- United States

- /

- Communications

- /

- NYSE:UI

Is Analyst Upgrades and Momentum Score Shifting the Investment Case for Ubiquiti (UI)?

Reviewed by Sasha Jovanovic

- Ubiquiti Inc. recently attracted significant analyst attention, receiving a strong buy rating and a Momentum Style Score of B, with upward revisions to its earnings estimates as of early October 2025.

- This surge in positive analyst sentiment reflects renewed confidence in the company’s ability to outperform its peers and improve future financial results.

- We'll explore how these analyst upgrades and rising earnings projections could shape Ubiquiti's investment narrative in the current market.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Ubiquiti's Investment Narrative?

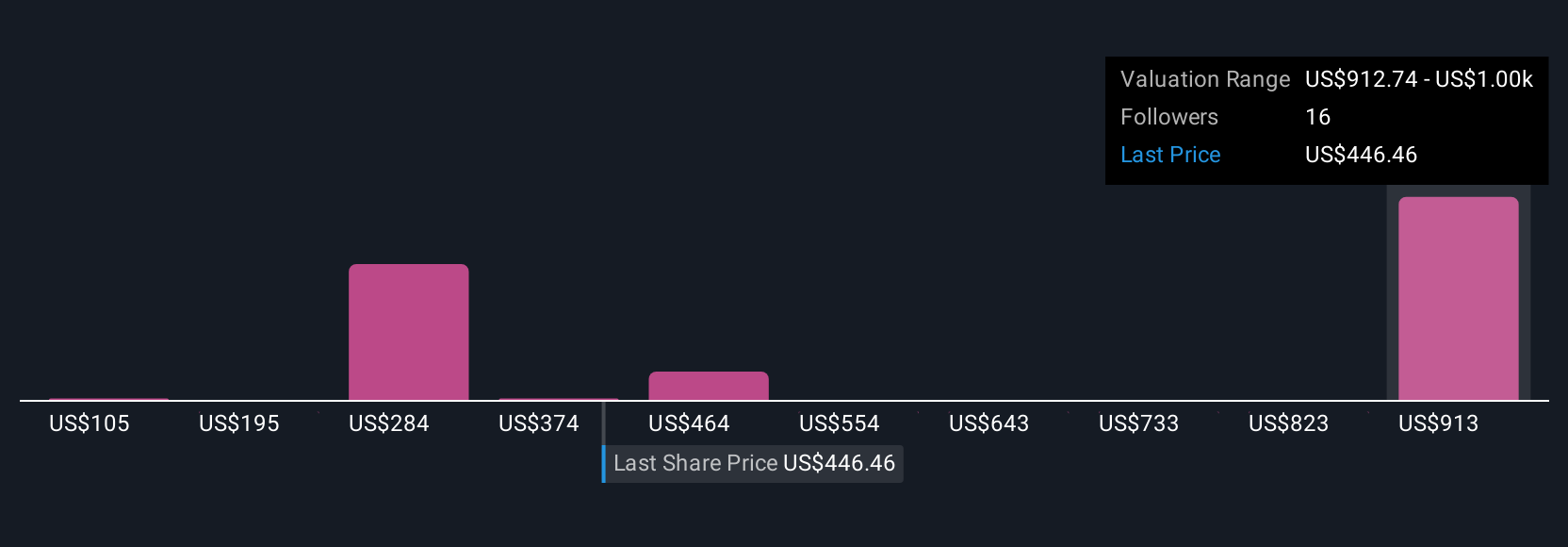

The big picture for Ubiquiti shareholders centers on believing in the company’s ongoing ability to drive double-digit earnings and revenue growth, maintain high profit margins, and return capital through increasing dividends and buybacks despite its premium valuation. The recent news around strong analyst momentum and upward earnings revisions could reinforce confidence in these short-term growth drivers, putting additional focus on next quarter’s results and the sustainability of recent margin gains. However, given that Ubiquiti has already experienced a large share price run-up and is trading well above consensus fair value estimates, the risk of any slowdown in revenue growth or shifts in sector demand remains front and center. While positive sentiment may boost near-term catalysts, the company’s high valuation increases sensitivity to downside surprises, and past single-digit shareholder returns show these risks can materialize quickly. For investors, the current analyst optimism strengthens short-term drivers, but amplifies the potential impact if future growth expectations aren’t met.

But, if growth slows or margins compress, those holding at current prices may face increased risk. Ubiquiti's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 11 other fair value estimates on Ubiquiti - why the stock might be worth over 2x more than the current price!

Build Your Own Ubiquiti Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ubiquiti research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Ubiquiti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ubiquiti's overall financial health at a glance.

No Opportunity In Ubiquiti?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 33 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UI

Ubiquiti

Develops networking technology for service providers, enterprises, and consumers in North America, Europe, the Middle East, Africa, Asia Pacific, South America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives