Is There Now an Opportunity in Vontier After Recent Expansion into EV Infrastructure?

Reviewed by Bailey Pemberton

Are you weighing your next move with Vontier stock? You are not alone. This stock has been a topic of steady interest for good reason, inviting both value-focused investors and momentum chasers to take a closer look. While Vontier’s share price has pulled back by 5.3% over the past week and is down 7.0% for the last month, moves that might spook short-term traders, it is still impressively up by 9.8% year to date and a strong 17.2% over the last year. If you zoom out even further, the stock has soared by 129.4% over three years and delivered a 44.8% return in five years, hinting at underlying business resilience and long-term growth potential.

Some of these moves have come as the broader market adjusts to evolving technology trends and infrastructure needs, areas where Vontier is firmly positioned. Shifts in risk perception and optimism about new market segments have clearly caught investors' attention, fueling both excitement and healthy debate about what the stock is truly worth.

Here is something to consider before making your decision: when we scored Vontier using six valuation checks, it came out with a perfect value score of 6. That means it looks undervalued across every metric we tested. Of course, understanding these valuation approaches is only step one. In the following sections, we will break down each method, and, at the end, explore an even more insightful way to assess whether Vontier deserves a place in your portfolio.

Why Vontier is lagging behind its peers

Approach 1: Vontier Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to the present using a risk-adjusted rate. This approach lets investors gauge what the underlying business is worth today, based on expected long-term performance.

For Vontier, the current Free Cash Flow stands at $431 million. Analysts project steady growth, with Free Cash Flow expected to reach $505 million in 2026 and $523 million by 2027. Beyond those years, projections continue to increase gradually each year, reaching about $668 million in 2035, primarily driven by consistent annual growth extrapolated from recent trends. All these figures are in US Dollars, and values beyond 2027 are derived from reputable estimates and analytical modeling.

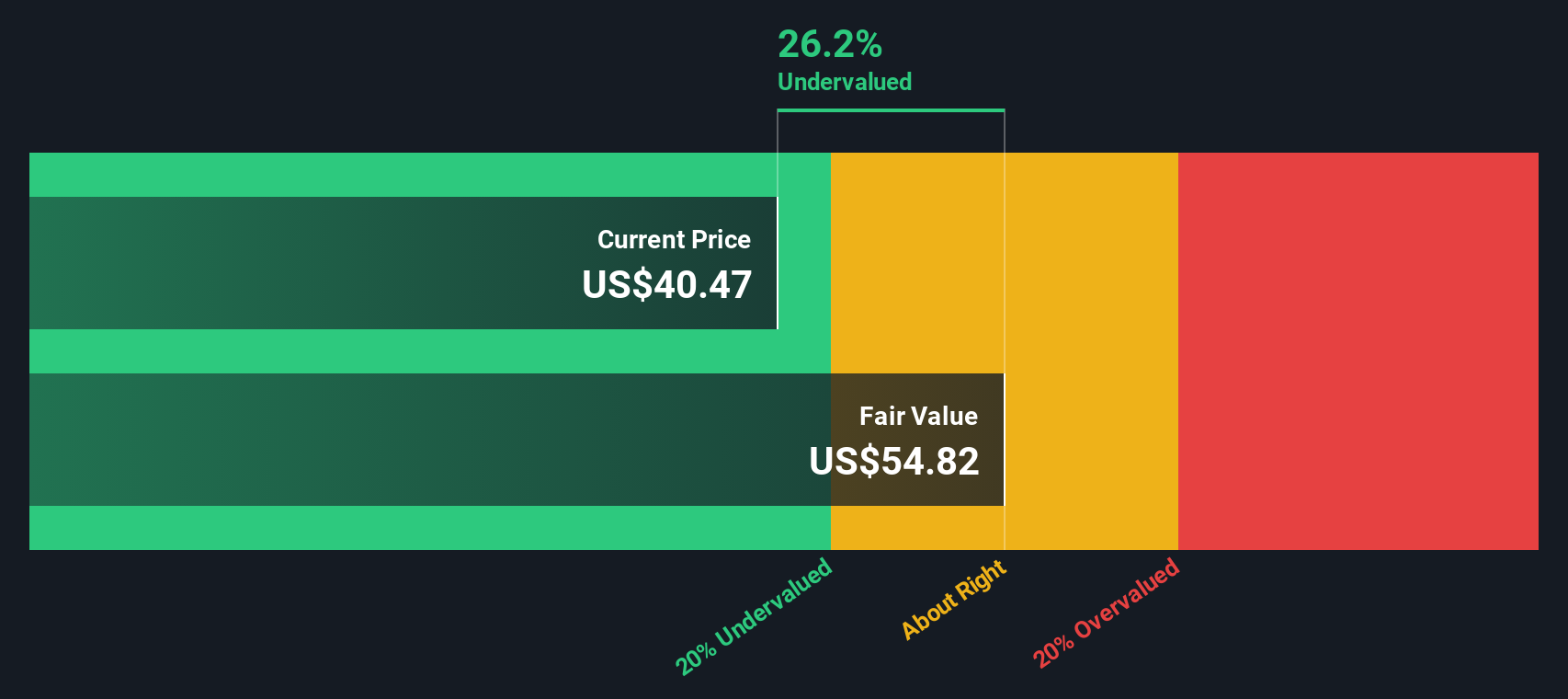

Factoring these forecasts into the DCF model, Vontier’s intrinsic value is calculated at $56.11 per share. Given the current share price, this signals a 29.4% discount compared to the estimated intrinsic value, suggesting the stock may be significantly undervalued relative to its future cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vontier is undervalued by 29.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Vontier Price vs Earnings (PE Multiple)

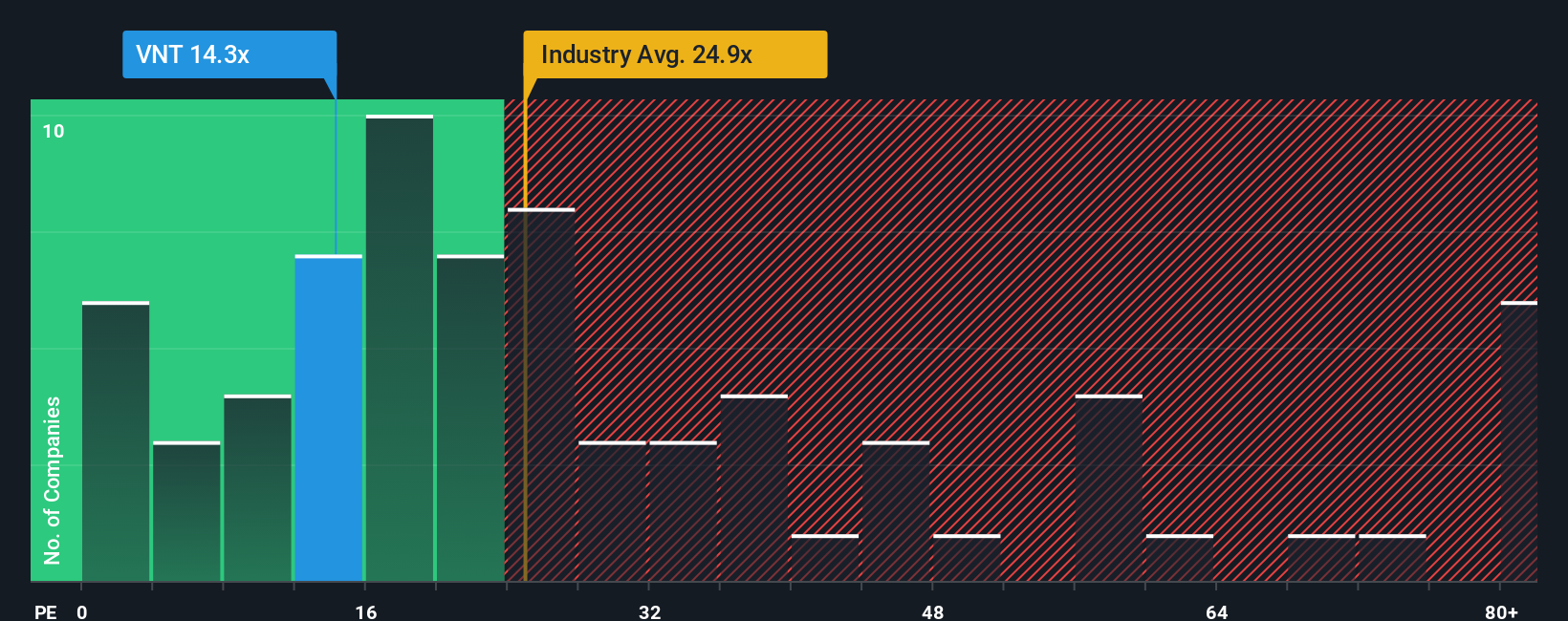

The Price-to-Earnings (PE) ratio is widely regarded as the go-to metric for valuing profitable companies, since it measures how much investors are willing to pay for each dollar of earnings. For a business that consistently generates profits like Vontier, the PE ratio makes it easy to compare valuations across both industries and individual stocks.

However, what counts as a “fair” PE ratio is not set in stone. It is influenced by the company's expected earnings growth and the risks it faces. High-growth companies typically command higher PE ratios, reflecting optimistic expectations. Riskier businesses or those with less predictable earnings often trade at lower multiples.

Currently, Vontier is trading at a PE ratio of 14.7x. This is significantly below the Electronic industry average of 25.5x and also well under the peer average of 45.5x. In simple terms, the market is valuing Vontier’s earnings at a considerable discount compared to similar companies.

Simply Wall St introduces the “Fair Ratio,” which at 25.3x estimates the appropriate multiple for Vontier based on a blend of factors including its earnings growth, risk profile, profit margins, market cap, and the characteristics of its industry. This holistic approach gives a more accurate picture than simple peer or industry comparisons, as it customizes the expected PE ratio using company-specific dynamics.

Comparing the Fair Ratio of 25.3x with Vontier’s actual 14.7x, the stock appears to be undervalued relative to its profit potential and fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vontier Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company: the big picture perspective that ties together what you believe about its future prospects, your key assumptions (like revenue growth or profit margins), and your resulting fair value estimate. Instead of relying solely on numbers, Narratives connect the dots, from a company's history and strategy, to a personal financial forecast, and finally to what you think the stock is really worth.

With Simply Wall St’s Narratives tool, featured on the Community page and used by millions of investors, you can easily share and compare these story-driven valuations. Narratives help you decide when to buy or sell by showing how your unique Fair Value stacks up against the current market Price, and they are automatically updated each time new news or earnings come out, ensuring your thesis stays relevant.

For Vontier, one investor’s Narrative might confidently highlight recurring revenue from digital platforms and operational efficiency, supporting a fair value of $54.08. Meanwhile, a more cautious view may focus on slow core growth and the risk from electric vehicle adoption, arriving at a fair value of $47.99.

Do you think there's more to the story for Vontier? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VNT

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion