Assessing Keysight Technologies (KEYS) Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

What recent performance says about Keysight Technologies (KEYS)

Without a clear news catalyst, Keysight Technologies (KEYS) has still drawn attention after recent price gains, including a 2.2% move over the past day and a 6.4% return over the past month.

Over the past 3 months, the stock shows a 28.7% return, while the 1 year total return sits at 25.5%. Against that backdrop, investors are weighing how the company’s fundamentals line up with the current share price.

See our latest analysis for Keysight Technologies.

The recent share price strength, with a 28.7% 90 day share price return and a 25.5% 1 year total shareholder return, points to building momentum as investors reassess growth prospects and risk around Keysight’s test and measurement business.

If Keysight’s move has you looking at other tech names, it could be a good time to see how high growth tech and AI stocks compare on growth, quality, and recent price performance.

With Keysight trading near its analyst price target and showing a strong multi year track record of total returns, you have to ask: is there still mispricing here, or is the market already baking in future growth?

Price-to-Earnings of 42.8x: Is it justified?

With Keysight trading at US$216.69, the current P/E of 42.8x suggests investors are paying a premium for each dollar of reported earnings.

The P/E ratio compares the share price to earnings per share, so a higher number usually reflects strong profit expectations or a willingness to pay up for quality.

For Keysight, that 42.8x multiple sits above both the estimated fair P/E of 28x and the US Electronic industry average of 27.2x. This implies the market is assigning a richer valuation than both a model based on fundamentals and the broader peer group. At the same time, it is lower than the peer average P/E of 46.9x, so the stock trades at a discount to a narrower set of comparables even while screening as expensive against wider benchmarks. The fair P/E level is a valuation anchor the market could move closer to over time.

Explore the SWS fair ratio for Keysight Technologies

Result: Price-to-Earnings of 42.8x (OVERVALUED)

However, you also have to consider the risk that a 42.8x P/E leaves little room for earnings disappointment or sector wide volatility to affect the story.

Find out about the key risks to this Keysight Technologies narrative.

Another view on value

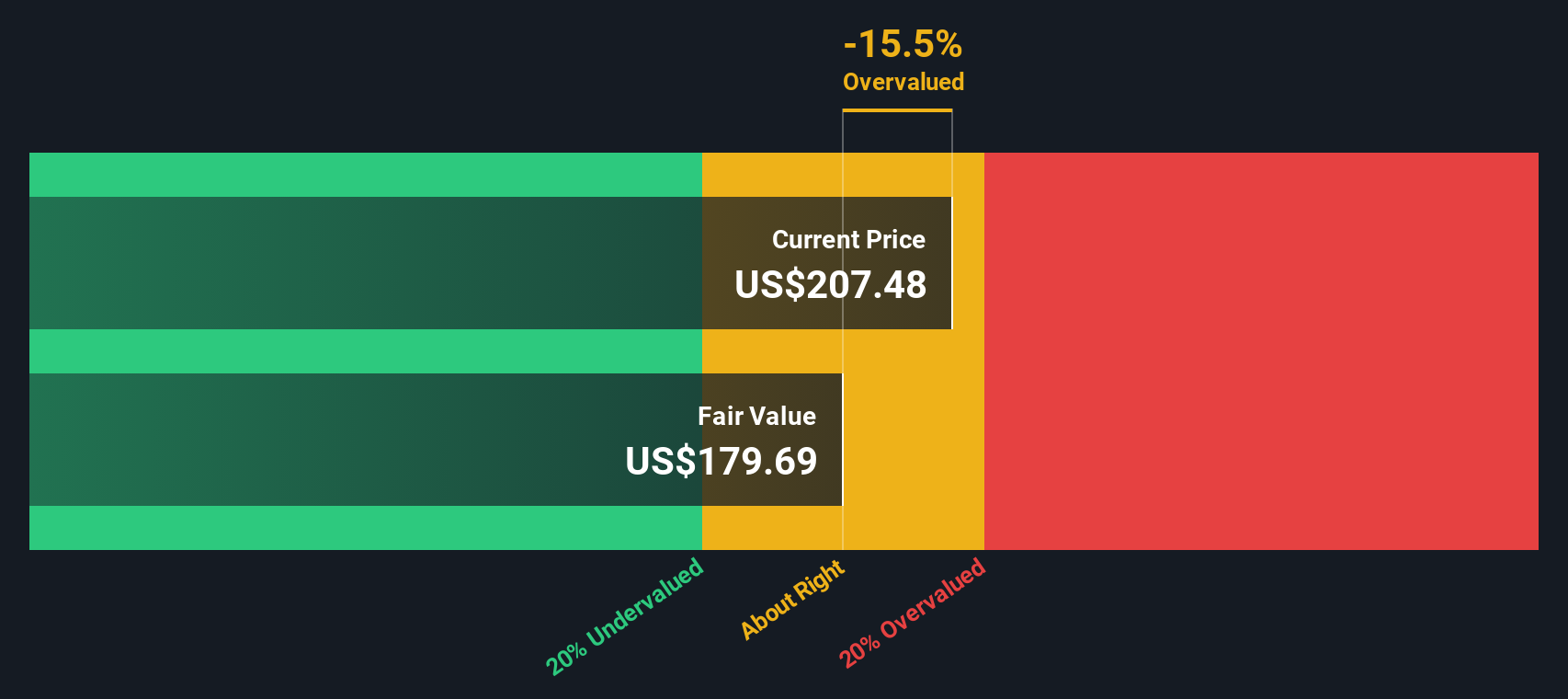

Our DCF model also suggests that Keysight is trading at a full price. At US$216.69, the shares sit above an estimated future cash flow value of US$178.64, so this method also indicates that the stock may be overvalued. If both earnings and cash flow checks appear rich, where is the margin of safety?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Keysight Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Keysight Technologies Narrative

If this view does not quite match your own or you prefer to work directly with the numbers, you can build a Keysight narrative yourself in just a few minutes using Do it your way.

A great starting point for your Keysight Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Keysight has sharpened your interest, do not stop here, use the Simply Wall St Screener to surface other focused ideas that match your style.

- Target potential mispricing by checking out these 878 undervalued stocks based on cash flows that currently score well on cash flow based metrics.

- Spot emerging themes in digital assets by scanning these 19 cryptocurrency and blockchain stocks tied to blockchain and cryptocurrency trends.

- Prioritise income potential by reviewing these 13 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keysight Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KEYS

Keysight Technologies

Provides electronic design and test solutions worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Nova Ljubljanska Banka d.d. future looks bright with a profit margin change of 38%

Viohalco S.A. (VIO.AT): Greece's Leading Integrated Metals Processor

M&A machine with a relentless focus on operational excellence

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!

with the recent increase in Yttrium over the course of 2025 and it's now apparent value perceived by the market, Rainbow Rare Earths states this would add approx. 30M USD (@Ex rate 0.75USD - 1GBP of 0.75)/22.5M GBP to EBITDA per annum. Therefore I adjust my fair value price to MORE than previous - how much more? Who cares... I'm simply allowing for 40% of this figure to fall to the bottom line in my estimation of fair value. I now now estimate the fair value of >£1.20 - that's all I need to know.