Should Investors Rethink Keysight After Recent Flat Performance and Industry Valuation Shifts?

Reviewed by Simply Wall St

Thinking about whether to hold onto, buy, or move on from Keysight Technologies stock? You are not alone. Navigating the world of tech stocks can feel like a rollercoaster, and Keysight’s journey lately has certainly kept investors on their toes. Over the past year, the stock has essentially stayed flat, eking out a tiny 0.4% gain. However, if you look at a five-year period, the story appears much brighter, with a total return of 61.6%. On shorter timeframes, there have been some minor dips, with the stock down about 2% over the last three months, but this is not unusual given the broader market’s fluctuations.

There is a sense that the market’s perception of risk around Keysight is gradually changing, perhaps reflecting cautious optimism about the growth in demand for their measurement and testing equipment across the tech space. Still, for the past year, the valuation score for the company has been 0 out of 6, meaning that not a single traditional metric currently indicates that Keysight is undervalued. That might sound discouraging at first glance, but it is important to break down what goes into these numbers and whether conventional valuation approaches provide the full story. Understanding the value of a company like Keysight might require looking beyond the usual checkboxes. Here is a closer look at the methods analysts use, followed by a perspective that could give you a clearer picture of what this stock is really worth.

Keysight Technologies delivered 0.4% returns over the last year. See how this stacks up to the rest of the Electronic industry.Approach 1: Keysight Technologies Cash Flows

The Discounted Cash Flow (DCF) model projects a company’s expected future cash flows and then discounts them back to today’s value, helping investors estimate what the business is truly worth. For Keysight Technologies, the latest twelve months’ Free Cash Flow is $1.38 billion. Analysts expect this figure to grow steadily over the coming years, with projections showing Free Cash Flow reaching about $1.91 billion in 2035.

Using a two-stage Free Cash Flow to Equity model, the estimated intrinsic value per share for Keysight comes out to $157.37. When this estimate is compared with the current share price, the stock appears to be just 0.7% overvalued, which is very close to fair value according to the DCF approach.

In summary, Keysight’s current price aligns closely with its underlying cash generation and growth prospects, at least by this valuation method.

Result: ABOUT RIGHT

Approach 2: Keysight Technologies Price vs Earnings

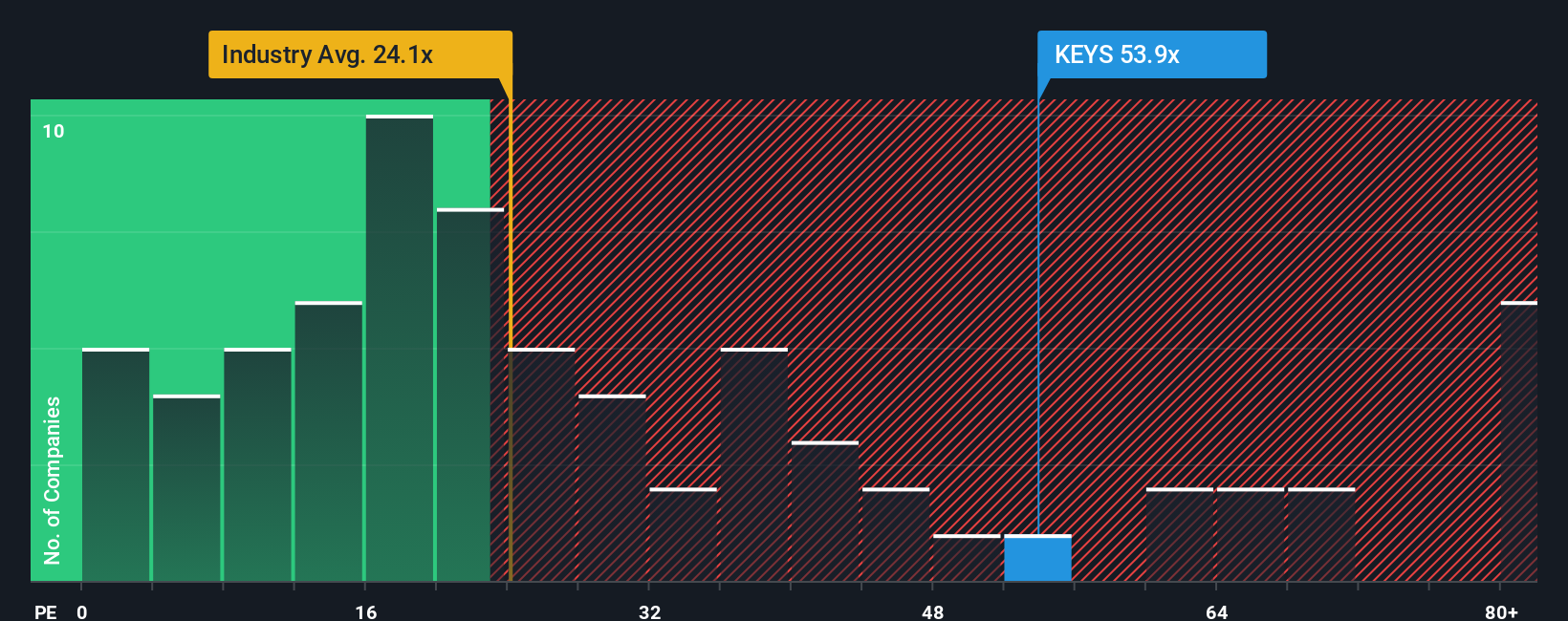

For profitable companies like Keysight Technologies, the Price-to-Earnings (PE) ratio is often considered the primary valuation metric. This is because it directly relates a company’s share price to its earnings, providing investors with a clear understanding of what the market is willing to pay for each dollar of profit.

Growth expectations and perceived risks play a significant role in determining what is considered a reasonable or fair PE ratio. If a company is expected to grow earnings quickly or operates a very stable business, the market will often assign a higher multiple. In contrast, slower growth or higher risk typically results in a lower PE ratio being seen as more appropriate.

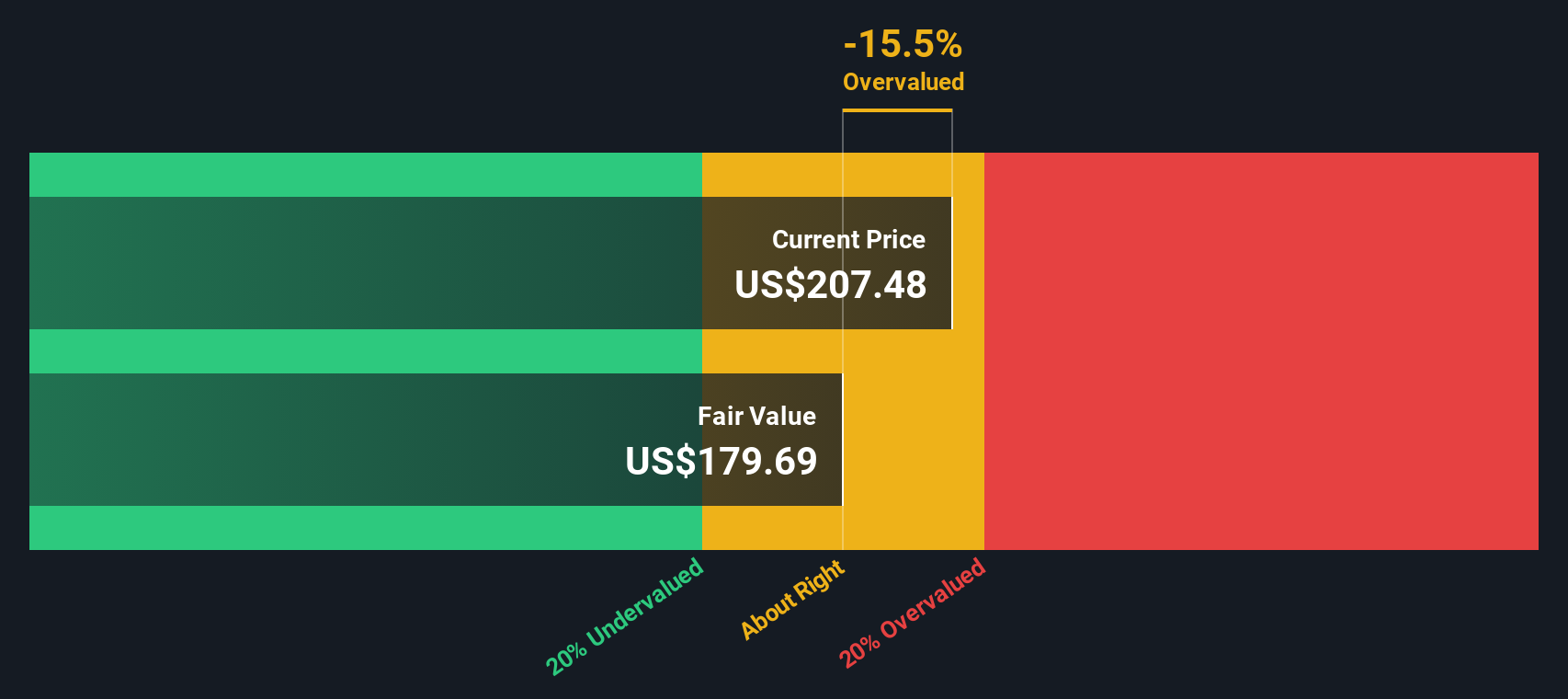

Currently, Keysight trades at a PE ratio of 50.1x. This is notably higher than the industry average for electronic companies at 22.7x and the average among its direct peers at 45.8x. However, Simply Wall St’s proprietary Fair Ratio, which accounts for factors such as company growth, profitability, and risk, is 27.9x for Keysight. This suggests that, based on a comprehensive evaluation, Keysight’s shares are trading well above what could be considered fair for its current situation.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Keysight Technologies Narrative

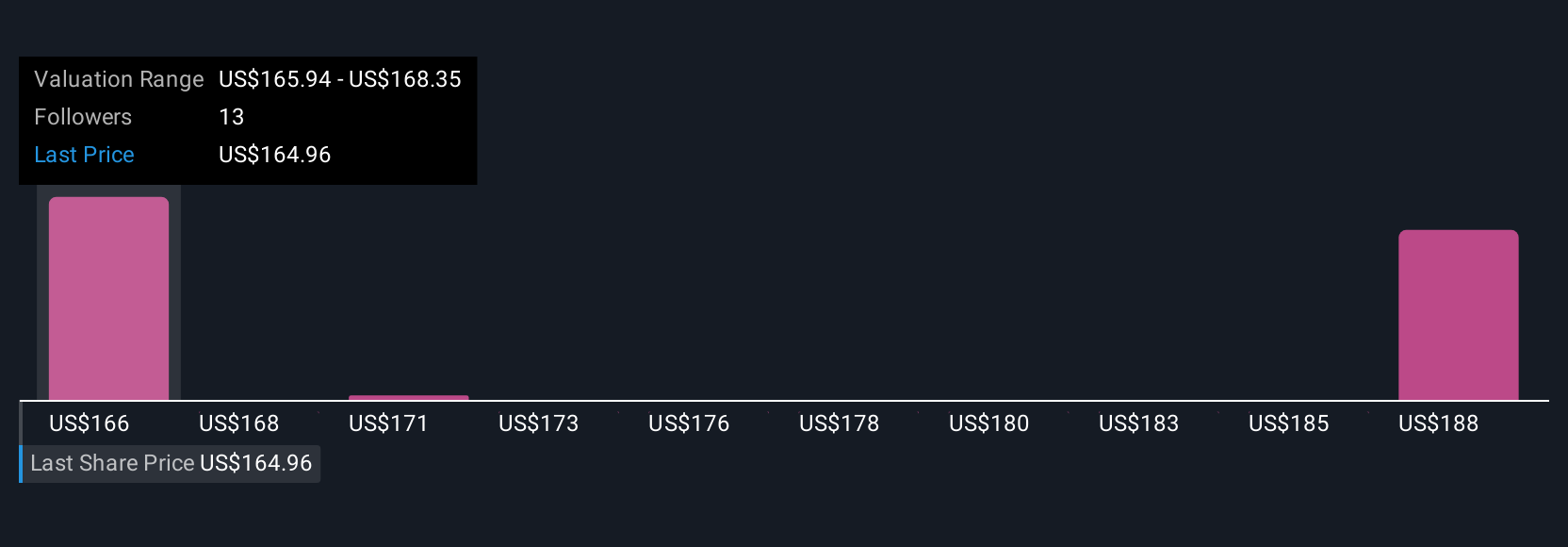

A Narrative is a simple, story-driven way to make investment decisions. Instead of relying only on numbers, you form a clear perspective about a company’s future by connecting what you know about its business with your own estimates for things like revenue, profits, and margins.

With Narratives, you describe how you think a company’s story will unfold, then translate that view into a forecast and a fair value. This approach makes the reason for your investment decision much more transparent and actionable.

On the Simply Wall St platform, Narratives are designed to be easy and accessible for everyone. Millions of investors use them every day to bridge the gap between headlines and financials, and to see how their view compares with the community.

Narratives empower you to decide when to buy or sell Keysight Technologies by showing exactly where you believe the Fair Value stands versus the current Price. They are always updating as new earnings or news emerge.

For example, you might see one investor with a Narrative pricing Keysight at $200 per share by forecasting rapid AI-driven revenue growth, while another expects only $157 if new tariffs and sector risks weigh down margins. Your chosen Narrative lets you make smarter, more confident decisions when it matters most.

Do you think there's more to the story for Keysight Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Keysight Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEYS

Keysight Technologies

Provides electronic design and test solutions worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)