- United States

- /

- Communications

- /

- NYSE:MSI

Motorola Solutions (NYSE:MSI) Expands Public Safety AI Capabilities Across More Roles and Functions

Reviewed by Simply Wall St

Motorola Solutions (NYSE:MSI) recently launched Summit 2025, highlighting advancements in its public safety offerings, including expanded AI capabilities like Assist Chat, which are now more integrated in public safety agency workflows. Despite these product-related announcements, the company's stock movement remained flat over the past week, aligning with broader market trends and generally reinforcing rather than deterring its overall trajectory. While the tech sector saw gains with companies like Nvidia and AMD leading the rally, Motorola Solutions' performance suggests a more stabilized position amidst the tech-driven market momentum, unaffected significantly by specific news from last week's events.

We've identified 1 weakness for Motorola Solutions that you should be aware of.

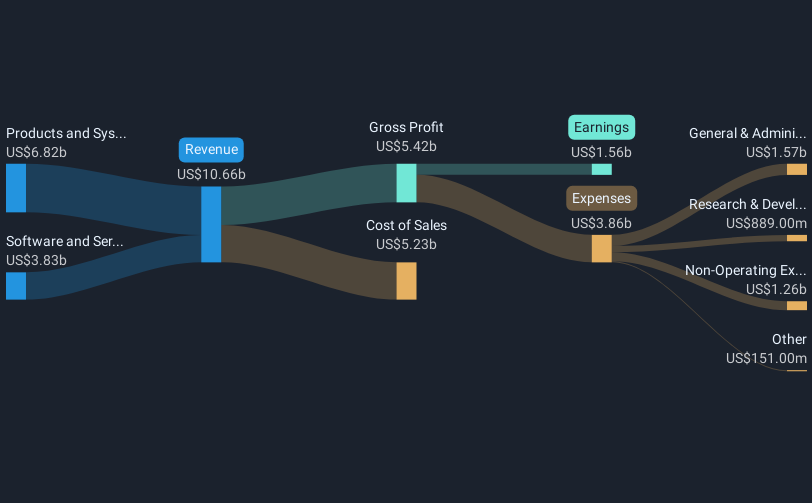

Motorola Solutions' recent introduction of Summit 2025, emphasizing advancements in AI and public safety, may set the stage for long-term growth. The company's strategic product enhancements like Assist Chat could bolster its competitive edge and support forecasted increases in revenue and earnings. These advancements may stimulate higher-tier product adoption, potentially contributing to future earnings targets, which analysts expect to rise to US$2.7 billion by 2028. Despite these innovations, the share price has stayed flat in the short term, aligning with broader market stabilization.

Over the broader five-year period, the company's total return, including share price and dividends, was 222.08%. This significant return reflects robust performance relative to the broader communication industry. Over the past year, Motorola Solutions' earnings growth of 46.6% surpassed the 32.3% growth in the US Communications industry, although its share return underperformed compared to the industry’s 28.8%. This context highlights cohesion between long-term growth initiatives and evolving industry conditions.

In terms of valuation, the current share price of US$412.64 sits around 16.5% below analysts' consensus price target of approximately US$493.89. This discount may convey a potential upside if Motorola Solutions sustains its revenue and earnings growth trajectory despite challenges from tariffs and currency fluctuations. Moreover, future strategies, including integration of acquisitions and mitigation of external risks, remain critical to achieving projected market value alignment.

Understand Motorola Solutions' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Motorola Solutions, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSI

Motorola Solutions

Provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives