TE Connectivity (TEL) Expects Q4 Sales of US$4.55 Billion with 140% EPS Increase

Reviewed by Simply Wall St

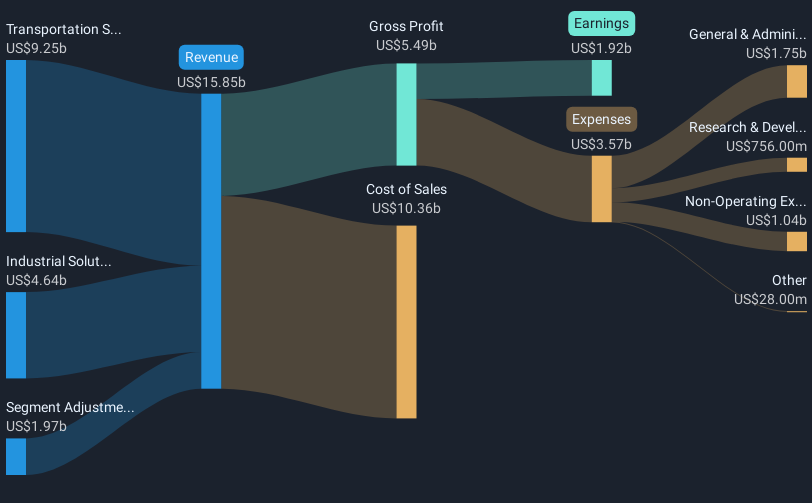

TE Connectivity (TEL) recently guided for a strong Q4 FY 2025, anticipating net sales of $4.55 billion with significant year-over-year EPS growth. This came alongside impressive Q3 earnings results, showing notable year-over-year increases in sales and net income. Over the last quarter, TEL's share price surged by 33%, aligning well with market optimism as major indices hit record highs. Despite a slight moderation, the overall market showed robust investor sentiment driven by favorable trade agreements and strong earnings across sectors. TEL's positive corporate performance and guidance likely supported this substantial uptick alongside broader market trends.

We've identified 1 risk for TE Connectivity that you should be aware of.

The recent guidance and strong Q3 results from TE Connectivity could potentially reinforce the ongoing narrative of revenue and earnings growth driven by localized manufacturing and advancements in AI. The company is expected to see revenue from AI applications exceeding US$700 million in fiscal 2025, aligning well with this upbeat guidance. Analysts have forecasted a 6.6% annual growth in revenue for the next three years, suggesting that the current positive performance might translate into longer-term growth. This aligns with the company's focus on operational efficiency and expanding product offerings through strategic acquisitions.

Over the past five years, TE Connectivity's total return, including share price gains and dividends, was a substantial 125.76%, reflecting strong underlying business fundamentals. This long-term performance significantly outpaces the industry average over one year, despite an earnings decline of 59.4% amidst a challenging environment for the Electronic industry. However, this momentum evidenced in the recent quarter could lend support to the forecasted earnings growth of 18.22% per year moving forward.

With the current share price at US$180.47, slightly above the consensus price target of US$180.18, there appears to be a slight disparity between market valuation and average analyst expectations. This could indicate that investors are factoring in potential future growth beyond the consensus, influenced by recent positive corporate forecasts and sector trends. Nonetheless, ongoing geopolitical tensions and tariff impacts remain risks to closely monitor, as they could affect revenue rooted in the Western auto markets and the Medical segment.

Explore TE Connectivity's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TE Connectivity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEL

TE Connectivity

Manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia–Pacific, and the Americas.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives