Teledyne Technologies (NYSE:TDY) Faces Shareholder Proposal challenge on Special Meeting Powers

Reviewed by Simply Wall St

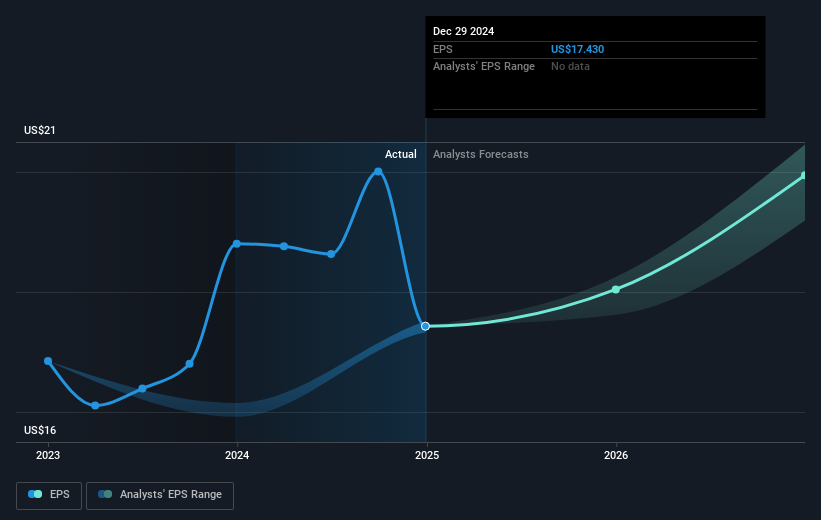

Teledyne Technologies (NYSE:TDY) is currently navigating a wave of investor activism after shareholder John Chevedden proposed changes to its governing documents, seeking to empower stakeholders to call special meetings. In response, Teledyne filed a preliminary proxy statement urging shareholders to vote against this proposal. Over the past quarter, the company's share price increased by 6.1%, a movement that can be linked to shareholder activism and various internal corporate developments. During this period, Teledyne reported a decline in net income and EPS despite a rise in sales, while its share buyback program continued, repurchasing 47,900 shares for $21.4 million. The broader market context showed a 1.4% market drop amid mixed investor sentiments influenced by benign inflation data and tech sector volatility. The company's actions, along with market movements, likely influenced its performance, contrasting with the S&P 500's decline and shedding light on its resilience amid broader market challenges.

Click here to discover the nuances of Teledyne Technologies with our detailed analytical report.

Teledyne Technologies' total shareholder return over the last five years has been 52.54%, reflecting solid performance a amidst significant events. Notably, the company was awarded a substantial five-year IDIQ contract up to US$74.2 million with the U.S. Coast Guard to provide modernized imaging surveillance systems, positively impacting investor perception. Meanwhile, ongoing buybacks, totaling US$353.97 million, bolstered shareholder value and played a crucial role in the company's returns.

In the past year, however, earnings have experienced a downturn, with net income showing a decline from previous performance. Despite these earnings pressures, Teledyne's shares outperformed both the US electronic industry and the broader US market over the past year, demonstrating resilience. The company's price-to-earnings ratio, perceived as expensive compared to industry and peer averages, may also factor into investor sentiment. Additionally, significant insider trading activity over the recent months could influence market dynamics.

- Discover whether Teledyne Technologies is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Explore the potential challenges for Teledyne Technologies in our thorough risk analysis report.

- Already own Teledyne Technologies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teledyne Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDY

Teledyne Technologies

Provides enabling technologies for industrial growth markets in the United States and internationally.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives