- United States

- /

- Communications

- /

- NYSE:UI

Exploring High Growth Tech Stocks In The United States January 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has experienced a significant rise of 23% over the past 12 months, with earnings expected to grow by 15% per annum in the coming years. In this dynamic environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and resilience in rapidly evolving sectors.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 22.86% | 54.70% | ★★★★★★ |

| AVITA Medical | 33.76% | 52.47% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.47% | 56.38% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 237 stocks from our US High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Vertex (NasdaqGM:VERX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vertex, Inc. offers enterprise tax technology solutions for the retail trade, wholesale trade, and manufacturing industries both in the United States and internationally, with a market cap of approximately $8.25 billion.

Operations: Vertex, Inc. generates revenue primarily from its software and programming segment, which accounts for $643.23 million.

Vertex, a player in the tech sector, has demonstrated a robust financial turnaround with its recent earnings report showing a swing from a net loss to a profit within the year. The company's revenue surged to $170.44 million in Q3 2024 from $145.03 million in the same quarter last year, reflecting an annual growth rate of 14.1%. This performance is complemented by an impressive forecast of earnings growth at 48.1% annually over the next three years, outpacing both its past performance and broader market expectations which stand at 15% per year. At the Wells Fargo TMT Summit, Vertex's leadership underscored these achievements and provided forward guidance projecting revenues between $663.3 million and $666.3 million for 2024, signaling continued upward trajectory bolstered by strategic initiatives and possibly enhanced by their recent conference presentations which highlighted future strategies and operational insights.

- Click here and access our complete health analysis report to understand the dynamics of Vertex.

Gain insights into Vertex's historical performance by reviewing our past performance report.

Phreesia (NYSE:PHR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Phreesia, Inc. offers an integrated SaaS-based software and payment platform tailored for the healthcare industry across the United States and Canada, with a market capitalization of approximately $1.65 billion.

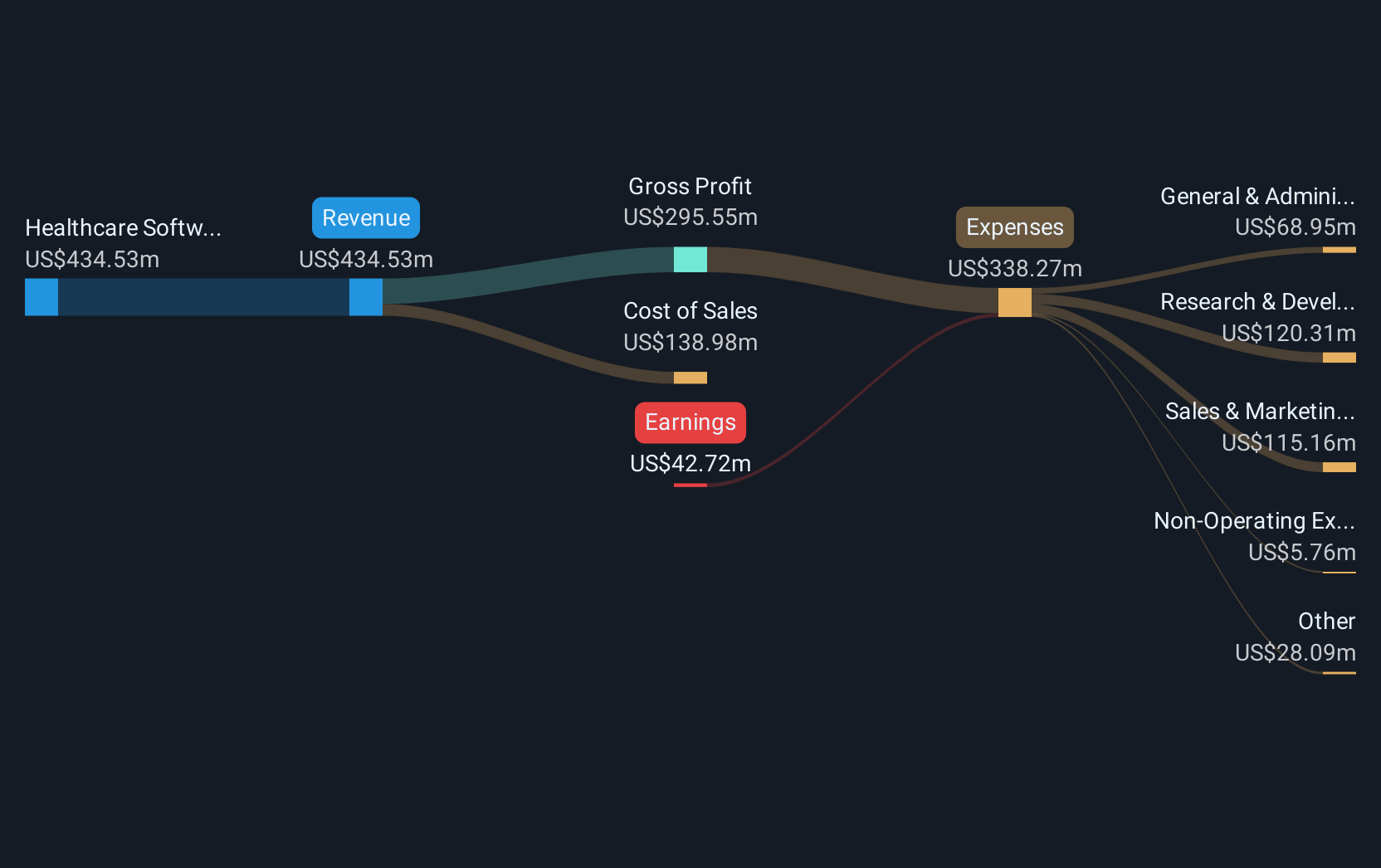

Operations: Phreesia generates revenue primarily from its healthcare software segment, which contributed $405.14 million. The company operates within the healthcare industry in the United States and Canada, leveraging a SaaS-based model to deliver its services.

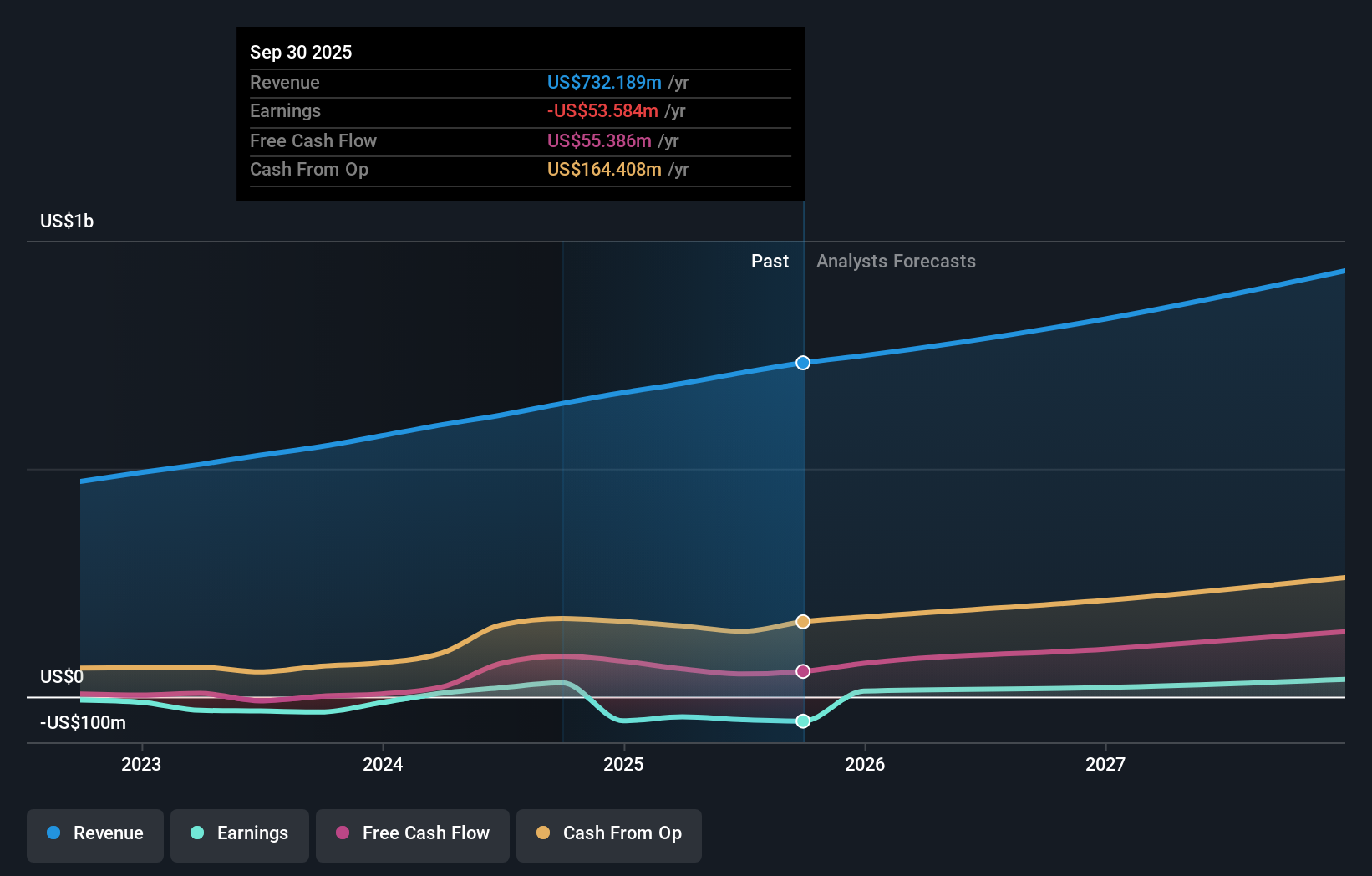

Phreesia's recent financial performance showcases a significant reduction in net loss, dropping from $31.94 million to $14.4 million year-over-year for Q3, with an increase in revenue from $91.62 million to $106.8 million during the same period. This improvement is underpinned by their strategic integration with Oracle Health EHR, enhancing patient intake efficiency across healthcare settings—a move that has demonstrably increased payment collections and operational efficiencies for its users. Looking ahead, Phreesia projects revenue growth of 17% to 18% for FY2025 and anticipates expanding its automated health system checks (AHSCs) significantly by FY2026, which could further solidify its market position by leveraging technology to streamline healthcare administration and improve patient experiences.

- Click here to discover the nuances of Phreesia with our detailed analytical health report.

Explore historical data to track Phreesia's performance over time in our Past section.

Ubiquiti (NYSE:UI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ubiquiti Inc. develops networking technology for service providers, enterprises, and consumers, with a market cap of approximately $21.59 billion.

Operations: Ubiquiti generates revenue primarily from its wireless communications equipment segment, which accounts for approximately $2.02 billion. The company's focus on networking technology serves a diverse customer base, including service providers, enterprises, and consumers.

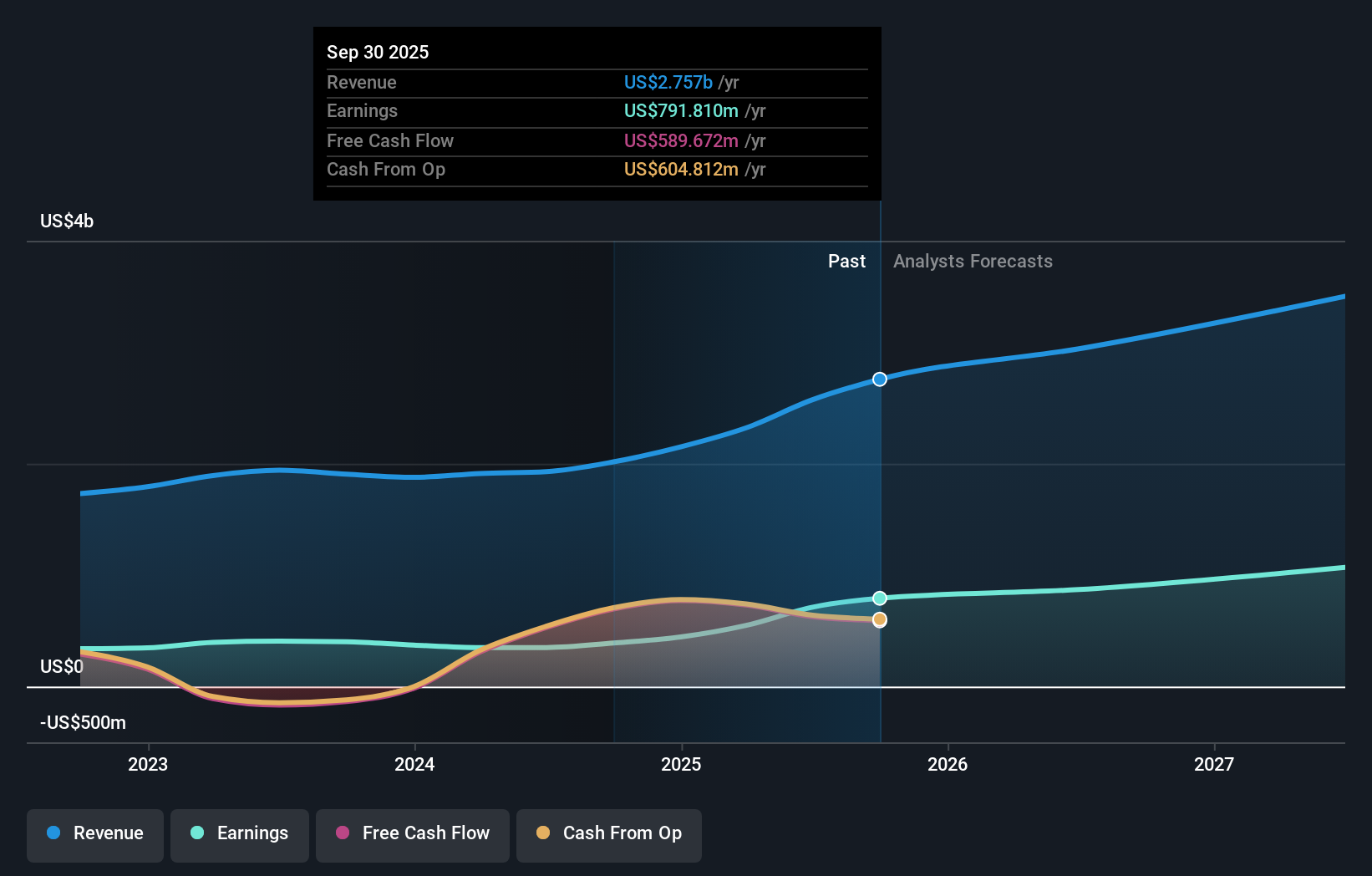

Ubiquiti's recent financials reveal a robust upward trajectory, with Q1 sales soaring to $550.34 million from $463.08 million year-over-year, complemented by a significant rise in net income from $87.75 million to $127.99 million. This performance is underpinned by strategic expansions and product innovations that resonate well within the tech sector, notably in high-demand areas like network technology where Ubiquiti excels. The company also declared a consistent dividend of $0.60 per share, reinforcing its commitment to shareholder returns amidst its growth narrative. Looking ahead, Ubiquiti's focus on enhancing product offerings and penetrating new markets is expected to sustain its competitive edge and financial health.

- Take a closer look at Ubiquiti's potential here in our health report.

Evaluate Ubiquiti's historical performance by accessing our past performance report.

Make It Happen

- Reveal the 237 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UI

Ubiquiti

Develops networking technology for service providers, enterprises, and consumers.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives