Assessing Vishay Intertechnology (VSH) Valuation: Is There Opportunity After Recent Share Price Drift?

Reviewed by Kshitija Bhandaru

Vishay Intertechnology (VSH) has seen its stock move gradually over the past week, finishing at $16.15. As investors review recent performance, some may be curious about how the company’s fundamentals compare to its valuation.

See our latest analysis for Vishay Intertechnology.

Vishay Intertechnology’s share price has drifted slightly in recent weeks, reflecting subdued momentum after a period of modest volatility. For long-term investors, a 1-year total shareholder return of -8% underscores the company’s muted performance and hints at ongoing questions about future growth versus current valuation.

If you’re weighing your next investment steps, now could be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

With shares lagging and recent analyst targets below the current price, investors are left to ponder whether Vishay Intertechnology is now undervalued or if the market is already accounting for all that lies ahead.

Most Popular Narrative: 15% Overvalued

With the latest narrative assigning Vishay Intertechnology a fair value of $14.00, the stock’s last close of $16.15 implies a gap that is hard to ignore. This sets up a sharp debate between the company’s strong sector tailwinds and concerns that may be holding valuations back.

With major multi-year investments in capacity expansion nearing completion, including readiness across nearly all product lines and the ramp of high-growth, higher-profit products, Vishay is well positioned to capture share as demand accelerates in areas like AI, smart grid infrastructure, data centers, and automotive electrification. This supports higher future revenues and improved operating leverage.

Curious about the real engine behind this premium price? This narrative hints at sky-high future profitability, massive sector growth, and assumptions on margins that only the boldest forecasters would make. Want to know which numbers analysts are betting on and what is driving the valuation upward? Dive in to see what could fuel the next surprise move.

Result: Fair Value of $14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing negative cash flow from heavy investments and persistent low margins could challenge the optimistic outlook for Vishay's future growth and returns.

Find out about the key risks to this Vishay Intertechnology narrative.

Another View: The Multiples Perspective

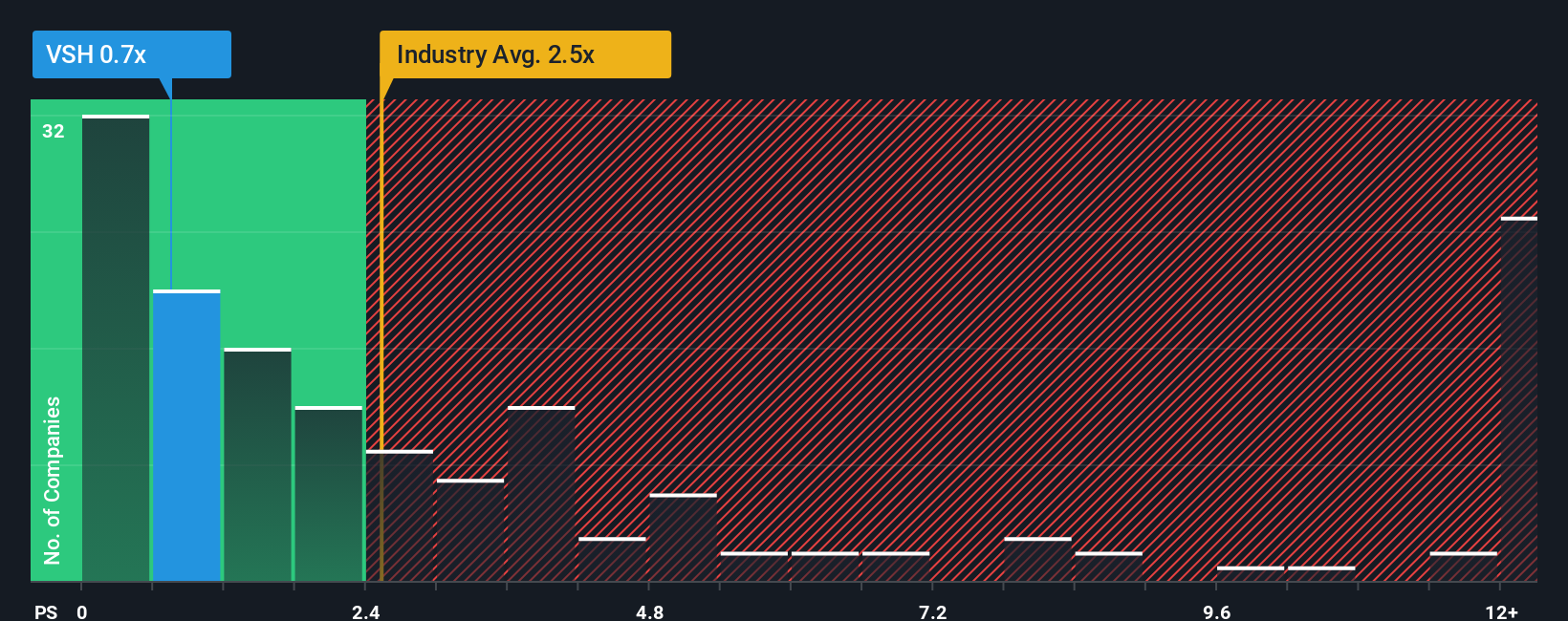

While analyst forecasts and discount models suggest Vishay Intertechnology is overvalued, a quick look at its price-to-sales ratio tells another story. Trading at just 0.7 times sales, compared to industry and peer averages of 2.4 to 2.5 times and even below its fair ratio of 1.0, the stock appears attractively priced by this measure. Does this apparent bargain hint at opportunity, or are current risks more significant than the numbers reveal?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vishay Intertechnology Narrative

If the current perspectives do not align with your thinking, or if you prefer hands-on analysis, you can quickly shape your own investment view in just a few minutes by using Do it your way.

A great starting point for your Vishay Intertechnology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investing means knowing where opportunities are about to break out. Give yourself an edge and act now. These unique stock shortlists could help you spot your next winner ahead of the crowd.

- Pinpoint potential bargains by reviewing these 896 undervalued stocks based on cash flows, where you’ll find companies pricing in less than their future cash flows might suggest.

- Catch the latest wave in technology by checking out these 24 AI penny stocks, highlighting dynamic firms at the forefront of artificial intelligence innovation.

- Tap into a stream of regular income with these 19 dividend stocks with yields > 3%, collecting stocks that offer robust yields above 3% to strengthen your portfolio returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VSH

Vishay Intertechnology

Manufactures and sells discrete semiconductors and passive electronic components in the United States, Germany, rest of Europe, Israel, and Asia.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives