- United States

- /

- Semiconductors

- /

- NasdaqGS:MCHP

US Stock Market Today: S&P 500 Futures Dip amid Cooling Jobs, Mixed Soft-Landing Hopes

Reviewed by Sasha Jovanovic

The Morning Bull - US Market Morning Update Thursday, Dec, 4 2025

US stock futures are slightly softer this morning, as investors juggle strong signals from the services side of the economy with a surprise cooling in hiring. A key health check on the services sector came in at 52.6 in November, showing businesses are still growing and prices are rising more slowly, which helps the case for steady growth without runaway inflation. But a separate jobs report showed private payrolls dropping by 32,000, the biggest fall since early 2023, hinting that hiring momentum is fading. The big question is whether this softer job market is good news for interest rate cuts or an early warning sign for growth, a call that puts rate sensitive areas like tech, financials, and parts of consumer spending firmly in focus for today’s session.

In a cooling jobs market where stock picking matters more than ever, we have uncovered undervalued stocks based on cash flows before Wall Street catches on.

Top Movers

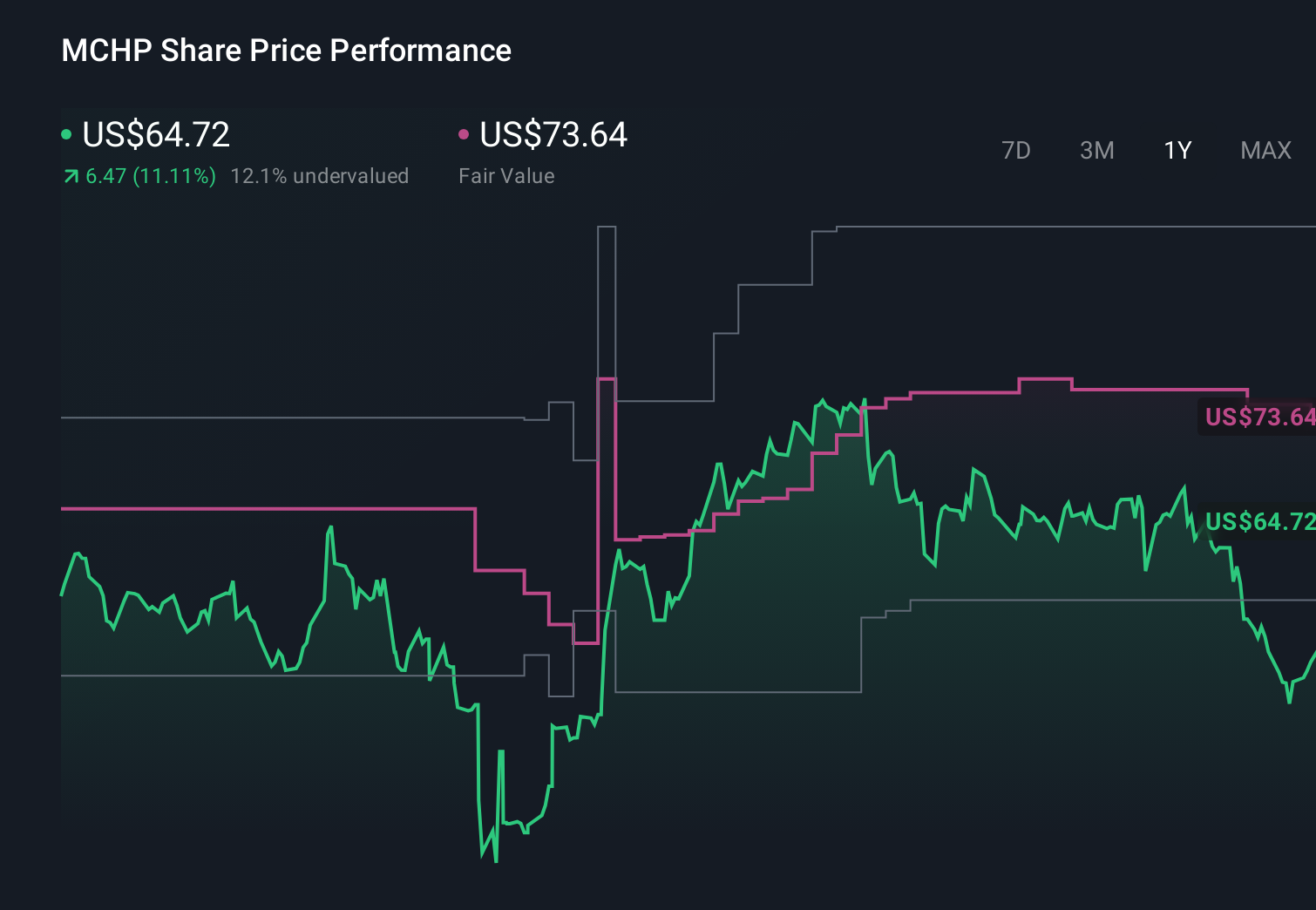

- Microchip Technology (MCHP) jumped 12.17% after raising quarterly guidance and unveiling new ultra efficient power monitors.

- ON Semiconductor (ON) surged 11.01% as traders rotated back into power sensitive chip names after Microchip’s upbeat outlook.

- Symbotic (SYM) climbed 9.37% on renewed optimism about AI driven warehouse automation demand.

Is Microchip Technology still a smart investment or just hype? Read our most popular narrative and get all the answers you need.

Top Losers

- Pure Storage (PSTG) plunged 27.31% as investors punished soft margins despite raised full year revenue guidance.

- Sandisk (SNDK)

- Netflix (NFLX)

Look past the noise - uncover the top narrative that explains what truly matters for Pure Storage's long-term success.

On The Radar

After the bell, a trio of growth and value names will offer fresh clues on US consumer and enterprise spending.

- Ulta Beauty (ULTA) reports Q3 results today, with comps and holiday guidance key for assessing beauty demand and discretionary spending.

- Samsara (IOT) posts Q3 numbers today, where ARR growth and margin progress will help gauge appetite for IoT driven digital transformation.

- Dollar General (DG) reports Q3 today, and traffic trends will highlight pressures on low income consumers and trade down patterns.

Use our Portfolio or Watchlist features to track market-moving events like these and get alerts for the companies you own, free!

Identify The Next Market Leaders

Look past today’s headline movers and focus on where smart money is quietly positioning now. The real upside often emerges before consensus notices, and our deep dive into 25 AI penny stocks reveals a focused group of innovators at the sweet spot of accelerating demand and still reasonable valuations.

Ready to take control of your investing playbook? Use our stock screener to run custom searches that fit your unique style and set timely alerts so you never miss the next hidden gem.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHP

Microchip Technology

Develops, manufactures, and sells smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia.

High growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026