Vontier (VNT): Margin Decline Tests Bullish Narratives Despite Low Valuation Ahead of Earnings Season

Reviewed by Simply Wall St

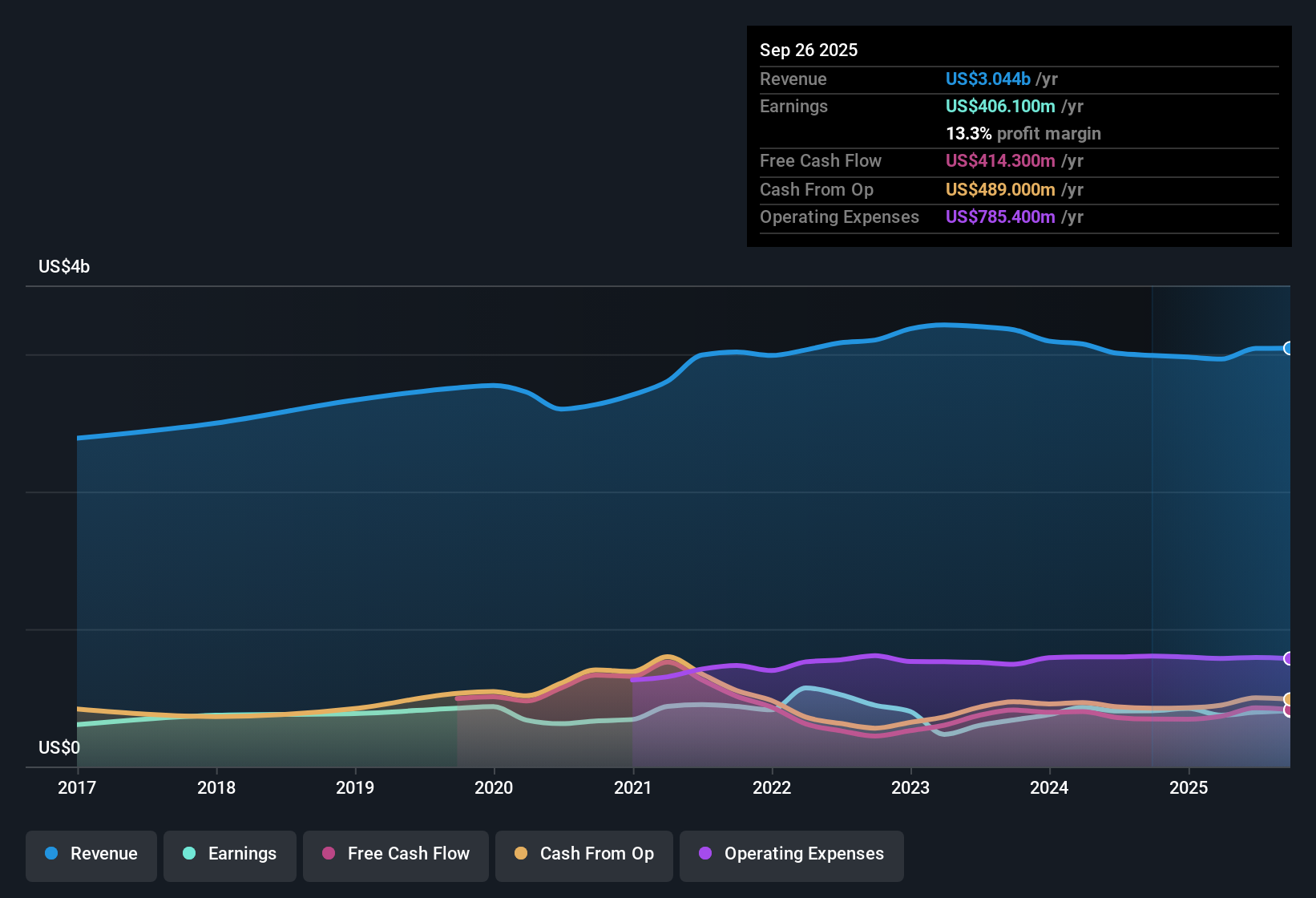

Vontier (VNT) is forecasting earnings growth of 8.5% per year and revenue growth at 5.5% annually, even as its net profit margin stands at 13%, down slightly from 13.4% last year. Recent earnings have declined, with a five-year average annual decrease of 1.6% and the latest period showing negative earnings growth. This highlights continued margin pressures. Despite this, Vontier’s share price of $38.08 trades well below its estimated fair value of $65.78 and at much lower earnings multiples than both its industry and peers. This signals a cautious but potentially rewarding setup for investors as earnings season unfolds.

See our full analysis for Vontier.The next step is to dig beneath the headline numbers and see how they stack up against the current narratives shaping market sentiment around Vontier. Some expectations may get confirmed, while others will face a reality check.

See what the community is saying about Vontier

Margin Upside Tied to SaaS and Digital Solutions

- Analysts project net profit margins rising from 13% today to 15.9% over the next three years, driven by higher-margin digital and recurring SaaS revenues becoming a larger share of sales.

- The consensus narrative emphasizes that Vontier's expansion of high-margin digital solutions and recurring services is set to cement its competitive position. This may make margins more resilient even if traditional segments face headwinds.

- Recurring SaaS and software now make up at least 30% of total revenue, with Mobility Technologies' recurring base reaching about 40%.

- Operational efficiency moves like lean manufacturing and portfolio optimization are highlighted as supporting longer-term margin improvement and consistency.

Dependence on Legacy Fueling Solutions Raises Growth Risks

- Vontier’s traditional Fueling Solutions segment remains the major revenue driver, and its future growth could be limited if the shift to electric vehicles and alternative fuels accelerates faster than expected.

- The consensus narrative warns that Vontier’s heavy reliance on this segment makes it especially vulnerable. If demand for legacy fueling equipment declines due to transportation electrification, this could undermine the broader revenue growth story presented by bulls.

- Rising competition in software and a Repair Solutions segment with ongoing revenue declines add to the risk that new digital revenues may not fully offset shrinking demand elsewhere.

- Regulatory or market delays in underground tank replacements and digital upgrades would threaten planned revenue cycles and cash flows.

Valuation Discount Signals Cautious Optimism

- Vontier trades at a Price-To-Earnings Ratio of 14.1x, a significant discount compared to the US Electronic industry average (25.7x) and its peers (47.3x), and well below its own DCF fair value of $65.78 per share (current price: $38.08).

- The analysts' consensus view presents this discount as a potential opportunity, but balances it against the need for investors to believe revenue will reach $3.4 billion and margins will climb by 2028, in order to justify the analyst price target of $48.81.

- If these milestones aren’t achieved, the valuation gap could persist or even widen despite today’s seeming bargain multiples.

- Declining earnings over the last five years urge caution even at a low multiple, as market skepticism is based on real challenges.

Consensus points to better margins and a competitive moat, but legacy fuel exposure remains a risk. Read the full Vontier Consensus Narrative to see how these tensions play out. 📊 Read the full Vontier Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Vontier on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? In just a few minutes, you can craft your own interpretation and share your narrative. Do it your way

A great starting point for your Vontier research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Vontier’s reliance on its legacy Fueling Solutions segment and declining earnings highlight concerns about stable and consistent growth as markets evolve.

Want investments that prioritize dependable results and avoid such volatility? Discover companies demonstrating consistent strength and earnings momentum through stable growth stocks screener (2111 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VNT

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)