- United States

- /

- Communications

- /

- NYSE:MSI

Motorola Solutions (MSI): Revisiting Valuation After Recent Share Price Moves

Reviewed by Kshitija Bhandaru

Motorola Solutions (MSI) has landed back on investors’ radars after a recent move in its share price, sparking fresh debate about where the stock could be headed next. While there is no headline-grabbing catalyst driving this week’s price action, sometimes these quieter stretches in the news cycle can be just as telling. For shareholders and would-be buyers, even modest swings in a steady operator like Motorola Solutions can serve as a prompt to revisit its long-term valuation pitch.

Over the past year, Motorola Solutions has delivered a 5% return, with gains picking up in the past three months as the stock climbed 12%. The past month still saw a more moderate rise, while short-term dips have appeared in recent days and weeks. Broadly, the longer-term trend remains positive, further supported by the company’s steady annual revenue and net income growth. Recent updates have focused more on business execution than on big splash announcements, suggesting a focus on delivering reliable results.

After these mixed yet overall constructive moves, the question for investors now is whether Motorola Solutions is trading below its real worth or if the market has simply priced in the next phase of growth already.

Most Popular Narrative: 6.6% Undervalued

The latest narrative from market consensus now sees Motorola Solutions as undervalued, as analysts expect the company’s future earnings power and growth to outpace its current share price.

The accelerating focus on public safety and security, fueled by heightened geopolitical instability, border security needs, and new government funding programs like the "One Big Beautiful Bill," is driving strong, sustained customer demand for advanced, integrated communication solutions. This expanding long-term tailwind is visible in Motorola's record Q2 orders, growing backlog, and consistent multi-year contract wins. These factors are supporting above-trend revenue growth and durability.

Curious what’s powering Motorola’s fair value estimate? This narrative is built on ambitious yet specific profit, revenue, and margin assumptions that could shape the company’s trajectory for years. Wondering which future milestones and financial turning points give analysts such confidence in their target price? Dive into the underlying formula that explains why some believe this stock remains undervalued, even after sharp multi-year gains.

Result: Fair Value of $503.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as slower adoption of new software and heavy reliance on government contracts could challenge Motorola Solutions’ long-term outlook, despite the company’s promising prospects.

Find out about the key risks to this Motorola Solutions narrative.Another View: Comparing to the Industry

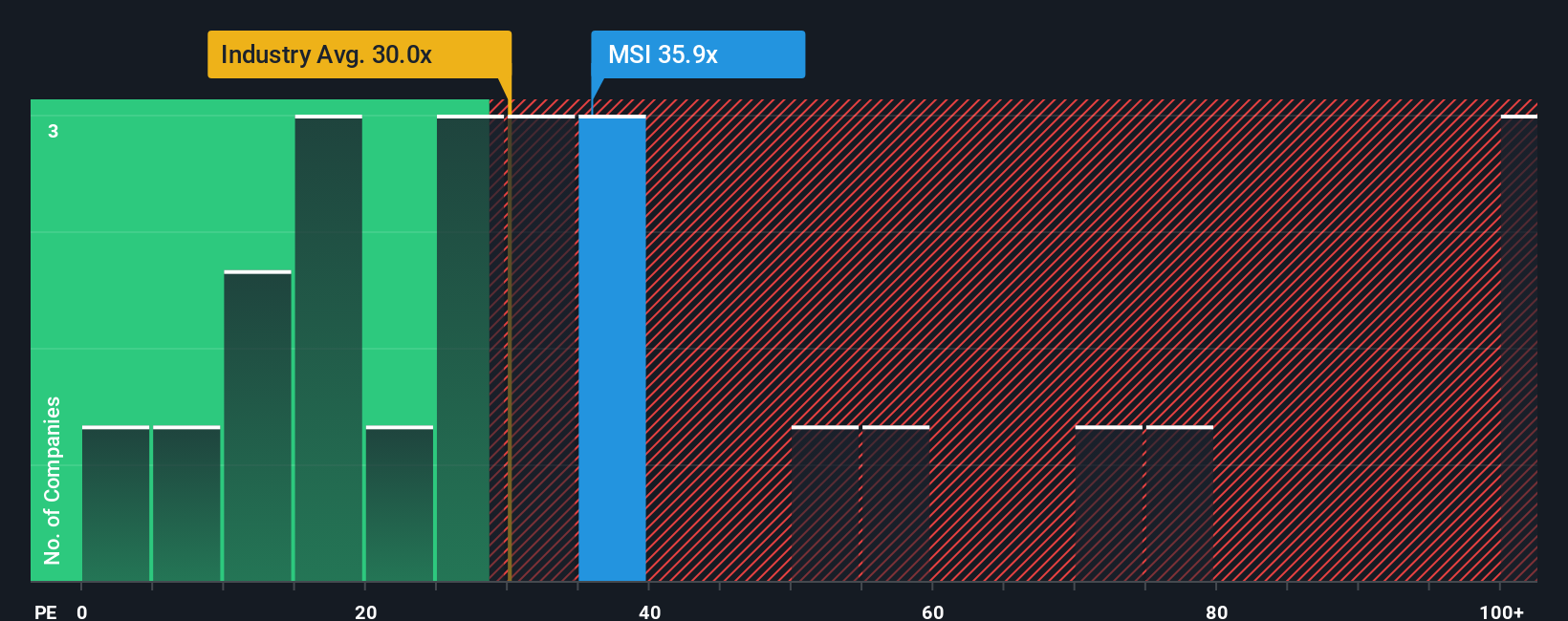

Looking at Motorola Solutions through the lens of market pricing, shares are currently valued higher than the broader US Communications industry using common earnings ratios. This challenges the undervalued story and invites a closer look. Is the premium justified, or is the market too optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Motorola Solutions to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Motorola Solutions Narrative

If you see things differently or want to dig into the numbers yourself, it's easy to construct your own storyline and set your own fair value assumptions in just a few minutes. Do it your way

A great starting point for your Motorola Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your opportunities to just one stock. Use these powerful tools to find fresh investment angles and get ahead before the next market move.

- Uncover stocks offering yield potential and consistent payouts by analyzing the market’s best performers with the dividend stocks with yields > 3% built for income seekers.

- Level up your portfolio with companies at the intersection of medicine and machine intelligence by harnessing insights from the healthcare AI stocks that’s spotlighting innovators in AI-driven healthcare.

- Identify hidden gems trading below their true worth by leveraging the undervalued stocks based on cash flows tailored for value-focused investors hunting for the next bargain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSI

Motorola Solutions

Provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives