- United States

- /

- Communications

- /

- NYSE:MSI

Is Motorola Solutions Still Worth a Look After Recent Share Price Pullback?

Reviewed by Bailey Pemberton

If you’re weighing your next move with Motorola Solutions stock, you’re definitely not alone. Investors have watched this name climb by an impressive 113.7% over the past three years, leaving many to wonder if there’s more fuel in the tank or if it’s time to lock in gains. Despite that strong long-term performance, the last year has been more subdued, with a 2.6% dip, and shares recently closed at $456.25. Over the past month, the stock is down 5.3%, a move that has some traders debating whether short-term market jitters or subtle shifts in sector sentiment are at play.

On major news fronts, Motorola Solutions has kept a steady profile, letting its fundamentals and reputation in mission-critical communications drive market perceptions. The slight negative trend in recent months may say more about broader market developments or recalibrating risk appetites than about any company-specific weakness.

When it comes to value, Motorola Solutions holds a valuation score of 1 out of 6, which means it is currently flagged as undervalued by only one out of six major valuation checks. So, what’s behind that score, and how do the different methods stack up? Let’s break down the numbers and see how traditional valuation tools compare in this case. Understanding the bigger picture may give you an even sharper edge.

Motorola Solutions scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Motorola Solutions Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation approach that estimates a company's intrinsic worth by projecting its future cash flows and discounting them back to their present value. This method provides investors with a forward-looking view of what the business is fundamentally worth, beyond current market sentiment.

For Motorola Solutions, the latest trailing twelve months Free Cash Flow stands at $2.35 billion. Analyst estimates cover up to five years out, with projections extended further to reach $3.25 billion by 2029 and beyond using growth estimates. These future cash flows are then adjusted by discounting them to today's dollars, which accounts for the time value of money.

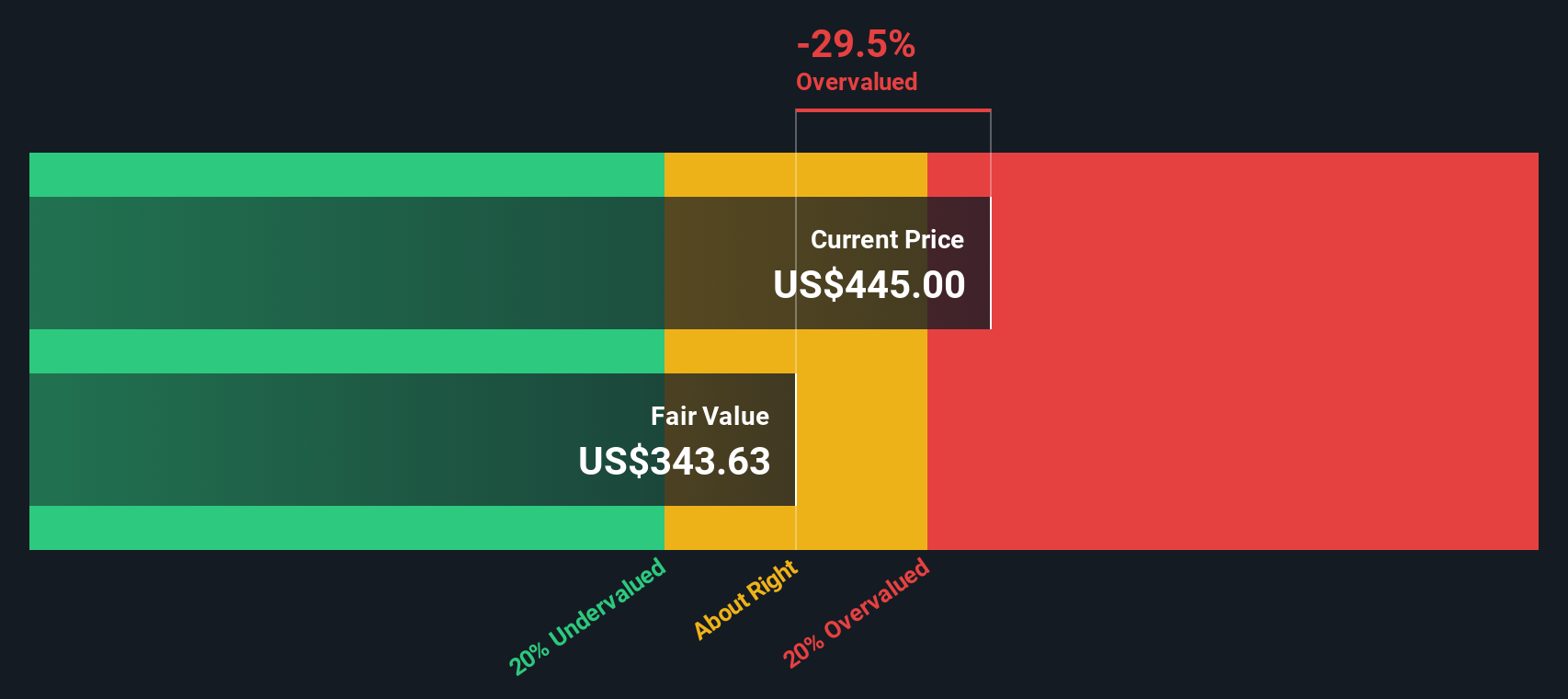

After running Motorola Solutions' numbers through the DCF model, the estimated intrinsic value per share comes out to $344.00. Compared to the most recent share price of $456.25, this implies the stock is about 32.6% overvalued.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Motorola Solutions may be overvalued by 32.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Motorola Solutions Price vs Earnings

For companies like Motorola Solutions that generate consistent profits, the price-to-earnings (PE) ratio is a widely accepted and practical measure of valuation. The PE ratio captures how much investors are willing to pay today for each dollar of future earnings, offering an intuitive sense of whether the stock is expensive or cheap relative to its profitability.

Of course, deciding what constitutes a “normal” or “fair” PE ratio is not straightforward. Higher expected growth rates typically justify a loftier PE multiple, while elevated risk or slower prospects should push it lower. Comparing a company’s PE to benchmarks can help, but it does not tell the whole story on its own.

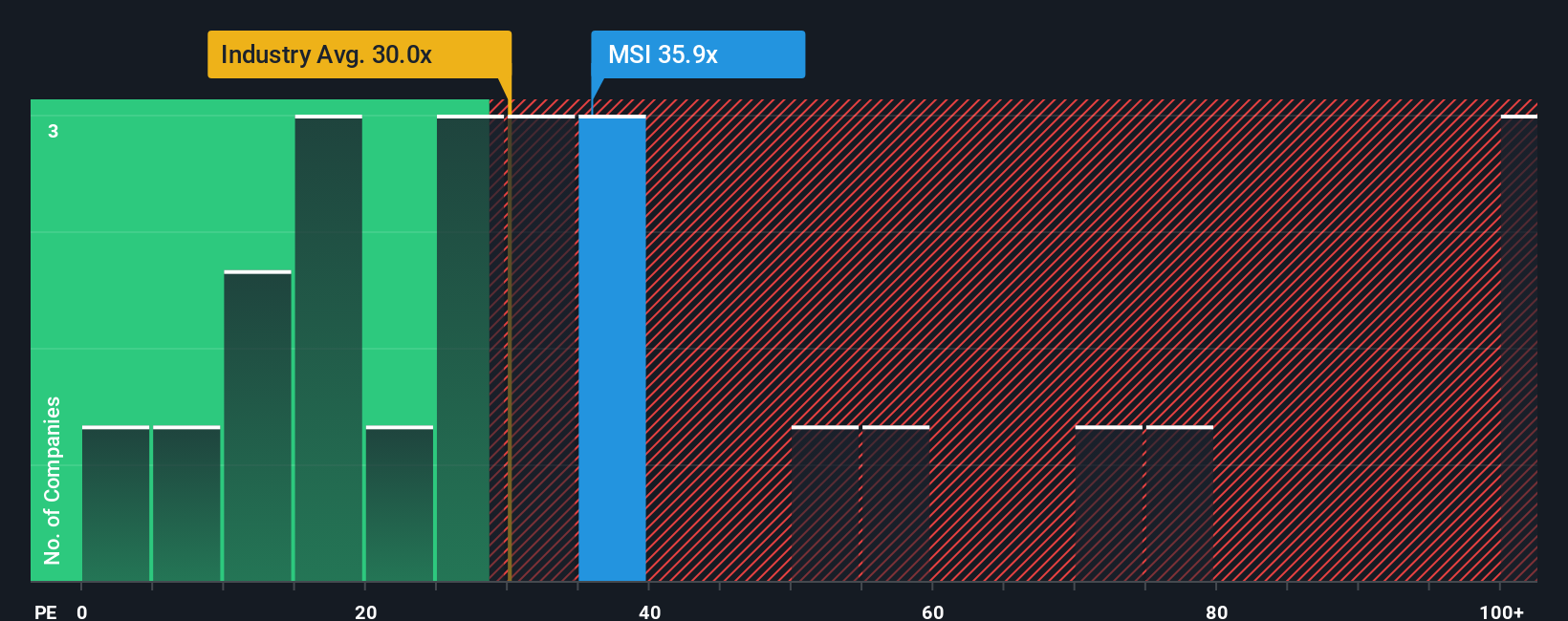

Currently, Motorola Solutions trades at a PE of 35.92x, well above the communications industry average of 30.47x and its peer group’s 76.64x. However, the proprietary “Fair Ratio” calculated by Simply Wall St for Motorola Solutions is 29.39x. This metric goes beyond simple industry comparisons, as it factors in the company’s earnings growth, profit margin, risk profile, industry context, and market capitalization. By accounting for all these elements, the Fair Ratio provides a more personalized yardstick of what the stock should legitimately be worth based on its own prospects and challenges.

With Motorola Solutions’ actual PE slightly higher than the Fair Ratio, but not to an extreme degree, the stock appears to be just a bit on the expensive side when considering all the fundamentals in play.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Motorola Solutions Narrative

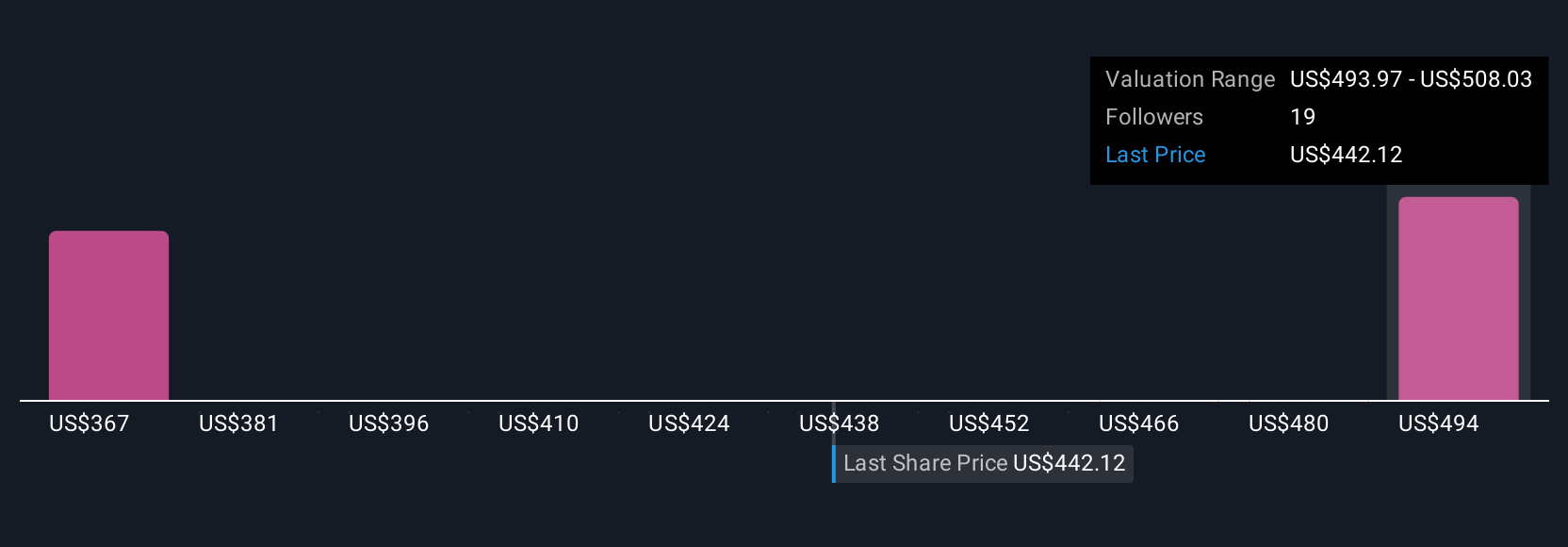

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story or viewpoint about a company, connecting your assumptions about its future, such as revenues, earnings, and margins, with a fair value and a clear investment thesis. Think of it as a bridge between the numbers and what you genuinely believe is possible for Motorola Solutions, helping you move beyond generic ratios to a truly personalized outlook.

Narratives are easy and accessible tools, available right on Simply Wall St’s Community page, where millions of investors share, compare, and refine their perspectives. They update dynamically when new information comes in, so your view can adapt instantly to breaking news or earnings results. By creating or following a Narrative, you see exactly how your expectations translate into a Fair Value, and can quickly spot if the current price offers a buying or selling opportunity.

For example, some investors see ongoing demand for public safety tech and Motorola’s strong move into software driving future earnings well beyond consensus, putting fair value above $500. Others are more cautious about government contract risk and increased competition, landing at a fair value below $350. Narratives let you decide whose story and price target you agree with, and update your investment decision as the facts evolve.

Do you think there's more to the story for Motorola Solutions? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MSI

Motorola Solutions

Provides public safety and enterprise security solutions in the United States, the United Kingdom, Canada, and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives