- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:CARG

High Growth Tech Stocks to Watch in US March 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a 2.5% drop, yet it remains up by 13% over the past year with earnings forecasted to grow by 14% annually. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for innovation and scalability while navigating current market fluctuations effectively.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.26% | 29.10% | ★★★★★★ |

| TG Therapeutics | 26.02% | 36.70% | ★★★★★★ |

| Travere Therapeutics | 28.43% | 65.01% | ★★★★★★ |

| Alkami Technology | 20.94% | 85.17% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| Bitdeer Technologies Group | 44.71% | 127.45% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.90% | 58.64% | ★★★★★★ |

| Applied Optoelectronics | 58.93% | 141.15% | ★★★★★★ |

| Lumentum Holdings | 21.24% | 119.37% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

CarGurus (NasdaqGS:CARG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CarGurus, Inc. operates an online automotive platform for buying and selling vehicles both in the United States and internationally, with a market cap of approximately $3.36 billion.

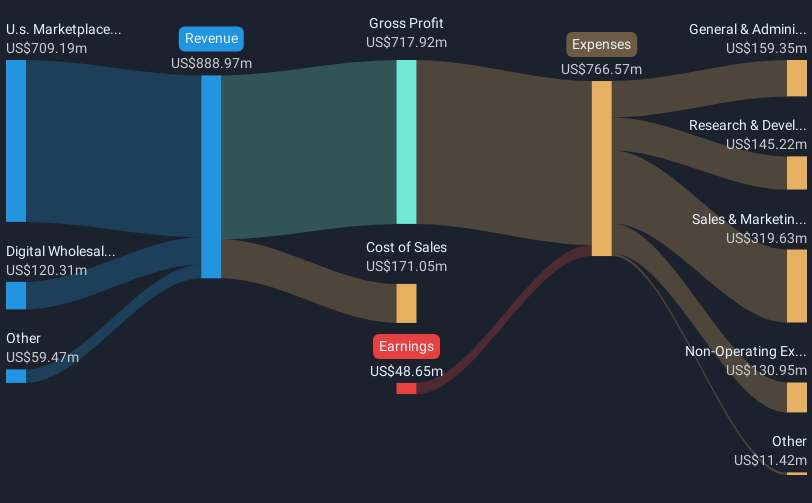

Operations: The company generates revenue primarily from its U.S. Marketplace segment, which accounts for $733.69 million, and Digital Wholesale segment at $97.79 million. The focus on these segments highlights its core business operations in the automotive platform industry.

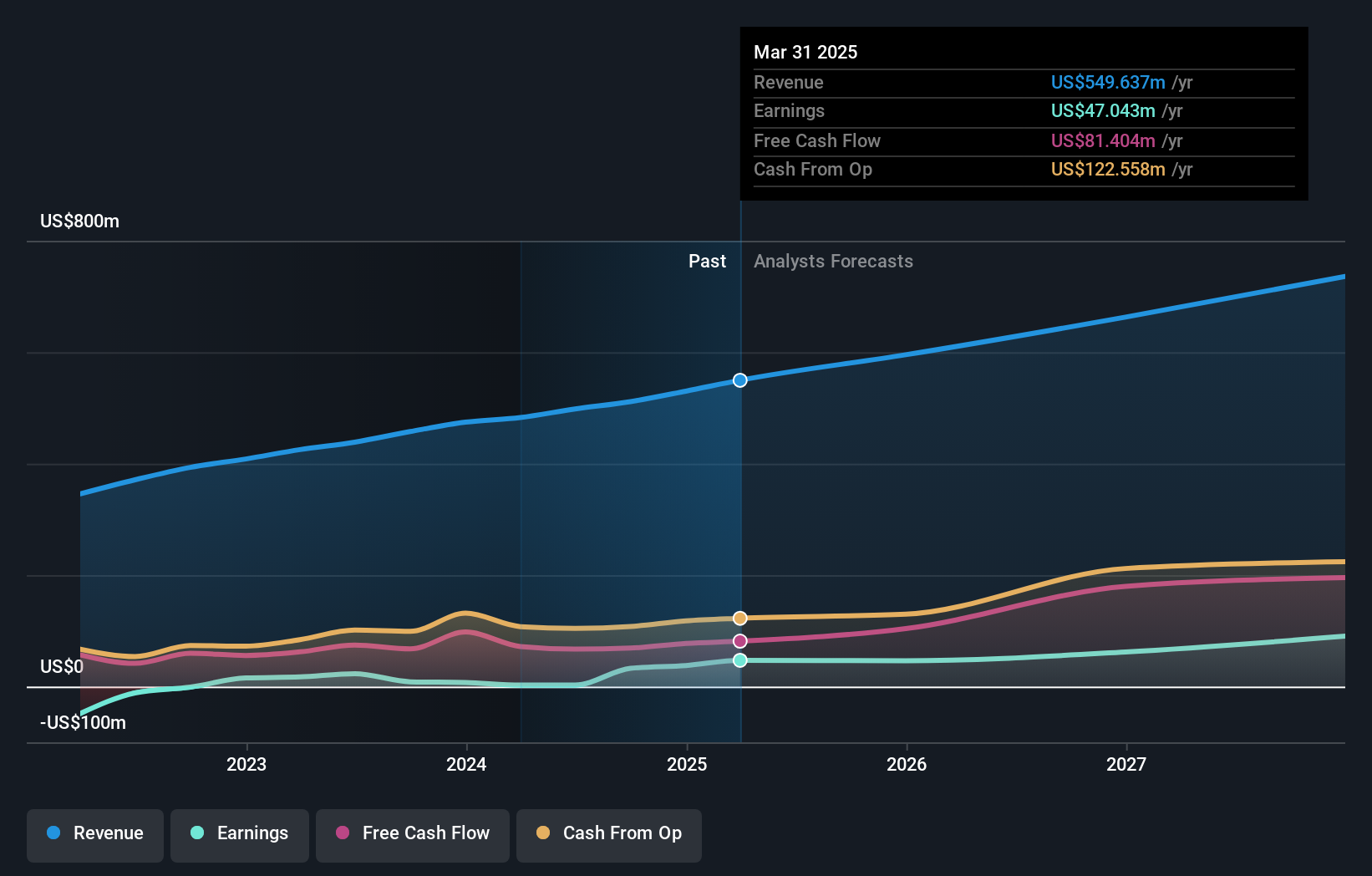

CarGurus, navigating through a transformative phase, recently reported a notable uptick in quarterly sales to $210.19 million from the previous year's $182.25 million, reflecting resilience despite broader market fluctuations. This growth comes amidst executive changes, with CEO Jason Trevisan taking on additional financial oversight roles following CFO Elisa Palazzo's departure. While CarGurus' annual revenue saw a slight dip to $894.38 million from $914.24 million, its strategic adjustments and leadership restructuring hint at an agile response to evolving market demands and potential for future stabilization and growth in the competitive online automotive marketplace.

- Delve into the full analysis health report here for a deeper understanding of CarGurus.

Review our historical performance report to gain insights into CarGurus''s past performance.

Integral Ad Science Holding (NasdaqGS:IAS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Integral Ad Science Holding Corp. is a digital advertising verification company with operations across multiple countries, including the United States, the United Kingdom, and Japan, and has a market cap of approximately $1.72 billion.

Operations: IAS specializes in digital advertising verification, offering services that ensure the quality and effectiveness of online ads across various international markets. The company generates revenue primarily through its technology solutions that help advertisers and publishers optimize their digital ad spend by verifying viewability, fraud detection, brand safety, and contextual targeting.

Integral Ad Science Holding Corp. (IAS) showcased robust growth, with a 422.2% increase in annual net income, reflecting strong execution and market demand. In the latest quarter, sales rose to $153.04 million from $134.3 million year-over-year, underpinning a solid revenue trajectory with expectations set between $588 million to $600 million for the upcoming fiscal year. Innovatively addressing digital ad placement challenges, IAS's partnership with Meta for Content Block List optimization marks a strategic pivot towards enhancing online advertising effectiveness while reducing wastage by 71%. This AI-driven approach not only fortifies its product suite but also aligns with evolving advertiser needs for precision and efficiency in media spending.

PAR Technology (NYSE:PAR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PAR Technology Corporation offers omnichannel cloud-based hardware and software solutions for the restaurant and retail sectors globally, with a market capitalization of $2.66 billion.

Operations: The company generates revenue primarily from its restaurant and retail segments, with the restaurant/retail sector contributing $349.98 million. The focus is on providing cloud-based solutions that integrate hardware and software for these industries globally.

PAR Technology's recent earnings reveal a significant revenue jump to $105.01 million in Q4 2024, up from $69.9 million the previous year, underscoring its adaptation and growth in high-tech solutions for the restaurant industry. Despite a net loss, improvements are evident with a reduced basic loss per share from $0.77 to $0.68 year-over-year. Innovatively, PAR has launched PAR OPS, integrating analytics and operational tools to enhance restaurant efficiencies—trusted by over 38,000 locations—which illustrates its strategic pivot towards leveraging technology for operational excellence and customer engagement in an evolving market landscape.

- Take a closer look at PAR Technology's potential here in our health report.

Explore historical data to track PAR Technology's performance over time in our Past section.

Key Takeaways

- Access the full spectrum of 234 US High Growth Tech and AI Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade CarGurus, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CARG

CarGurus

Operates an online automotive platform for buying and selling vehicles in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives