VSH), you may have noticed the string of new product announcements in the past week. The company has rolled out next-generation ESD protection diodes as well as compact, industrial-grade cermet trimmers, both aimed at fast-evolving sectors such as automotive electronics, industrial automation, and more. These launches underscore Vishay's strategy to serve demanding environments and strengthen its position in the supply chain for critical components. This move has implications for long-term growth, but also raises questions about how the market is factoring in future earnings or risk.

Despite these product rollouts, Vishay Intertechnology’s stock story over the past year has been more complicated. The stock has slid 22% in the last 12 months, even as momentum has bounced up and down. Over the past three months, shares climbed about 8%, partially reversing recent declines. With soft revenue growth and negative net income over the last year, there is clear uncertainty about when these innovative products will meaningfully impact financials and sentiment.

The main question remains: after this year’s drop and recent signals of innovation, is Vishay Intertechnology undervalued, or has the market already priced in the company’s roadmap for future growth?

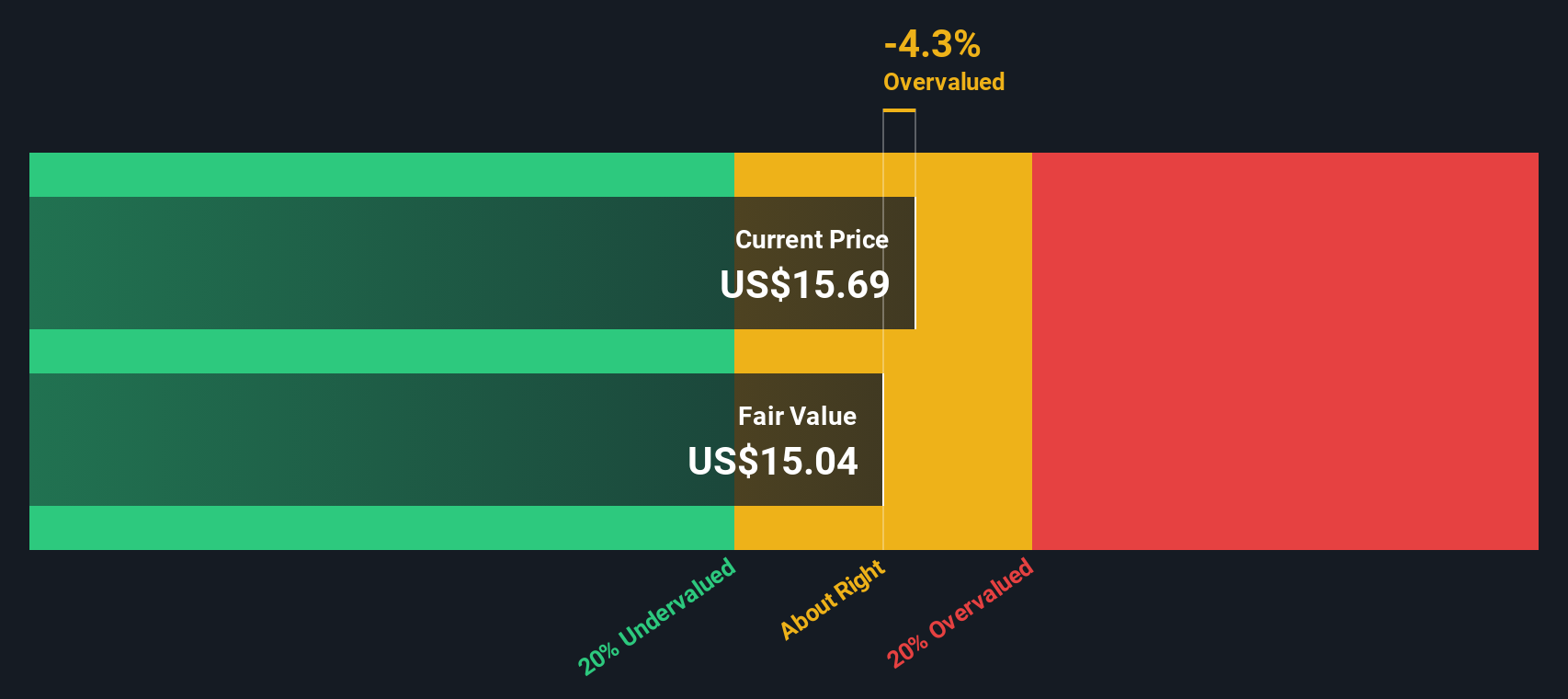

Most Popular Narrative: 11.3% Overvalued

According to community narrative, Vishay Intertechnology is currently considered overvalued by 11.3%. This viewpoint weighs aggressive growth assumptions and future market dynamics against recent operational and financial headwinds.

With major multi-year investments in capacity expansion nearing completion, including readiness across nearly all product lines and the ramp of high-growth, higher-profit products, Vishay is well positioned to capture share as demand accelerates in areas like AI, smart grid infrastructure, data centers, and automotive electrification. This is expected to support higher future revenues and improved operating leverage.

Curious what is fueling such an ambitious price target? The real intrigue lies in the optimistic forecasts for revenue, profits, and margins that drive this valuation. What key numbers does the narrative bank on for this growth story, and how do these projections stack up against current challenges? Unpack the full narrative to see the bold financial assumptions that shape this fair value call.

Result: Fair Value of $14.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent cash flow strain or prolonged margin weakness could quickly undermine these optimistic forecasts, particularly if new demand does not materialize.

Find out about the key risks to this Vishay Intertechnology narrative.Another View: DCF Model Signals Fair Value

Looking at the numbers from another perspective, our DCF model suggests Vishay Intertechnology is trading close to its intrinsic value. Unlike earnings multiples, this method focuses on cash flows instead of recent market swings. Which approach should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Vishay Intertechnology Narrative

If you see the story differently or prefer to dig into the details with your own analysis, it's simple to craft your own perspective in minutes, so why not do it your way.

A great starting point for your Vishay Intertechnology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Staying ahead means targeting what matters most. Don’t limit yourself to just one company when great ideas are waiting. Use the Simply Wall Street Screener to unlock powerful trends and handpicked stocks aligned with your investing goals. Move with confidence and turn your research into action before the next big run leaves you behind.

- Tap into potential rapid growth by reviewing AI penny stocks. Emerging technologies and AI-focused companies are reshaping entire industries right now.

- Seize the chance for steady income with dividend stocks with yields > 3%. This highlights stocks offering robust yields over 3% for those looking to boost their portfolio’s cash flow.

- Jump on innovative breakthroughs by browsing quantum computing stocks. This resource showcases businesses at the forefront of quantum computing advancements and real-world applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSH

Vishay Intertechnology

Manufactures and sells discrete semiconductors and passive electronic components in the United States, Germany, rest of Europe, Israel, and Asia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives