- United States

- /

- Tech Hardware

- /

- NYSE:PSTG

Does US-China Trade Tension Risk Disrupt Pure Storage’s (PSTG) Cloud Transition Story?

Reviewed by Sasha Jovanovic

- In the past week, Pure Storage saw its shares drop after President Trump threatened sharp tariff hikes on Chinese imports, heightening investor fears of renewed US-China trade tensions and potential disruptions for technology firms.

- While Pure Storage is anticipated to deliver year-over-year growth in earnings and revenue, analysts are closely watching for changes in estimates as market uncertainty and supply chain risks persist for the sector.

- We'll explore how renewed trade war concerns and potential supply chain disruptions could affect Pure Storage's outlook and ongoing cloud transition.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Pure Storage Investment Narrative Recap

To be a Pure Storage shareholder today means believing in the company’s ability to transition its data storage portfolio toward cloud-native and subscription-based models, capitalizing on accelerating enterprise cloud adoption. While renewed US-China trade tensions and tariff threats caused a sharp pullback in shares, the most important near-term catalysts, recurring revenue growth and margin expansion driven by cloud solutions, are not expected to face direct, material changes, though ongoing supply chain uncertainty remains the biggest short-term risk. One relevant recent announcement, Pure Storage’s late September platform enhancements for AI and cyber resilience, underscores the company’s focus on high-growth and mission-critical enterprise use cases. As Pure strengthens its cloud and AI-ready solutions, these moves align with management’s expectations for increasing demand in emerging segments, even as macro uncertainties temporarily unsettle share prices. However, investors should also be mindful that, despite a strong focus on recurring revenue, forecast accuracy for product and as-a-service mix remains a key risk if...

Read the full narrative on Pure Storage (it's free!)

Pure Storage's narrative projects $5.1 billion revenue and $571.5 million earnings by 2028. This requires 15.2% yearly revenue growth and a $432.3 million earnings increase from $139.2 million today.

Uncover how Pure Storage's forecasts yield a $84.94 fair value, a 8% downside to its current price.

Exploring Other Perspectives

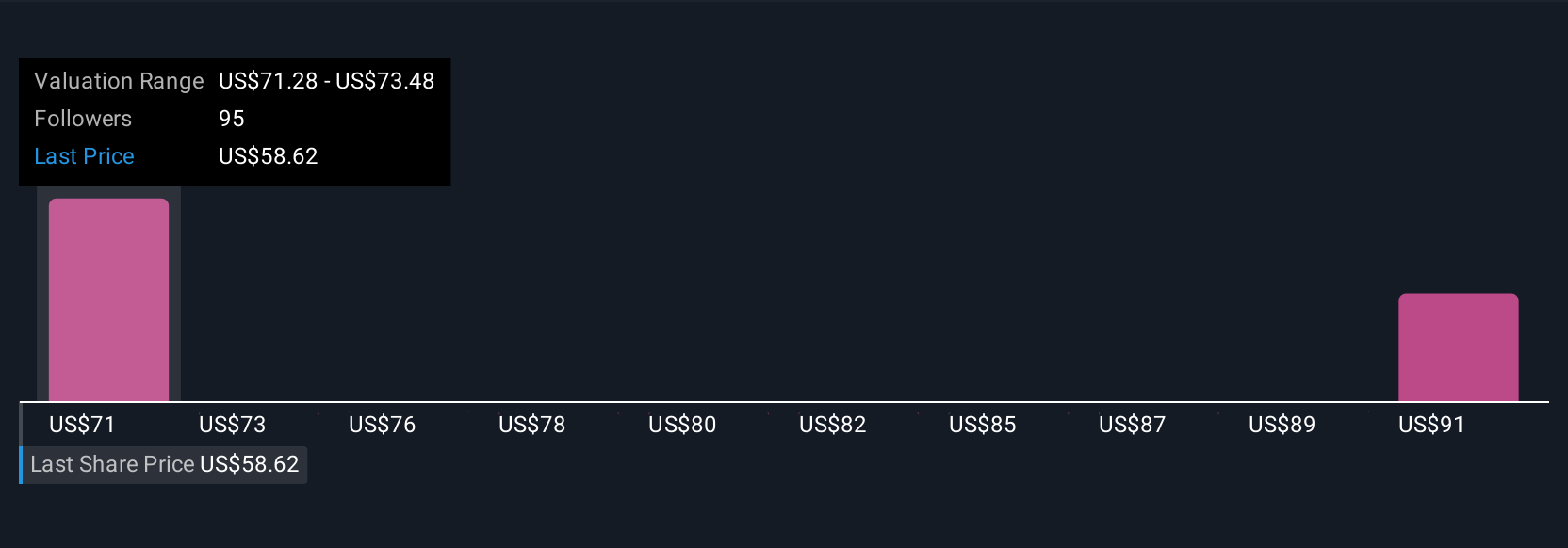

The Simply Wall St Community submitted four different fair value estimates for Pure Storage shares, ranging from US$84.94 to US$102.95. While opinions differ, heightened tariff risks and global supply chain disruptions could play a significant role in shaping future performance, so be sure to explore these alternative viewpoints.

Explore 4 other fair value estimates on Pure Storage - why the stock might be worth 8% less than the current price!

Build Your Own Pure Storage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pure Storage research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pure Storage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pure Storage's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSTG

Pure Storage

Provides data storage and management technologies, products, and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives