- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Pure Storage (PSTG): Valuation in Focus Following Cloud Platform Launch and Expanded Azure Integration

Reviewed by Kshitija Bhandaru

Purer Storage (PSTG) has found itself in the spotlight after unveiling a wave of new platform features, including its Pure Storage Cloud product and expanded Azure integrations. These advancements are attracting fresh investor interest as organizations increasingly focus on AI-driven data management strategies.

See our latest analysis for Pure Storage.

Pure Storage’s momentum is hard to ignore, with the stock riding a wave of enthusiasm for next-gen data infrastructure and AI integration. Even after a brief pullback, the 1-year total shareholder return stands at nearly 68%, and the five-year figure is an impressive 389%. While some volatility persists with the broader tech sector, investors are clearly betting on continued demand for reliable, scalable storage in an AI-powered future.

If Pure’s expansion got you thinking about where tech’s heading next, you should check out the landscape of innovators in our tech and AI stocks screener: See the full list for free.

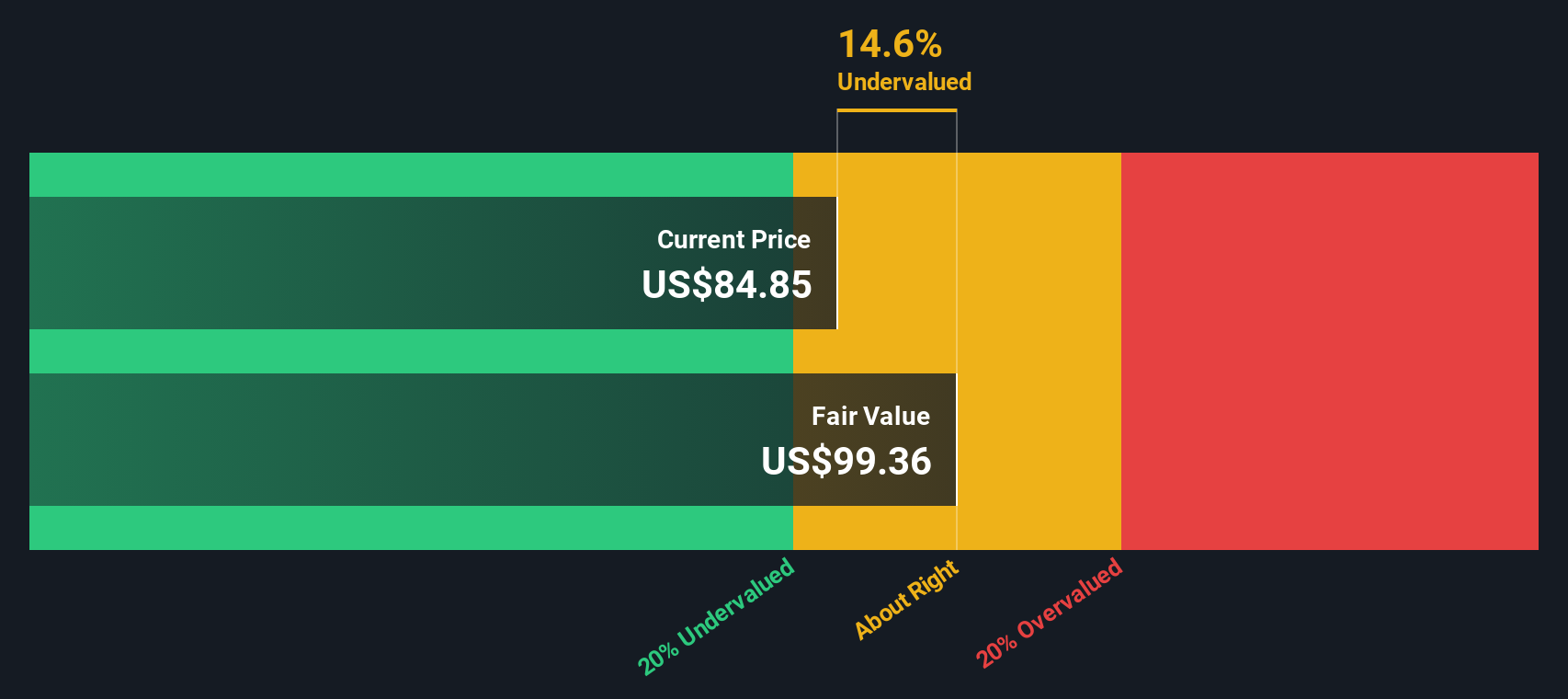

Yet with shares up sharply over the past year, investors now face a critical question. Is Pure Storage still undervalued given its growth prospects, or has the market already priced in the next stage of its evolution?

Most Popular Narrative: 5.2% Overvalued

With Pure Storage's last close price of $89.37 now standing higher than the widely-followed narrative's fair value estimate of $84.94, the latest narrative sets a higher valuation bar driven by strong cloud adoption hopes and growth projections. This narrative pins its conclusion on expanding enterprise capabilities and a bold outlook for future profitability, but the current market price trades above consensus fair value.

The adoption of Pure's Enterprise Data Cloud architecture and software-defined solutions is accelerating among large enterprises, driven by the need to manage rapidly growing and increasingly valuable data assets in the evolving AI economy. This positions Pure to capture rising long-term revenue from digital transformation and AI/ML-driven workloads.

Want to know the blockbuster numbers behind this bold valuation call? The real story rests on projected revenue leaps, sustained margin expansion, and a future profit multiple that is sure to spark debate. Discover what assumptions are fueling such optimism—and why this narrative thinks Pure Storage is set up for an AI-powered windfall.

Result: Fair Value of $84.94 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty still lingers. Pure Storage’s shift to recurring cloud revenues could stall if hyperscaler deals remain slow to ramp or if competition intensifies.

Find out about the key risks to this Pure Storage narrative.

Another View: Discounted Cash Flow Puts a Twist on the Story

For a fresh perspective, our SWS DCF model suggests Pure Storage is actually undervalued, with a fair value estimate of $102.87 versus the current share price. This approach looks beyond market multiples and tries to capture long-term cash flow potential. So, which narrative best describes reality? Is it the market's caution, or this optimistic DCF scenario?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Pure Storage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Pure Storage Narrative

If you see things differently or feel like digging into the numbers yourself, you can craft a complete investment story in just a few minutes. Do it your way

A great starting point for your Pure Storage research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities slip past you. Use the Simply Wall St screener to quickly unlock unique growth, income, and technology ideas tailored to your style.

- Start building wealth by identifying profit potential in underappreciated gems through these 903 undervalued stocks based on cash flows.

- Accelerate your research with a handpicked selection of innovative companies transforming healthcare using artificial intelligence. Check out these 32 healthcare AI stocks.

- Catch market momentum and boost your returns with steady passive income from leading these 19 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives