Why Mirion Technologies (MIR) Is Up 7.4% After Doubling SMR Exposure With Paragon Acquisition

Reviewed by Sasha Jovanovic

- Mirion Technologies recently announced the acquisition of Paragon, which doubles its small modular reactor (SMR) exposure and significantly expands its next-generation nuclear technology offerings.

- This move is seen as transformative, as it not only broadens Mirion's product portfolio but also reinforces its position in a market supported by strong nuclear power demand and recurring revenue streams.

- We’ll explore how the Paragon acquisition could reshape Mirion’s long-term growth outlook and recurring revenue profile.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Mirion Technologies Investment Narrative Recap

To be a Mirion Technologies shareholder, you’ll want to believe in sustained global nuclear demand and the value of specialized, recurring-revenue businesses. The Paragon acquisition adds scale and broadens the nuclear product set, but it does not eliminate the company’s near-term sensitivity to new nuclear project pipelines, which remains the single most important catalyst, and risk, since sector headwinds could still cap growth regardless of expansion moves.

Among recent company developments, Mirion’s partnership with Westinghouse Electric to deliver digital Nuclear Instrumentation Systems stands out. This announcement is particularly relevant in light of the Paragon acquisition, reinforcing Mirion’s reach into advanced, potentially higher-margin nuclear infrastructure projects and aligning with the sector’s shift toward modernization and digital controls.

Yet for all the upside, investors should also be mindful that, despite this expansion, the concentration risk linked to long-term nuclear build activity remains a factor that...

Read the full narrative on Mirion Technologies (it's free!)

Mirion Technologies' outlook estimates $1.1 billion in revenue and $105.2 million in earnings by 2028. This scenario requires 7.9% annual revenue growth and a $95.2 million increase in earnings from the current $10.0 million.

Uncover how Mirion Technologies' forecasts yield a $25.67 fair value, a 3% upside to its current price.

Exploring Other Perspectives

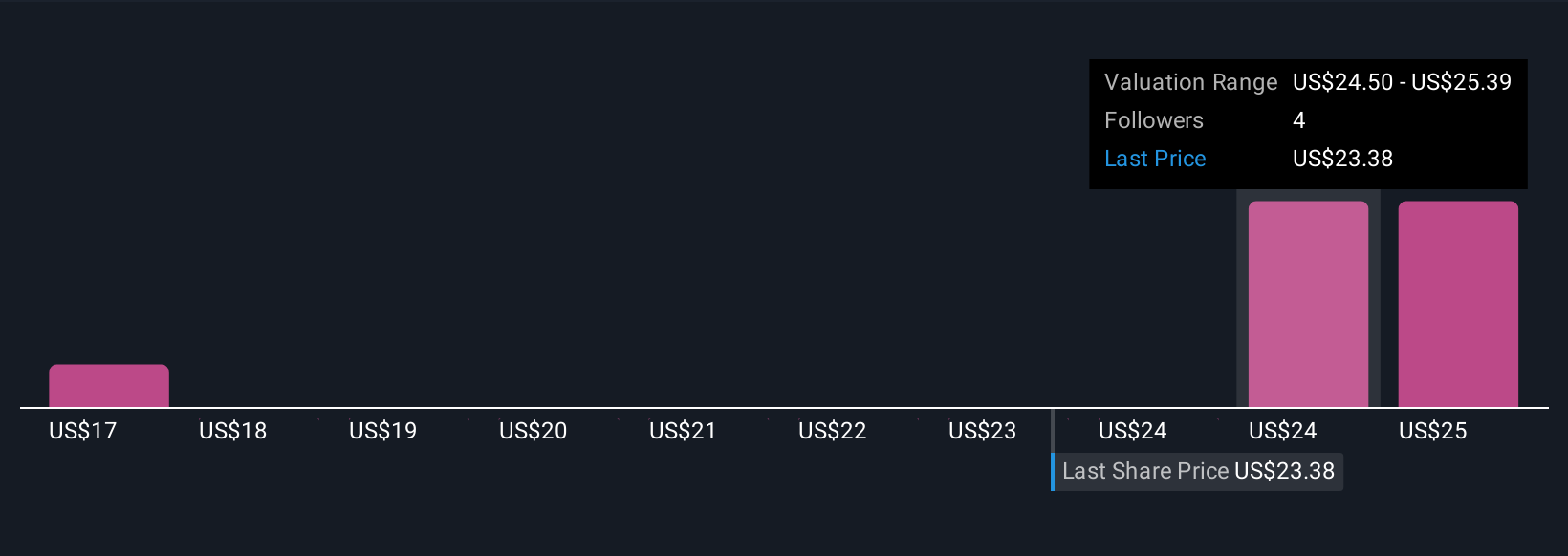

Simply Wall St Community fair value estimates for Mirion range from US$17.35 to US$25.67 based on three unique analyses. While opinions on price may diverge, many continue to watch whether Mirion can capitalize on its expanded presence in advanced nuclear markets.

Explore 3 other fair value estimates on Mirion Technologies - why the stock might be worth 30% less than the current price!

Build Your Own Mirion Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mirion Technologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Mirion Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mirion Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MIR

Mirion Technologies

Provides radiation detection, measurement, analysis, and monitoring products and services in North America, Europe, and the Asia Pacific.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives