TE Connectivity (TEL): Assessing Valuation Following Breakout Q3 Results and Bullish Guidance

Reviewed by Simply Wall St

TE Connectivity (TEL) just gave investors something to chew on with its blockbuster third-quarter results. The company not only delivered an 18% jump in adjusted earnings per share, but its Industrial Solutions segment stood out, especially with demand pouring in from AI and modern data center customers. Management’s upbeat guidance for the next quarter, featuring more double-digit growth and healthy margins, has helped fuel fresh optimism around where the company is heading.

This enthusiasm has played out in the stock price. Shares of TE Connectivity jumped nearly 12% on the day of the earnings release and now sit up 46% since the start of the year, building on impressive gains over the past three years. While there were earlier periods of sideways trading, momentum has clearly returned following these recent results. The market now seems tuned in to the company’s expanding role in high-growth sectors like AI and infrastructure.

So, after this powerful surge and stronger guidance, is TE Connectivity’s current price still a bargain, or has the market already baked in the company’s next phase of growth?

Most Popular Narrative: 5.8% Undervalued

According to community narrative, TE Connectivity is currently seen as undervalued by nearly 6% compared to its fair value, based on consensus analyst assumptions about the next stage of growth and profit expansion.

"TE Connectivity's rapid revenue growth in AI-driven data center infrastructure demonstrates the increasing global demand for high-performance connectivity. This growth is supported by a near tripling of AI-related revenue from $300M to over $800M in fiscal 2025. Continued investment and scaling suggest this trend will fuel further top-line growth and maintain above-segment margins."

How does this blue-chip industrial become a favorite in growth-focused portfolios? According to the leading narrative, it all rides on bold expansion plans in next-gen tech and vehicle markets. Profit targets are based on bullish financial projections. Want to see the surprising forecast assumptions powering that fair value? The story behind these numbers could upend your expectations.

Result: Fair Value of $217.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts in global demand for AI and Asian transportation, or setbacks in operational improvements, could quickly challenge the current bullish outlook.

Find out about the key risks to this TE Connectivity narrative.Another View: One Metric Sends a Warning

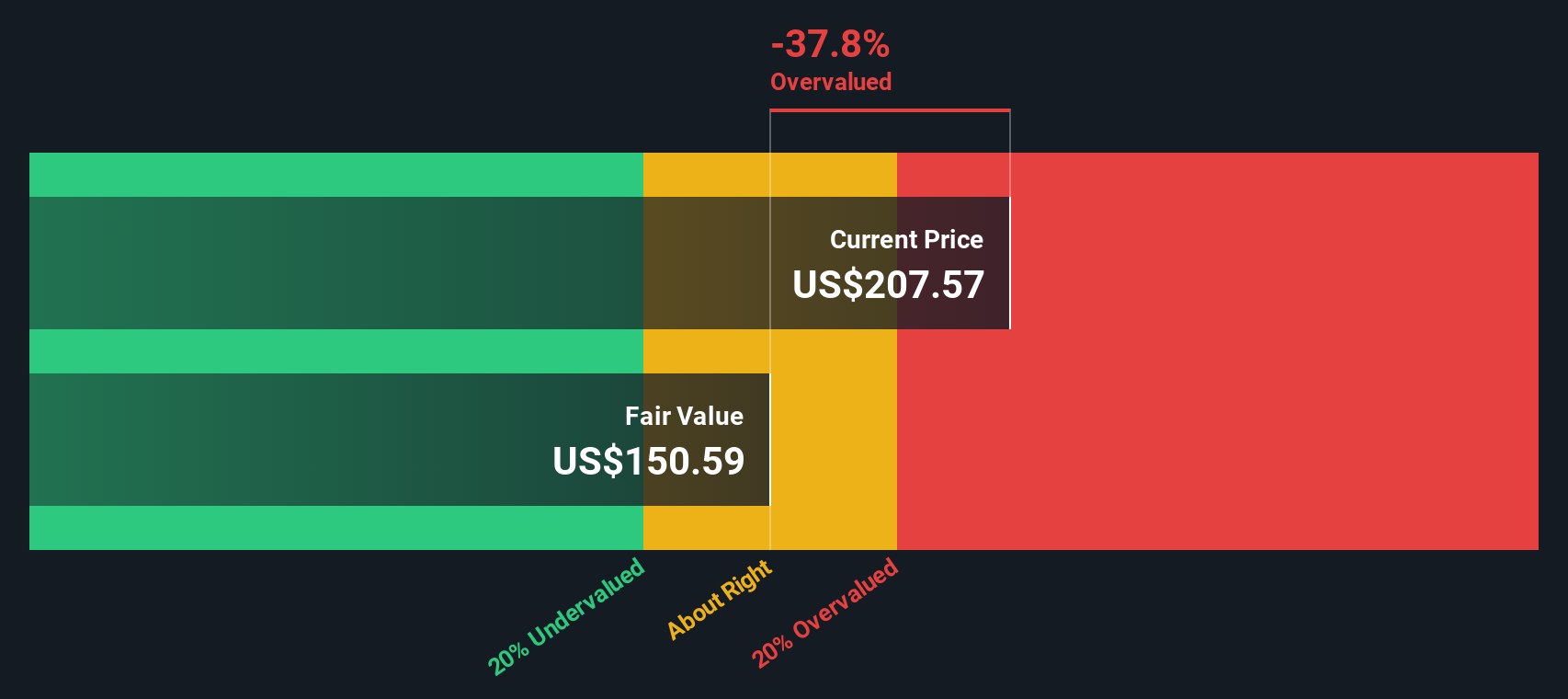

Looking through a different lens, our DCF model actually suggests TE Connectivity could be trading above fair value right now. This approach raises doubts about how much future growth is already priced in. Are the optimistic forecasts a stretch?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TE Connectivity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TE Connectivity Narrative

If you have different ideas or want to dig into the numbers on your own terms, you can build your personal take on TE Connectivity in just a few minutes, so why not do it your way?

A great starting point for your TE Connectivity research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Ideas?

Do not limit your potential to just one stock. With so many sectors heating up, now is the perfect time to set your next investment in motion. Make sure you are not missing out on these stand-out opportunities shaping the market right now:

- Unlock steady cash flow and consistent returns by targeting dividend stocks with yields > 3%. This approach could help bolster your portfolio with reliable income streams.

- Seize the chance to back companies harnessing artificial intelligence in healthcare. Get ahead of major trends with healthcare AI stocks shaping new medical breakthroughs.

- Capture long-term growth by zeroing in on undervalued stocks based on cash flows and uncovering stocks that the market might be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TE Connectivity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEL

TE Connectivity

Manufactures and sells connectivity and sensor solutions in Europe, the Middle East, Africa, the Asia–Pacific, and the Americas.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives