Could Rogers' (ROG) Cautious Outlook Reveal Shifting Competitive Pressures in Advanced Materials?

Reviewed by Sasha Jovanovic

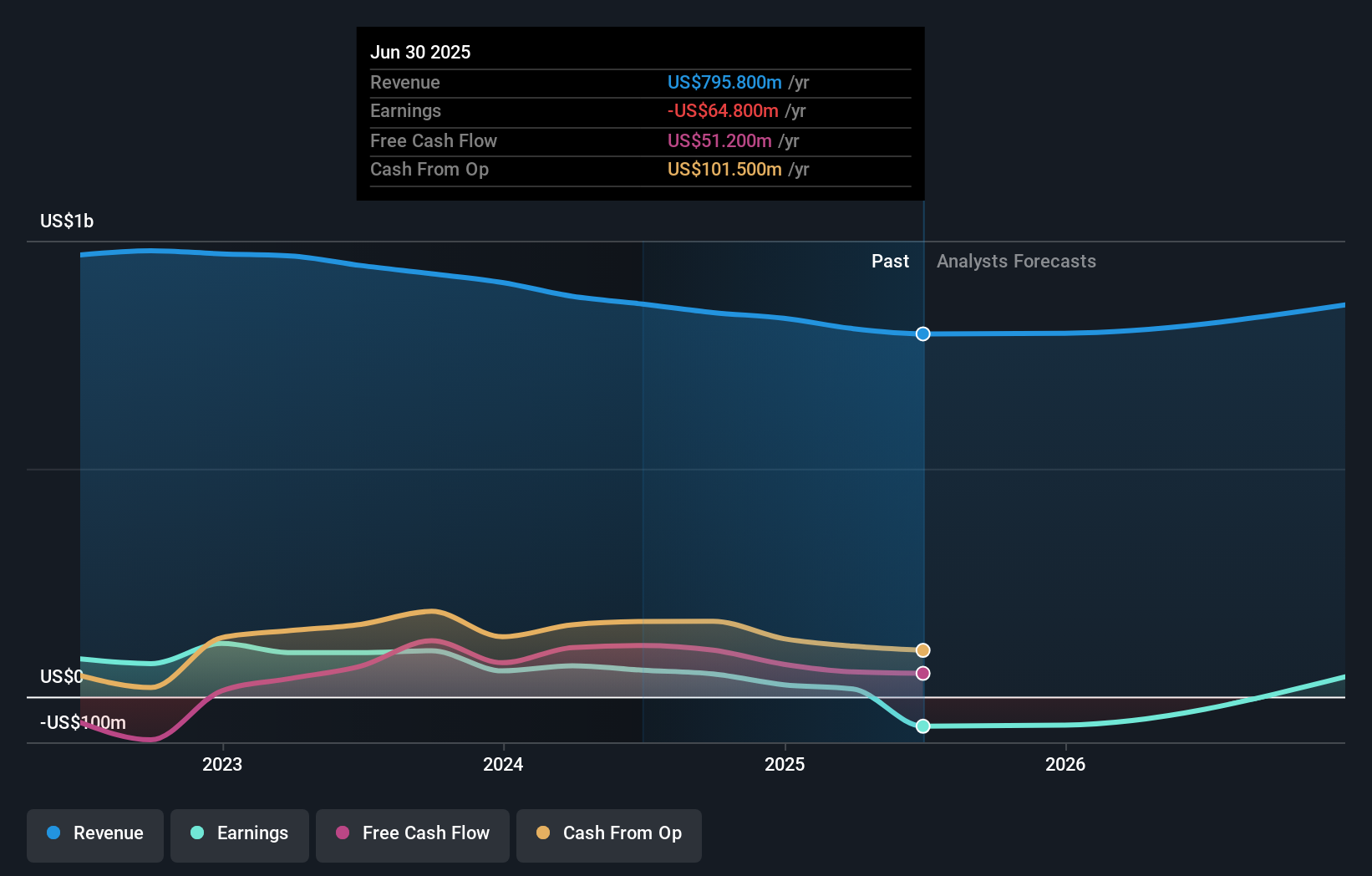

- Rogers (NYSE:ROG) recently presented at Battery Show North America 2025 in Detroit, shortly after reporting a 5.3% year-on-year decline in quarterly revenue, which still surpassed analyst expectations by 2%, but missed next quarter's EPS guidance.

- This mixed quarterly performance drew particular focus given the sector's overall strength and underscores investor sensitivity to Rogers' forward-looking earnings in a competitive landscape.

- We'll examine how the weaker than expected future earnings guidance shapes the outlook for Rogers' investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Rogers Investment Narrative Recap

To be a shareholder in Rogers, you need to believe that the company can successfully leverage accelerating electrification trends, particularly in electric vehicles and high-performance industrial applications, while executing a turnaround amid stiff global competition. Despite Rogers outperforming revenue expectations this quarter, its soft forward EPS guidance has dampened some optimism, as near-term earnings quality is now the main short-term catalyst, and the biggest risk continues to be ongoing earnings instability due to restructuring and margin pressures. The latest news does not materially change these dynamics for now.

One of the most relevant recent developments is Starboard Value LP’s engagement with Rogers’ management regarding opportunities to create greater shareholder value. This comes at a time when investors are closely watching for concrete progress in margin improvement and operational execution, which are key areas of focus given the company’s cautious guidance and sector-wide growth.

Yet while quarterly volatility can ripple through share prices, what investors should be aware of is the ongoing risk that Rogers’ restructuring actions may not deliver the anticipated cost savings if...

Read the full narrative on Rogers (it's free!)

Rogers' narrative projects $921.6 million revenue and $83.3 million earnings by 2028. This requires 5.0% yearly revenue growth and a $148.1 million increase in earnings from the current $-64.8 million.

Uncover how Rogers' forecasts yield a $80.00 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Private investors in the Simply Wall St Community assigned fair value estimates for Rogers ranging from US$16.66 to US$80, showing a broad split from just two perspectives. With persistent margin and earnings headwinds flagged by analysts, you may want to compare these numbers and see which risk or catalyst you think will most influence results.

Explore 2 other fair value estimates on Rogers - why the stock might be worth as much as $80.00!

Build Your Own Rogers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Rogers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rogers' overall financial health at a glance.

No Opportunity In Rogers?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ROG

Rogers

Designs, develops, manufactures, and sells engineered materials and components in the United States, other Americas, China, other Asia Pacific countries, Germany, Europe, the Middle East, and Africa.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives