A Look at Mirion Technologies (MIR) Valuation Following IAEA Partnership and Upbeat Financial Results

Reviewed by Kshitija Bhandaru

If you’re holding or eyeing Mirion Technologies (MIR) after the last week’s action, you’re probably debating your next move. Shares just spiked 8.4% in a single session, a jump fueled by both impressive financial results and a freshly announced global partnership with the International Atomic Energy Agency. The standout quarterly earnings, backed by revenue growth ahead of expectations and an upbeat update to the company’s financial outlook, gave investors plenty to cheer about. Mirion’s core business in nuclear safety and radiation detection is also getting a further credibility boost thanks to its collaboration with the IAEA.

This momentum follows a string of recent headlines spotlighting Mirion’s expanding global footprint, from presenting at the IAEA General Conference to supporting new international training initiatives. Over the past year, the stock has delivered a total return of 1.3%. However, the real story is the acceleration seen in recent months, with gains approaching 45% year-to-date. The swing in sentiment is not solely about results from a single quarter; it reflects how investors are weighing renewed optimism for Mirion’s growth prospects alongside the company’s efforts to embed deeper into the nuclear technology value chain.

The question now is straightforward: does this move signal an undervalued opportunity, or are we seeing the market already pricing in all the future growth that Mirion can deliver?

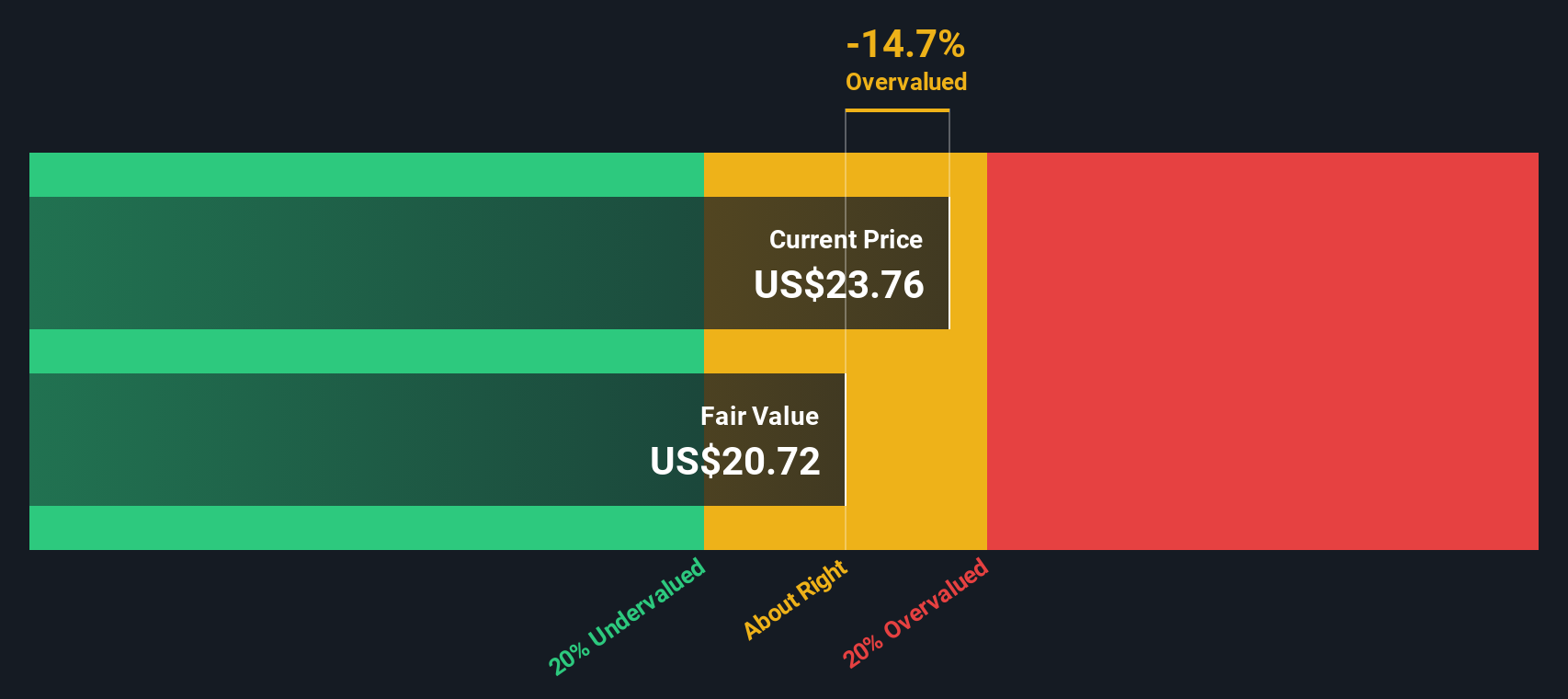

Most Popular Narrative: 4.3% Overvalued

The most widely followed narrative suggests Mirion Technologies is slightly overvalued, with projections indicating a fair value slightly below the current share price.

The accelerating global shift toward expanded nuclear power generation, coupled with rising capital budgets for modernization, life extensions, and increased capacity of the existing reactor fleet, is likely to drive sustained double-digit organic revenue growth and expand Mirion's higher-margin installed base business in coming years.

Want to know the real story behind Mirion’s stretched valuation? One critical assumption is baked into the future: analysts expect sector-defying growth if Mirion can deliver. Wondering just how ambitious these projections are, and what financial targets must be hit for this narrative to work out? The numbers driving this fair value are not what you’d expect from a typical industrial stock.

Result: Fair Value of $23.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if new nuclear buildouts stall or the integration of recent acquisitions falters, Mirion’s high growth and margin projections could quickly lose steam.

Find out about the key risks to this Mirion Technologies narrative.Another View: Our DCF Model Says It's Fairly Priced

While multiples suggest Mirion is sitting above fair value, our SWS DCF model takes a different approach and lands within striking distance of the current share price. This raises the question: could the stock be priced just right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Mirion Technologies Narrative

If you’d rather check the facts for yourself and map out your own take, you can dig into the numbers and shape your own story from scratch in just a couple minutes. Do it your way

A great starting point for your Mirion Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next big stock opportunity pass you by. Smart investors always keep an eye on fresh trends and emerging sectors. See what’s gaining momentum right now.

- Uncover hidden gems shaking up healthcare technology and stay ahead of the curve with healthcare AI stocks.

- Capitalize on powerful dividend plays that put cash in your pocket by spotting your next income powerhouse through dividend stocks with yields > 3%.

- Catch surging AI disruptors before they become household names by starting your research with AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MIR

Mirion Technologies

Provides radiation detection, measurement, analysis, and monitoring products and services in North America, Europe, and the Asia Pacific.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives