Assessing Teledyne Technologies (TDY) Valuation Following Recent Share Price Gains

Reviewed by Kshitija Bhandaru

Teledyne Technologies (TDY) has captured some attention lately, mainly due to its recent share price movements. Investors might be curious about how its past month’s gain of 2% fits into the bigger picture.

See our latest analysis for Teledyne Technologies.

While Teledyne Technologies' 1-month share price return of 1.5% suggests steady momentum, the real story is in the longer-term resilience, with a 1-year total shareholder return of 26.8% and even stronger gains over three and five years. Market watchers see this as evidence that confidence in the company's outlook, especially following its recent moves, remains intact.

If you're looking for fresh ideas beyond Teledyne, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With such strong returns on record, the key question now is whether Teledyne Technologies remains undervalued or if the market has already factored in future growth, leaving little room for new buyers to capitalize.

Most Popular Narrative: 7.8% Undervalued

Teledyne Technologies finished at $565.02, while the most followed narrative pegs its fair value almost 8% higher. This reflects strong future expectations compared to today’s market consensus.

Strong international defense and unmanned systems demand (notably through FLIR and marine unmanned vehicles), coupled with record-high global defense and aerospace spending, is fueling robust long-cycle order growth and positioning Teledyne for continued revenue expansion and improved operating leverage in core segments.

Curious about why the market’s top narrative projects such premium upside? The secret lies in ambitious profit forecasts, margin expansion, and bold growth bets. Discover which financial levers drive this high-stakes valuation; there is more to Teledyne’s story than meets the eye.

Result: Fair Value of $612.9 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing organic sales and persistent supply chain challenges could pressure margins. This may potentially challenge the strong outlook priced into Teledyne's shares.

Find out about the key risks to this Teledyne Technologies narrative.

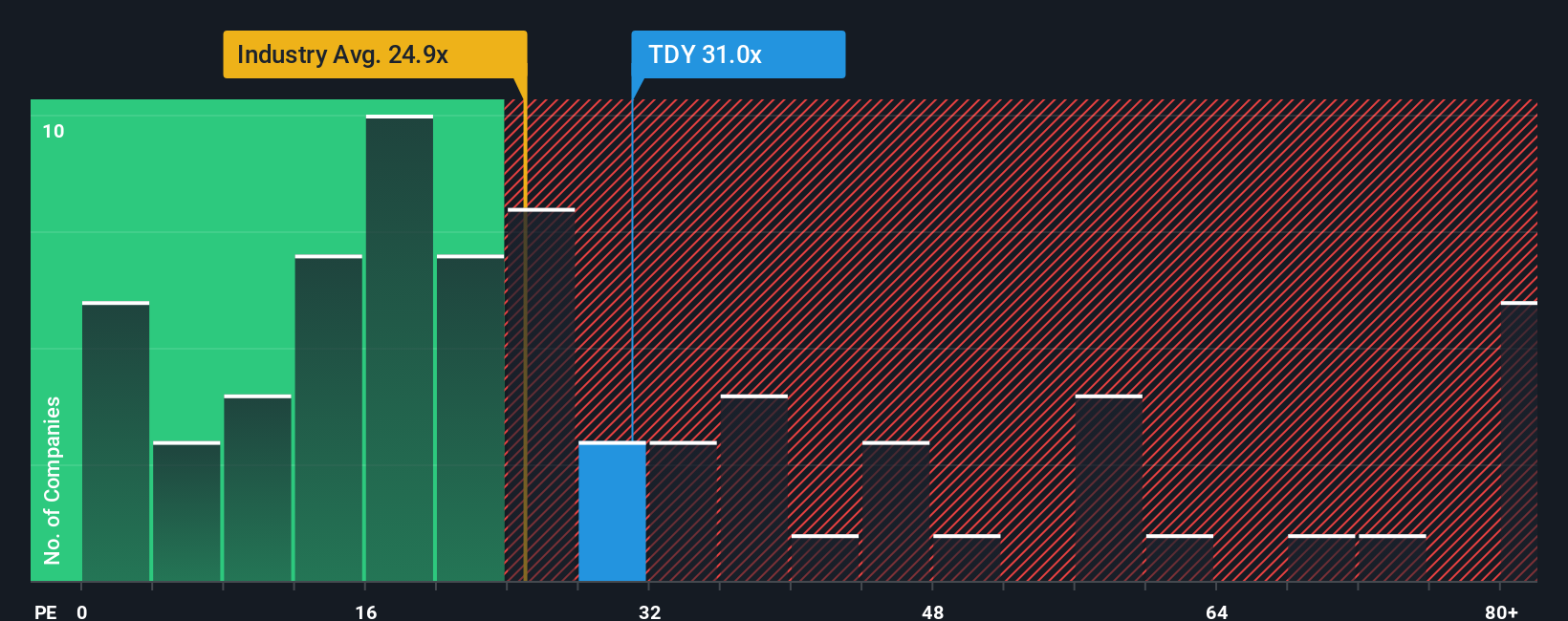

Another View: What Do Multiples Say?

Looking from another angle, Teledyne Technologies trades on a price-to-earnings ratio of 30.8x, which is higher than the US electronics industry average of 25.4x. It is also above its estimated fair ratio of 27x. This suggests that investors may be paying a premium compared to the broader market and its peers. Is the optimism justified, or does it raise the risk of overpaying?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Teledyne Technologies Narrative

If you see Teledyne’s story differently or want to run your own numbers, you can craft a personal narrative in just a few minutes. So why not Do it your way?

A great starting point for your Teledyne Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Want to stay ahead? Amplify your investing edge by checking out unique opportunities and market movers you might have overlooked. These screens could make all the difference.

- Unlock potential in emerging technology by tracking these 24 AI penny stocks, which are shaping industries with innovative artificial intelligence solutions and rapid market growth.

- Boost your income strategy with these 18 dividend stocks with yields > 3%, offering reliable yields and a track record of rewarding shareholders, especially in times of market volatility.

- Capitalize on future breakthroughs by targeting these 26 quantum computing stocks, developing the next wave of computing and security technologies with game-changing potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teledyne Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDY

Teledyne Technologies

Provides enabling technologies for industrial growth markets in the United States, Europe, Asia, and internationally.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives