The Bull Case For Jabil (JBL) Could Change Following Dividend Hike, $1B Buyback, and AI Partnership News

Reviewed by Simply Wall St

- Jabil recently announced the Board’s approval of a US$0.08 per share quarterly dividend for shareholders of record as of August 15, 2025, a US$1 billion share repurchase authorization, and an expanded collaboration with Endeavour Energy to deliver modular, just-in-time AI infrastructure in North America and Europe.

- This partnership aims to accelerate the deployment of AI-ready data centers while supporting ongoing shareholder returns through buybacks and dividends, illustrating Jabil’s commitment to both growth sectors and capital discipline.

- With the new US$1 billion buyback plan signaling strong shareholder focus, we’ll examine how these announcements impact Jabil’s broader investment outlook.

Jabil Investment Narrative Recap

To own shares in Jabil, you need to believe in its ability to capture long-term demand for AI and cloud infrastructure, while also managing volatility in slower-growing segments like regulated industries. The recent dividend affirmation and US$1 billion buyback authorization underscore a commitment to shareholder returns, but don’t materially shift near-term catalysts or mitigate the most important risks, which remain tied to demand recovery in challenged end markets and inventory normalization.

The expanded partnership with Endeavour Energy stands out as particularly relevant, as it ties Jabil directly to accelerating AI infrastructure growth in North America and Europe. This supports the thesis that AI-driven demand is a key driver for Jabil’s near-term growth, but it also means the pace and sustainability of AI adoption will remain closely watched by investors.

However, investors should also be aware that if cash flow pressures from elevated inventory days persist, especially alongside these investments...

Read the full narrative on Jabil (it's free!)

Jabil's outlook anticipates $34.1 billion in revenue and $1.2 billion in earnings by 2028. This is based on a 6.2% annual revenue growth rate and an earnings increase of $623 million from the current $577 million.

Uncover how Jabil's forecasts yield a $225.69 fair value, in line with its current price.

Exploring Other Perspectives

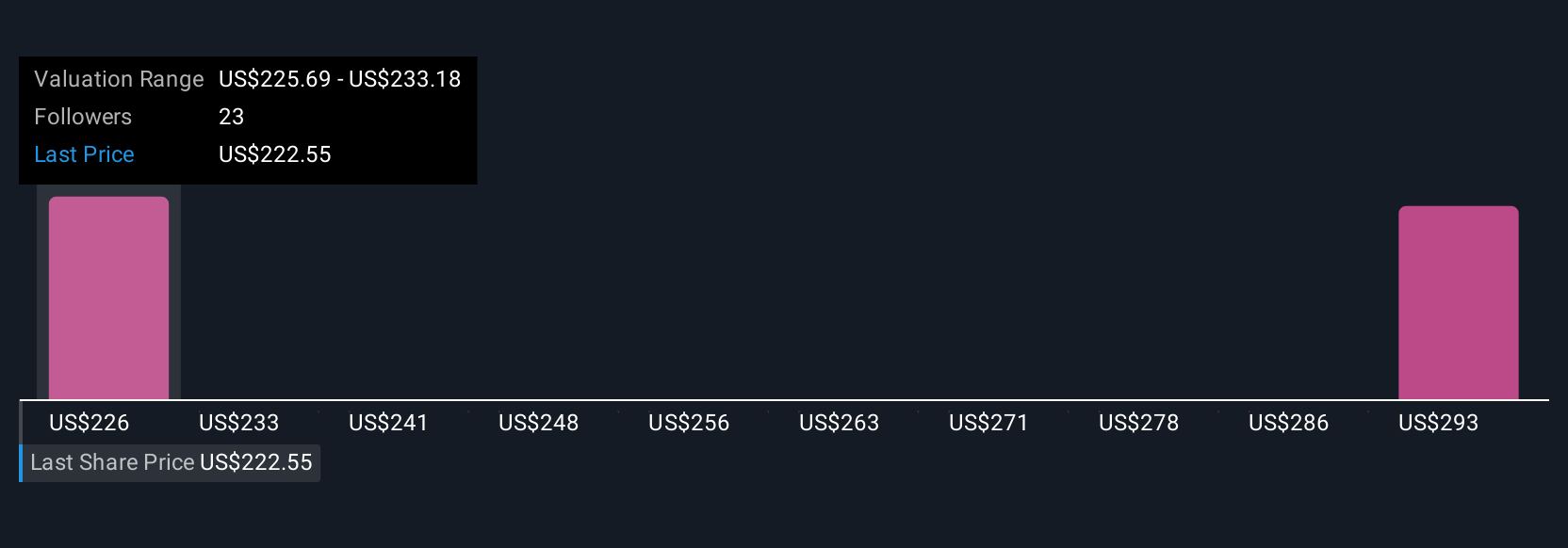

Simply Wall St Community views on Jabil’s fair value range from US$225.69 to US$283.52, based on 2 member estimates. While many are focused on growth potential from AI infrastructure, it’s clear opinions can widely differ, so consider reviewing these perspectives and the ongoing risks to cash flow stability for a fuller outlook.

Explore 2 other fair value estimates on Jabil - why the stock might be worth just $225.69!

Build Your Own Jabil Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jabil research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Jabil research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jabil's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBL

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives